Apple plus Tivo

Tysabri kills somebody

I value Berkshire

Monday, February 28, 2005

OT-Hunter S. Thompson

I suppose I'm probably kinda late to the party on this one, and I'm not sure it has much too with money or markets, but I read this article today on the suicide of Hunter S. Thompson, and I can't help it.

The Money Quote:

Anita Thompson, 32, said her husband had discussed killing himself in recent months . . .His suicidal talk put a strain on their relationship, she said.

"He wanted to leave on top of his game. I wish I could have been more supportive of his decision," she said. "It was a problem for us."

"I wish could have been more supportive of his decision"?????!!!!!?????

I truly don't know whether to laugh or cry at this one. A spouse's suicidal ideation is a "problem" for the relationship? The other spouse doesn't think it's a good idea, but is actually regretful that she can't be more "supportive" of his pathology?

"It's not you, dear, it's me; I wish I could support you in your misguided desire, but I can't, and I hate myself for it. I'm not really sure how our relationship is going to survive your wish to kill yourself."

I guess all I can say is that if you or someone you love needs help please seek it.

The Money Quote:

Anita Thompson, 32, said her husband had discussed killing himself in recent months . . .His suicidal talk put a strain on their relationship, she said.

"He wanted to leave on top of his game. I wish I could have been more supportive of his decision," she said. "It was a problem for us."

"I wish could have been more supportive of his decision"?????!!!!!?????

I truly don't know whether to laugh or cry at this one. A spouse's suicidal ideation is a "problem" for the relationship? The other spouse doesn't think it's a good idea, but is actually regretful that she can't be more "supportive" of his pathology?

"It's not you, dear, it's me; I wish I could support you in your misguided desire, but I can't, and I hate myself for it. I'm not really sure how our relationship is going to survive your wish to kill yourself."

I guess all I can say is that if you or someone you love needs help please seek it.

Valuing Berkshire Hathaway

Warren Buffett is one of the great value investors, and his Berkshire Hathaway company is a great company. But is it always a great stock? Over the past 5 years, buyers of BRK have done well or badly depending on when they bought—at 45,000 or 95,000. Valuing this company is tricky—although its main business is insurance, it owns furniture stores, gas pipelines, jewelers, World Book Encylopedia, and has major stockholdings including American Express, Coke, etc. I'm not nearly smart enough to value this company, but I know one guy who is--Warren Buffett himself. Buffett talks a great deal about intrinsic value (IV) of Berkshire, or what the company is really worth based on the net present value of future cash flows.

At the 1998 Berkshire Hathaway annual meeting, Mr. Buffett defined intrinsic value as follows: "In order to calculate intrinsic value, you take those cash flows that you expect to be generated and you discount them back to their present value - in our case, at the long-term Treasury rate. And that discount rate doesn't pay you as high a rate as it needs to. But you can use the resulting present value figure that you get by discounting your cash flows back at the long-term Treasury rate as a common yardstick just to have a standard of measurement across all businesses."

A value investor like Buffett would want to buy companies, even a great company like Berkshire, at some discount, a margin of safety (MOS) to intrinsic value.

Though he's never publicly stated what he thought Berkshire's IV was, at one point in the recent past, however, Buffett telegraphed, with a big wink and nudge, just what he thought IV-MOS was.From the 1999 Chairman's letter (March 2000), "Recently, when the A shares fell below $45,000, we considered making repurchases. . . we will make them if and when we believe that they represent an attractive use of the Company's money."I believe one can safely infer that Buffett believed IV-MOS in March 2000 was $45,000 per A share and thus $1500 per B share(the shares are convertible at a rate of 30:1). What is it now? Assuming MOS is a constant percentage of IV, the question becomes how much has IV changed since then. As always, we return to scripture for the answer. From the 2000 Chairman's letter (March 2001), "we believe Berkshire's gain in per-share intrinsic value moderately exceeded its gain in book value"--and book value gain was 6.5%. Moderately exceeded means 7%, 8%? This gives a range of $48,150 to $48,600 per A share and $1605 to $1620 per B share in March 2001.

From the 2001 Chairman's letter (March 2002), "Per-share intrinsic grew somewhat faster than book value during these 37 years, and in 2001 it probably decreased a bit less"--and book value decrease was 6.2%. Is decreased a bit less 6%, 5%? This results in a range of $45260 to $46170 per A share and $1508 B to $1539 per B share in March 2002.

From the 2002 Chairman's letter (March 2003) no statement regarding increase in intrinsic value is found, but book value grew by 10%. Using 8% to 12% as upper and lower estimates results in $48880 to $51710/A share and $1629 to $1723 /B in March 2003.

From the 2003 Chairman's letter (March 2004) the more generic statement "Despite their shortcomings, book value calculations are useful at Berkshire as a slightly understated gauge for measuring the long-term rate of increase in our intrinsic value." Book value increased by 21%. Using 22-24% for increase in intrinsic value gives an IV-MOS estimate of $59633 to $64120/A and $1988 to $2137 /B for March 2004.

What about since then? As a WAG, I'll add 0.25%-0.5% per month to estimate IV gains till the next chairman's letter. This is roughly $150 to $300/month for A's and $5 to $10/month for B's. Thus, for February 2005, I get a range of $61283 to $67420/A and $2043 to $2247 /B. Remember this is a "fire sale" price that is so much below IV that even a tightwad like Buffett would spend shareholders' cash to buy back stock. It would represent a "back up the truck" opportunity.

For me, I'll look at buying more BRK below $75000 A/$2500 B; below $67500A/ $2250 B that beep-beep-beep is my truck in reverse; below $63000A/ $2100 B, its margin, home equity loans, hock the kids, put it all down on Buffett. Will we see these prices again? My view is that if other great companies can get put on sale in a market decline, so can BRK--I don't think it is any more immune to the vagaries of Mr. Market than any other publicly traded entity. I think the opportunity will present itself.

This Saturday, March 5 will be the release date of the 2004 Berkshire Annual Report and Chairman's letter. In all likelihood, some statement about intrinsic value/book value will be made, and I will update my assessment accordingly.

At the 1998 Berkshire Hathaway annual meeting, Mr. Buffett defined intrinsic value as follows: "In order to calculate intrinsic value, you take those cash flows that you expect to be generated and you discount them back to their present value - in our case, at the long-term Treasury rate. And that discount rate doesn't pay you as high a rate as it needs to. But you can use the resulting present value figure that you get by discounting your cash flows back at the long-term Treasury rate as a common yardstick just to have a standard of measurement across all businesses."

A value investor like Buffett would want to buy companies, even a great company like Berkshire, at some discount, a margin of safety (MOS) to intrinsic value.

Though he's never publicly stated what he thought Berkshire's IV was, at one point in the recent past, however, Buffett telegraphed, with a big wink and nudge, just what he thought IV-MOS was.From the 1999 Chairman's letter (March 2000), "Recently, when the A shares fell below $45,000, we considered making repurchases. . . we will make them if and when we believe that they represent an attractive use of the Company's money."I believe one can safely infer that Buffett believed IV-MOS in March 2000 was $45,000 per A share and thus $1500 per B share(the shares are convertible at a rate of 30:1). What is it now? Assuming MOS is a constant percentage of IV, the question becomes how much has IV changed since then. As always, we return to scripture for the answer. From the 2000 Chairman's letter (March 2001), "we believe Berkshire's gain in per-share intrinsic value moderately exceeded its gain in book value"--and book value gain was 6.5%. Moderately exceeded means 7%, 8%? This gives a range of $48,150 to $48,600 per A share and $1605 to $1620 per B share in March 2001.

From the 2001 Chairman's letter (March 2002), "Per-share intrinsic grew somewhat faster than book value during these 37 years, and in 2001 it probably decreased a bit less"--and book value decrease was 6.2%. Is decreased a bit less 6%, 5%? This results in a range of $45260 to $46170 per A share and $1508 B to $1539 per B share in March 2002.

From the 2002 Chairman's letter (March 2003) no statement regarding increase in intrinsic value is found, but book value grew by 10%. Using 8% to 12% as upper and lower estimates results in $48880 to $51710/A share and $1629 to $1723 /B in March 2003.

From the 2003 Chairman's letter (March 2004) the more generic statement "Despite their shortcomings, book value calculations are useful at Berkshire as a slightly understated gauge for measuring the long-term rate of increase in our intrinsic value." Book value increased by 21%. Using 22-24% for increase in intrinsic value gives an IV-MOS estimate of $59633 to $64120/A and $1988 to $2137 /B for March 2004.

What about since then? As a WAG, I'll add 0.25%-0.5% per month to estimate IV gains till the next chairman's letter. This is roughly $150 to $300/month for A's and $5 to $10/month for B's. Thus, for February 2005, I get a range of $61283 to $67420/A and $2043 to $2247 /B. Remember this is a "fire sale" price that is so much below IV that even a tightwad like Buffett would spend shareholders' cash to buy back stock. It would represent a "back up the truck" opportunity.

For me, I'll look at buying more BRK below $75000 A/$2500 B; below $67500A/ $2250 B that beep-beep-beep is my truck in reverse; below $63000A/ $2100 B, its margin, home equity loans, hock the kids, put it all down on Buffett. Will we see these prices again? My view is that if other great companies can get put on sale in a market decline, so can BRK--I don't think it is any more immune to the vagaries of Mr. Market than any other publicly traded entity. I think the opportunity will present itself.

This Saturday, March 5 will be the release date of the 2004 Berkshire Annual Report and Chairman's letter. In all likelihood, some statement about intrinsic value/book value will be made, and I will update my assessment accordingly.

Warren Buffett, Richard Russell, and the Web

Chairman MaoXian had a great link the other day to notes from a Warren Buffett q and a with some Vanderbilt business students. These notes are all over the web--here, here and here. There's great stuff in there, everyone should read them and cogitate on them, and that's the way the web should work.

What's also interesting to me is that apparently, they also appeared here, in Richard Russell's $250/year newsletter. Now, Russell is a smart old guy who's been around forever and forgotten more about markets than Jaloti is likely to ever know. However, Russell lamented (and I quoted, here, back when only Trader Mike was reading me) that with the Internet giving stuff away for free, how could fee based newsletters survive? Again, with him putting non-origianl non-proprietary content in his newsletter that other people are giving away for free, the question is still relevant.

How, indeed?

What's also interesting to me is that apparently, they also appeared here, in Richard Russell's $250/year newsletter. Now, Russell is a smart old guy who's been around forever and forgotten more about markets than Jaloti is likely to ever know. However, Russell lamented (and I quoted, here, back when only Trader Mike was reading me) that with the Internet giving stuff away for free, how could fee based newsletters survive? Again, with him putting non-origianl non-proprietary content in his newsletter that other people are giving away for free, the question is still relevant.

How, indeed?

Going from 90 to 100, and confirmation bias

There has been a very nice multi-blog discussion, started here by Random Roger, and advanced by Michael Taylor of Taylor Tree, as well as Anumati, about the Tom Dorsey idea that once a stock gets to 90, its a buy because it will continue to 100. (Arguably, Ugly foreshadowed this idea here.)

To recap, Roger put the idea on the table, quoting Dorsey. Michael looked at the numbers, and said, while it's a little difficult to get comprehensive data because of splits, etc, it appears to happen "only" 55-60% of the time. Anumati then said this makes it an example of confirmation bias. All true, but let me put the Jaloti spin on it.

If this were a simple 50/50 bet, i.e. goes to 100/doesn't go to 100, and the odds were 55-45, you'd take that bet all day long--right? The casinos make billions on tighter odds than that. What is really be asked with this one, is how long does it take to get from 90 to 100, AND what are the chances it goes to 0 first? The way to make money off of this one is to ask, once a stock hits 90, how often does it get to 100, before it gets to 80 (or 85, or whatever margin of safety you want, to pervert the value investors' catchphrase). If, for instance, there was good data over time that after 90, 55% go to 100 before they go to 85, I'd take that one in a heartbeat.

Cut your losers short, and let your winners run, right?

To recap, Roger put the idea on the table, quoting Dorsey. Michael looked at the numbers, and said, while it's a little difficult to get comprehensive data because of splits, etc, it appears to happen "only" 55-60% of the time. Anumati then said this makes it an example of confirmation bias. All true, but let me put the Jaloti spin on it.

If this were a simple 50/50 bet, i.e. goes to 100/doesn't go to 100, and the odds were 55-45, you'd take that bet all day long--right? The casinos make billions on tighter odds than that. What is really be asked with this one, is how long does it take to get from 90 to 100, AND what are the chances it goes to 0 first? The way to make money off of this one is to ask, once a stock hits 90, how often does it get to 100, before it gets to 80 (or 85, or whatever margin of safety you want, to pervert the value investors' catchphrase). If, for instance, there was good data over time that after 90, 55% go to 100 before they go to 85, I'd take that one in a heartbeat.

Cut your losers short, and let your winners run, right?

Random Roger makes me think

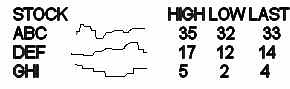

Loser List for February 28, 2005

ADAM-- nice chart, pullback in an uptrend, stop about 5.3, though volume is marginal.

BOOM-exploded out(sorry). If you're into breakouts, this is one, stop at the breakout--17.5

CALM--a short if it stays below 10.

DDDC--might be a buyable pullback above 4.2 or so.

EENC--breakout and pullback--long above 20.

IINT--long above 2.25

BGO--if gold's running, this one might, stop at 3

LAB might be a buyable pullback above 9.2

the Pennies--

MUCL--ok, that's it, the last time for this one--if it bounces off 0.40 its a buy with a stop at 0.38

CTCHC--if you have to buy a penny, this is as good as any--stop at 0.6

PMU--another on the penny list--long stop at 0.6

How to use this list. And what would it be without the disclaimer?

BOOM-exploded out(sorry). If you're into breakouts, this is one, stop at the breakout--17.5

CALM--a short if it stays below 10.

DDDC--might be a buyable pullback above 4.2 or so.

EENC--breakout and pullback--long above 20.

IINT--long above 2.25

BGO--if gold's running, this one might, stop at 3

LAB might be a buyable pullback above 9.2

the Pennies--

MUCL--ok, that's it, the last time for this one--if it bounces off 0.40 its a buy with a stop at 0.38

CTCHC--if you have to buy a penny, this is as good as any--stop at 0.6

PMU--another on the penny list--long stop at 0.6

How to use this list. And what would it be without the disclaimer?

Sunday, February 27, 2005

Sunday Night Charts for February 27, 2005

I'm gonna mix it up a little bit.

But first let's start with an old favorite.

The US Dollar Index. Weekly chart.

Courtesy of stockcharts.com

Still a downtrend. Interestingly, it broke my trendline, and is sitting just above it, but then it has done this before.

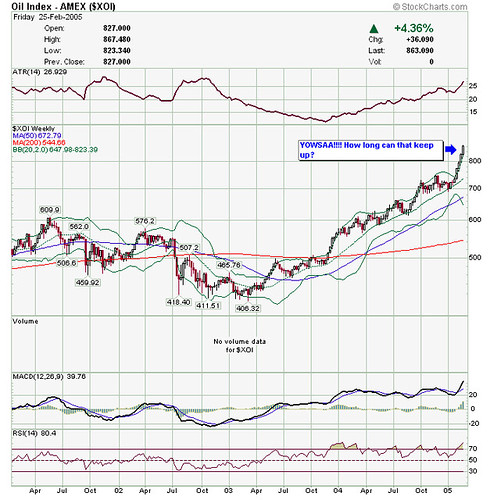

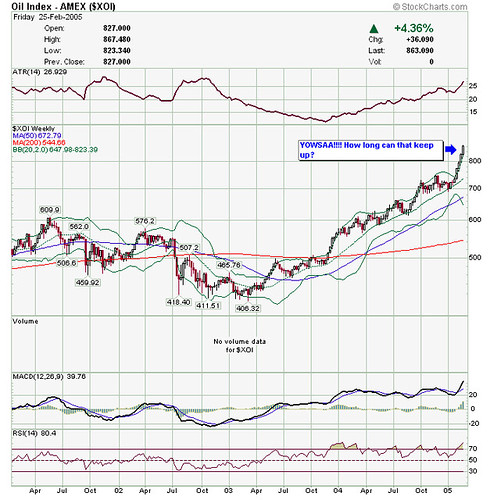

Next is the XOI oil index

Courtesy of stockcharts.com

Bill Cara is calling this a melt-up top in the oils. Sure looks like it will come down, but when? Bill's a lot smarter at this stuff than I am, and he may well be right--but timing is everything--it may drop on Monday, or it may run another 15% and 15 days before it drops. "Markets can remain irrational longer than you can remain solvent." (John Maynard Keynes).

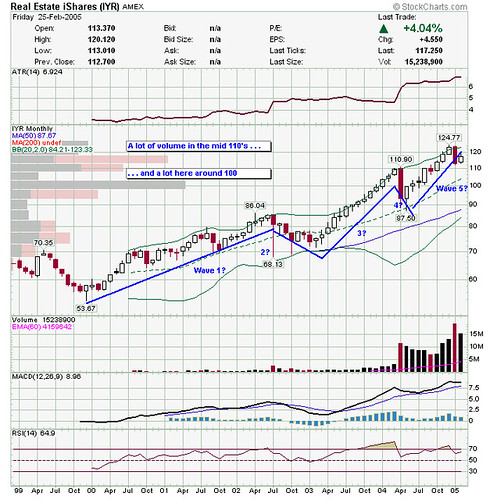

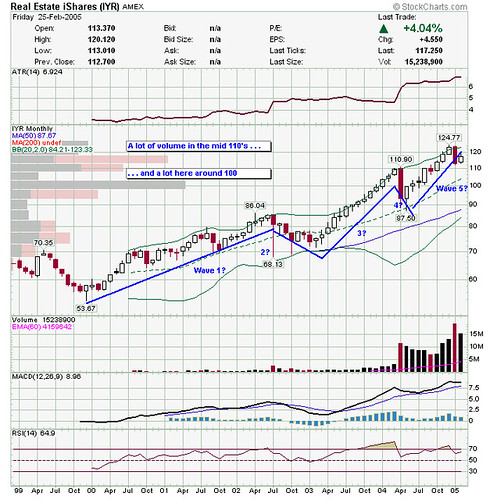

Next, a new one--the IYR (REIT iShares) Weekly

Courtesy of stockcharts.com

To me, looks like support at 110 from the previous high, and a lot of volume in the low 110s. (Although I'm less sure of what volume means in ETFs.) This makes it look like a buyable pullback in REITs.

But let's look at the monthly IYR chart.

Courtesy of stockcharts.com

REITs have been running for a long time, is this Elliot's 5th wave? Perhaps not, if we can stay above 110? What's that saying, "A man with a watch knows what time it is, a man with two watches is never sure". Substitute "chart" for "watch" and that's me!

Have a great week everyone!

But first let's start with an old favorite.

The US Dollar Index. Weekly chart.

Courtesy of stockcharts.com

Still a downtrend. Interestingly, it broke my trendline, and is sitting just above it, but then it has done this before.

Next is the XOI oil index

Courtesy of stockcharts.com

Bill Cara is calling this a melt-up top in the oils. Sure looks like it will come down, but when? Bill's a lot smarter at this stuff than I am, and he may well be right--but timing is everything--it may drop on Monday, or it may run another 15% and 15 days before it drops. "Markets can remain irrational longer than you can remain solvent." (John Maynard Keynes).

Next, a new one--the IYR (REIT iShares) Weekly

Courtesy of stockcharts.com

To me, looks like support at 110 from the previous high, and a lot of volume in the low 110s. (Although I'm less sure of what volume means in ETFs.) This makes it look like a buyable pullback in REITs.

But let's look at the monthly IYR chart.

Courtesy of stockcharts.com

REITs have been running for a long time, is this Elliot's 5th wave? Perhaps not, if we can stay above 110? What's that saying, "A man with a watch knows what time it is, a man with two watches is never sure". Substitute "chart" for "watch" and that's me!

Have a great week everyone!

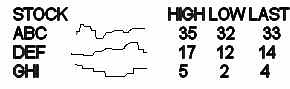

Roundtable stock--CMCSA

This weeks roundtable stock is CMCSA. Other roundtable members are Levi Bauer, Tom at Sixth World, Ron Sen, Bill Cara, and Kaushik Gala.

CMCSA has drawn a lot of interest lately with the news that Warren Buffett's Berkshire Hathaway has doubled its stake in the cable provider. A lot of people have been sort of scratching their heads, trying to figure out what the value angle is that the Sage of Omaha sees in Comcast. Let me end the suspense and give the answer at the end of this post;>).

First, I will offer a couple observations--1) A big chunk of Berkshire's equity portfolio is actually managed by Lou Simpson at Geico, with little/no input from Buffett. Simpson is no slouch himself as a stock picker, but the point is this may not be a Buffett pick per se. 2) Whether it is a Buffett pick or not, Buffett and Berkshire in the past have done very well with local newspapers and television stations--the Buffalo News, Washington Post, and Cap Cities/ABC. The thinking has been that these local media represent businesses with some sort of a "moat" --Buffett-speak for some sort of barrier, be it regulatory or whatever, to entry of competitors in the space. Cable television providers certainly fit into that category.

That having been said, Buffett has always maintained that you can't just buy a great business, you have to pay a good-to-great price for it. This is where the head scratching comes in, because any way you slice it, its hard to find the great valuation on CMCSA. The comparisons are a little difficult, since a lot of the broadcast/cable TV entities are privately held, but a quick review of the yahoo!finance stats shows a PE of 75 (!) compared to Echostar's 91 and the industry's 35, a P/Sales of 3.6 compared to Echostar's 2 and the industry's 1.7, and a PEG of 4, compared to Echostar's 2 and the industry's 2.5.

My summary of the fundies is that I don't see the screaming value here, but apparently somebody (Buffett and/or Simpson) a lot smarter than me does.

Now, let's look at the charts. As always, it depends on your time frame.

First, the daily charts, if you're looking for a swing trade of a few days duration.

courtesy of stockcharts.com

Well, its a nice uptrend, I guess you could look for a swing trade a couple different ways. There is pretty good support at 32, from prior lows and the uptrend line, but there is resistance from the old highs at 33. I guess if it dropped to 32 and bounced, you could buy it on a tight stop, with an expected run to 33, so maybe you could squeeze a risk return of 3/1 out of it, but you'd have to be pretty nimble--that's really more of a day trade than a swing trade, frankly.

The other way to play this is to buy a breakout of the old high at 33.6. I think if you have to swing trade this one that's what I'd do. There are probably better plays out there.

Next let's look at the weekly chart.

courtesy of stockcharts.com

Again, nothing terribly exciting. I think if you have to play it, the Gary B. Smith call would be to buy the breakout of the old high at 36.5, although there is a lot of resistance above that. Looking at the price by volume bars along the left side, you can see however that a lot of the outstanding volume traded around 30, so maybe there isn't a lot of supply in the high 30's. Still, nothing here that makes me eager to take a position.

Finally, the monthly chart, the one that Buffet and Simpson should be looking at :>)

courtesy of stockcharts.com

Aha!! Now we have our answer! Clearly, Buffett and Simpson looked at this chart, saw the wedge and all the volume right around 30, and concluded when this one pops to the upside, it'll really run!

Isn't great to solve a mystery??!!???

(Uh, where's the sarcasm button on this thing?)

CMCSA has drawn a lot of interest lately with the news that Warren Buffett's Berkshire Hathaway has doubled its stake in the cable provider. A lot of people have been sort of scratching their heads, trying to figure out what the value angle is that the Sage of Omaha sees in Comcast. Let me end the suspense and give the answer at the end of this post;>).

First, I will offer a couple observations--1) A big chunk of Berkshire's equity portfolio is actually managed by Lou Simpson at Geico, with little/no input from Buffett. Simpson is no slouch himself as a stock picker, but the point is this may not be a Buffett pick per se. 2) Whether it is a Buffett pick or not, Buffett and Berkshire in the past have done very well with local newspapers and television stations--the Buffalo News, Washington Post, and Cap Cities/ABC. The thinking has been that these local media represent businesses with some sort of a "moat" --Buffett-speak for some sort of barrier, be it regulatory or whatever, to entry of competitors in the space. Cable television providers certainly fit into that category.

That having been said, Buffett has always maintained that you can't just buy a great business, you have to pay a good-to-great price for it. This is where the head scratching comes in, because any way you slice it, its hard to find the great valuation on CMCSA. The comparisons are a little difficult, since a lot of the broadcast/cable TV entities are privately held, but a quick review of the yahoo!finance stats shows a PE of 75 (!) compared to Echostar's 91 and the industry's 35, a P/Sales of 3.6 compared to Echostar's 2 and the industry's 1.7, and a PEG of 4, compared to Echostar's 2 and the industry's 2.5.

My summary of the fundies is that I don't see the screaming value here, but apparently somebody (Buffett and/or Simpson) a lot smarter than me does.

Now, let's look at the charts. As always, it depends on your time frame.

First, the daily charts, if you're looking for a swing trade of a few days duration.

courtesy of stockcharts.com

Well, its a nice uptrend, I guess you could look for a swing trade a couple different ways. There is pretty good support at 32, from prior lows and the uptrend line, but there is resistance from the old highs at 33. I guess if it dropped to 32 and bounced, you could buy it on a tight stop, with an expected run to 33, so maybe you could squeeze a risk return of 3/1 out of it, but you'd have to be pretty nimble--that's really more of a day trade than a swing trade, frankly.

The other way to play this is to buy a breakout of the old high at 33.6. I think if you have to swing trade this one that's what I'd do. There are probably better plays out there.

Next let's look at the weekly chart.

courtesy of stockcharts.com

Again, nothing terribly exciting. I think if you have to play it, the Gary B. Smith call would be to buy the breakout of the old high at 36.5, although there is a lot of resistance above that. Looking at the price by volume bars along the left side, you can see however that a lot of the outstanding volume traded around 30, so maybe there isn't a lot of supply in the high 30's. Still, nothing here that makes me eager to take a position.

Finally, the monthly chart, the one that Buffet and Simpson should be looking at :>)

courtesy of stockcharts.com

Aha!! Now we have our answer! Clearly, Buffett and Simpson looked at this chart, saw the wedge and all the volume right around 30, and concluded when this one pops to the upside, it'll really run!

Isn't great to solve a mystery??!!???

(Uh, where's the sarcasm button on this thing?)

Weekend Wazzup for February 27, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here. The Roundtable stock this weekend is CMCSA. Already weighing in on the Roundtable this weekend is Levi Bauer--other roundtable members are Tom at Sixth World, Ron Sen, Bill Cara, Kaushik Gala, and yours truly.

Congrats to Mr. and Mrs. Sixth World on their new arrival, Emily!

Ron Sen wins a prize again this week, with a total so far of 16 posts since yesterday morning. Lots of nice charts, some yada yada yada for Louise Yamada, and an admonition.

Bill Cara had, as he usually does, an outstanding review of the week. You'll want to set aside some time to read it but let me just throw out 2 nuggets--Bill says crude oil will see $35 before $55, and gold will go to $475.

Galatime reminded us again about the free subscriptions available to SFO magazine, as well as some earnings season options strategies on AEOS, SNY, COST, and PETM.

Random Roger had an interesting tidbit from Tom Dorsey, about how once a stock hits $90, its a good bet to get to $100. Micheal Taylor from Taylortree looked at the data--its an interesting exchange. Bottom line, its not a sure bet, but its better than 50/50.

Byrne at Marketview has been busy this weekend, commenting on everything from Social Security to Bono at the World Bank to the great Florida trailer bubble.

Stephen Castellano at Reflections on Equity Research--puts it right out there and says that Qwest will not acquire MCI. Gotta love it when somebody makes a call!

Ugly at uglychart has a bit on how to start your own stock market kung fu blog.

TraderMike had a nice little review of NVDA's chart as well as EBAY's and GOOG.

And last but not least is Chairman MaoXian, with a newsletter and his chat every weekday 8:30-9:30 Eastern time. Tell him ni hao!

And that's wazzup with my cyber-peeps for this weekend.

Congrats to Mr. and Mrs. Sixth World on their new arrival, Emily!

Ron Sen wins a prize again this week, with a total so far of 16 posts since yesterday morning. Lots of nice charts, some yada yada yada for Louise Yamada, and an admonition.

Bill Cara had, as he usually does, an outstanding review of the week. You'll want to set aside some time to read it but let me just throw out 2 nuggets--Bill says crude oil will see $35 before $55, and gold will go to $475.

Galatime reminded us again about the free subscriptions available to SFO magazine, as well as some earnings season options strategies on AEOS, SNY, COST, and PETM.

Random Roger had an interesting tidbit from Tom Dorsey, about how once a stock hits $90, its a good bet to get to $100. Micheal Taylor from Taylortree looked at the data--its an interesting exchange. Bottom line, its not a sure bet, but its better than 50/50.

Byrne at Marketview has been busy this weekend, commenting on everything from Social Security to Bono at the World Bank to the great Florida trailer bubble.

Stephen Castellano at Reflections on Equity Research--puts it right out there and says that Qwest will not acquire MCI. Gotta love it when somebody makes a call!

Ugly at uglychart has a bit on how to start your own stock market kung fu blog.

TraderMike had a nice little review of NVDA's chart as well as EBAY's and GOOG.

And last but not least is Chairman MaoXian, with a newsletter and his chat every weekday 8:30-9:30 Eastern time. Tell him ni hao!

And that's wazzup with my cyber-peeps for this weekend.

Saturday, February 26, 2005

Paging drgood--you were right and Jaloti was wrong

Back here on my loser list I mentioned a buying opportunity in the "canroys"--canadian oil and gas royalty trusts. Drgood commented by asking, essentially, isn't there a lot of downside risk in these since they will probably drop as interest rates rise? I responded by saying I always thought these were correlated more with the price of oil than with interest rates, but maybe I was wrong--I posted the charts and said look at the charts, maybe there is some correlation there, whaddya think?

The other day in the chairman's chat I mentioned I was looking at the correlations between the canroys, interest rates, and oil prices using "math". Let me say officially that I was wrong and Drgood was right. I'll give a few details below, but I looked at one canroy, PGH, and found a strong correlation with the price of treasuries, and in fact a little better correlation with the Nasdaq, for goodness' sake, than with the price of oil.

My method was fairly straightforward--I downloaded historical price data from stockcharts.com for PGH, the CBOT treasuries index, the West Texas Intemediate crude price, and the COMPQ.

I entered the numbers into my trusty Open Office spreadsheet (almost as good as excel, but the price is much better-"free"), and used the "R" correlation function. If you don't know what R is, it is essentially a measure of how 2 variables are correlated. If 2 variables are perfectly correlated, (e.g. one changes in exactly the same direction and ratio as the other), R would equal 1, if there was no correlation (e.g. two sets of random numbers) R would equal 0, and if they were perfectly negatively correlated (e.g. one moves in exactly the opposite direction--like bond prices and interest rates) R would equal -1. (If your smart in math/statistics you'll undoubtedly find flaws in my descriptions--if I am "materially misleading or incorrect" let me know. Aw heck, even if you want to nitpick let me know).

The results surprised me. Over the past 10 months, the correlation between PGH and treasuries was 0.8--that's pretty highly correlated. The correlation between PGH and the COMPQ was 0.66 and between PGH and WTI crude was 0.58. That's right--PGH was a little better correlated with the Nasdaq, than with crude. Over the past month, correlations were lower, but still better with treasuries than oil--PGH and treasuries was 0.57, and PGH and WTI was 0.47.

I intend to play around with these correlations a little more, but I have to say I am surprised, and hopefully I learned something. In the words of Alexander Elder--"I reserve the right to be smarter tomorrow than I am today." Thanks Drgood!

The other day in the chairman's chat I mentioned I was looking at the correlations between the canroys, interest rates, and oil prices using "math". Let me say officially that I was wrong and Drgood was right. I'll give a few details below, but I looked at one canroy, PGH, and found a strong correlation with the price of treasuries, and in fact a little better correlation with the Nasdaq, for goodness' sake, than with the price of oil.

My method was fairly straightforward--I downloaded historical price data from stockcharts.com for PGH, the CBOT treasuries index, the West Texas Intemediate crude price, and the COMPQ.

I entered the numbers into my trusty Open Office spreadsheet (almost as good as excel, but the price is much better-"free"), and used the "R" correlation function. If you don't know what R is, it is essentially a measure of how 2 variables are correlated. If 2 variables are perfectly correlated, (e.g. one changes in exactly the same direction and ratio as the other), R would equal 1, if there was no correlation (e.g. two sets of random numbers) R would equal 0, and if they were perfectly negatively correlated (e.g. one moves in exactly the opposite direction--like bond prices and interest rates) R would equal -1. (If your smart in math/statistics you'll undoubtedly find flaws in my descriptions--if I am "materially misleading or incorrect" let me know. Aw heck, even if you want to nitpick let me know).

The results surprised me. Over the past 10 months, the correlation between PGH and treasuries was 0.8--that's pretty highly correlated. The correlation between PGH and the COMPQ was 0.66 and between PGH and WTI crude was 0.58. That's right--PGH was a little better correlated with the Nasdaq, than with crude. Over the past month, correlations were lower, but still better with treasuries than oil--PGH and treasuries was 0.57, and PGH and WTI was 0.47.

I intend to play around with these correlations a little more, but I have to say I am surprised, and hopefully I learned something. In the words of Alexander Elder--"I reserve the right to be smarter tomorrow than I am today." Thanks Drgood!

Friday, February 25, 2005

Request for Assistance

Assistance is needed from Jaloti's readers.

A doctoral candidate is interviewing financial blog readers for a research paper.

Any financial blog reader (that's you, if you're reading this) qualifies, but especially needed are readers under age 35, and female readers.

I was interviewed today, and rather enjoyed it, but then I enjoy just going on and on and on about myself, don't I . . .

Anyhow, if you are willing and able to be interviewed, please email me at harryjaloti@hotmail.com and I'll send your info along.

A doctoral candidate is interviewing financial blog readers for a research paper.

Any financial blog reader (that's you, if you're reading this) qualifies, but especially needed are readers under age 35, and female readers.

I was interviewed today, and rather enjoyed it, but then I enjoy just going on and on and on about myself, don't I . . .

Anyhow, if you are willing and able to be interviewed, please email me at harryjaloti@hotmail.com and I'll send your info along.

Another blog

Loser List for February 25, 2005

CULS a break out, but actually not by much; why do I get the feeling this one will fail?

CNC rising out of a pullback-- long, stop about 30.5- 31

DDDC Pull back, buy with a stop at 4.4

IINT if it shows strength, long with a stop at 2.3

TGA overbought, but if the gap holds above 8, this may be buyable.

LAB pullback in an uptrend, long with a stop at 9

For the "long term"-

ACAS may want to look at this on a fundie basis, might be a tradable pullback with a stop at 33-33.6

KO another long termer, I think 42 and change may well prove to be a good place to get into this one.

MFD nice long termer, good divy, pullback in an uptrend, buy around 20.5 or so.

The Pennies-

MUCL ?long with a stop about 0.4?

CTCHC how many days do I need to say it-a classic pullback with reduced volume. long with a stop about 0.55 -0.6

How to use this list. As always, read the disclaimer.

CNC rising out of a pullback-- long, stop about 30.5- 31

DDDC Pull back, buy with a stop at 4.4

IINT if it shows strength, long with a stop at 2.3

TGA overbought, but if the gap holds above 8, this may be buyable.

LAB pullback in an uptrend, long with a stop at 9

For the "long term"-

ACAS may want to look at this on a fundie basis, might be a tradable pullback with a stop at 33-33.6

KO another long termer, I think 42 and change may well prove to be a good place to get into this one.

MFD nice long termer, good divy, pullback in an uptrend, buy around 20.5 or so.

The Pennies-

MUCL ?long with a stop about 0.4?

CTCHC how many days do I need to say it-a classic pullback with reduced volume. long with a stop about 0.55 -0.6

How to use this list. As always, read the disclaimer.

Thursday, February 24, 2005

Free Energy!! (essentially)

Props to the truck and barter boys for this one:

money quote:

Although expensive to build, solar towers "essentially produce energy for free," said Sherif [a University of Florida professor of mechanial and aerospace engineering].

The Jaloti corollary:

"Although expensive to buy and hang in your living room, a Picasso provides enjoyment and prestige essentially for free"

(I won't even bring up opportunity cost like T&B did . . . )

money quote:

Although expensive to build, solar towers "essentially produce energy for free," said Sherif [a University of Florida professor of mechanial and aerospace engineering].

The Jaloti corollary:

"Although expensive to buy and hang in your living room, a Picasso provides enjoyment and prestige essentially for free"

(I won't even bring up opportunity cost like T&B did . . . )

Loser List for February 24, 2005

MFLX Pullback--long with a stop at 20?

ACU Volume is a little low, maybe long with a stop at 16

ADAM long, with a stop at 5.5. Maybe

CTCHC a penny, long, stop at 0.6

GLOW if it show shows strength, long with a stop at 2

ISCA long, stop at 54

PLUM might be peachy above 5

NFI if 32-33 holds it might be time to get back in--if it doesn't then it isn't :>)

ACU Volume is a little low, maybe long with a stop at 16

ADAM long, with a stop at 5.5. Maybe

CTCHC a penny, long, stop at 0.6

GLOW if it show shows strength, long with a stop at 2

ISCA long, stop at 54

PLUM might be peachy above 5

NFI if 32-33 holds it might be time to get back in--if it doesn't then it isn't :>)

Wednesday, February 23, 2005

Update to the Loser List for Today

It should be CTIC--I've changed the original post to reflect that.

And I wasn't kidding about free gasoline with SUOG--check out the press release, about 2/3 of the way down.

And I wasn't kidding about free gasoline with SUOG--check out the press release, about 2/3 of the way down.

Loser List for February 23, 2005

No more gloating about being on the right side of gold, oil, and the dollar--it's all about what's happening now.

COMPQ looks like it could go to 2000.

SINA and SOHU gapped right to the 200d and pulled back-funny how that works

ASTM--bring back the fork

BOOM--interesting chart--is that a buyable gap up, or a failed test of top? I'm not sure, so I'm staying away; if you've got an edge here go for it.

ALEX one of my long term holds (they own a lot of Hawaiian real estate carried on the books at 50 year old prices) , nice uptrend, this may be a buyable pullback above 42.

CTIC still looking like a failed breakout. Short with a stop at 11

GLOW might be a buyable pullback--if it shows some strength, long with a stop about 2

LCBM--strong uptrend, some range contraction, long with a 16 stop?

Pennies--if you've got any spare change, you might look at one of these slot machines:

PMU --breaking out--stop at 0.6

MUCL might take a poke at this one, long, with a stop at 0.40

SUOG, long above 0.20 and free gas!

IINT if you've got anything left over, might go long if it shows strength, stop about 2.4

Read what this list is about and check out the disclaimer.

COMPQ looks like it could go to 2000.

SINA and SOHU gapped right to the 200d and pulled back-funny how that works

ASTM--bring back the fork

BOOM--interesting chart--is that a buyable gap up, or a failed test of top? I'm not sure, so I'm staying away; if you've got an edge here go for it.

ALEX one of my long term holds (they own a lot of Hawaiian real estate carried on the books at 50 year old prices) , nice uptrend, this may be a buyable pullback above 42.

CTIC still looking like a failed breakout. Short with a stop at 11

GLOW might be a buyable pullback--if it shows some strength, long with a stop about 2

LCBM--strong uptrend, some range contraction, long with a 16 stop?

Pennies--if you've got any spare change, you might look at one of these slot machines:

PMU --breaking out--stop at 0.6

MUCL might take a poke at this one, long, with a stop at 0.40

SUOG, long above 0.20 and free gas!

IINT if you've got anything left over, might go long if it shows strength, stop about 2.4

Read what this list is about and check out the disclaimer.

Tuesday, February 22, 2005

Floor traders 1, Greenpeace 0

What happens when you screw with raw capitalism:

http://www.timesonline.co.uk/article/0,,2-1487741,00.html

WHEN 35 Greenpeace protesters stormed the International Petroleum Exchange (IPE) yesterday they had planned the operation in great detail.

What they were not prepared for was the post-prandial aggression of oil traders who kicked and punched them back on to the pavement.

“We bit off more than we could chew. They were just Cockney barrow boy spivs. Total thugs,” one protester said, rubbing his bruised skull. “I’ve never seen anyone less amenable to listening to our point of view.”

Another said: “I took on a Texan Swat team at Esso last year and they were angels compared with this lot.” Behind him, on the balcony of the pub opposite the IPE, a bleary-eyed trader, pint in hand, yelled: “Sod off, Swampy.”

http://www.timesonline.co.uk/article/0,,2-1487741,00.html

WHEN 35 Greenpeace protesters stormed the International Petroleum Exchange (IPE) yesterday they had planned the operation in great detail.

What they were not prepared for was the post-prandial aggression of oil traders who kicked and punched them back on to the pavement.

“We bit off more than we could chew. They were just Cockney barrow boy spivs. Total thugs,” one protester said, rubbing his bruised skull. “I’ve never seen anyone less amenable to listening to our point of view.”

Another said: “I took on a Texan Swat team at Esso last year and they were angels compared with this lot.” Behind him, on the balcony of the pub opposite the IPE, a bleary-eyed trader, pint in hand, yelled: “Sod off, Swampy.”

Don't you just hate . . .

. . . those pundits with selective memory who are always plugging their right calls and forgetting their wrong ones?

(sigh)I can't help it.

I'm one of them.

With today's moves in gold, oil, and the dollar, doesn't this Haiku look like I knew something?

Yeah, like a stopped clock knows something :>)

(sigh)I can't help it.

I'm one of them.

With today's moves in gold, oil, and the dollar, doesn't this Haiku look like I knew something?

Yeah, like a stopped clock knows something :>)

Loser List for February 22, 2005

Oil indices XOI and OIX look overextended and due for a correction, but when? If you're in the oils, trailing stop. If not in, wait for a pullback.

LENF --another BB, does range contraction ... at 5?

MFLX--if it shows some strength, it might be a buy with a stop at 22.

MUCL--if you've got beer money you don't need, take a flier with a stop at 0.40

ADAM buyable pullback stop at 6?

FFIV long stop at 51

NAT buyable pullback at 50?

PLUM--consolidating above 5, and maybe some of that range contraction stuff as well

TKF, long, stop 19

How to use this list. As always, read the disclaimer.

LENF --another BB, does range contraction ... at 5?

MFLX--if it shows some strength, it might be a buy with a stop at 22.

MUCL--if you've got beer money you don't need, take a flier with a stop at 0.40

ADAM buyable pullback stop at 6?

FFIV long stop at 51

NAT buyable pullback at 50?

PLUM--consolidating above 5, and maybe some of that range contraction stuff as well

TKF, long, stop 19

How to use this list. As always, read the disclaimer.

Monday, February 21, 2005

Just to show I'm not just a short term trader

Another one of those Top Performers lists--This is top 25 of 1994-2004.

http://www.thinkequity.com/blog/reports/topperformers.pdf

(note--I suspect #2 doesn't include the past couple months . . .)

1. APOL Apollo Group, Inc.

2. CREE Cree, Inc.

3. DRL Doral Financial Corp.

4. QCOM QUALCOMM, Inc.

5. SHFL Shuffle Master, Inc.

6. DHI D.R. Horton Inc.

7. AMHC American Healthways, Inc.

8. OSK Oshkosh Truck Corporation

9. WFMI Whole Foods Market, Inc.

10. SBUX Starbucks Corporation

11. SLM SLM Corporation

12. COF Capital One Financial Corp.

13. RYL The Ryland Group, Inc.

14. TECH Techne Corporation

15. EV Eaton Vance Corp.

16. HAR Harman International Industries Inc./DE/

17. TOL Toll Brothers, Inc.

18. MSCC Microsemi Corporation

19. CAI CACI International Inc

20. HARB Harbor Florida Bancshares, Inc.

21. NTY NBTY, Inc.

22. BZH Beazer Homes USA, Inc.

23. JKHY Jack Henry & Associates, Inc.

24. ZQK Quiksilver, Inc.

25. CDWC CDW Corporation

http://www.thinkequity.com/blog/reports/topperformers.pdf

(note--I suspect #2 doesn't include the past couple months . . .)

1. APOL Apollo Group, Inc.

2. CREE Cree, Inc.

3. DRL Doral Financial Corp.

4. QCOM QUALCOMM, Inc.

5. SHFL Shuffle Master, Inc.

6. DHI D.R. Horton Inc.

7. AMHC American Healthways, Inc.

8. OSK Oshkosh Truck Corporation

9. WFMI Whole Foods Market, Inc.

10. SBUX Starbucks Corporation

11. SLM SLM Corporation

12. COF Capital One Financial Corp.

13. RYL The Ryland Group, Inc.

14. TECH Techne Corporation

15. EV Eaton Vance Corp.

16. HAR Harman International Industries Inc./DE/

17. TOL Toll Brothers, Inc.

18. MSCC Microsemi Corporation

19. CAI CACI International Inc

20. HARB Harbor Florida Bancshares, Inc.

21. NTY NBTY, Inc.

22. BZH Beazer Homes USA, Inc.

23. JKHY Jack Henry & Associates, Inc.

24. ZQK Quiksilver, Inc.

25. CDWC CDW Corporation

George Orwell and Blogging

The fact that a loser like me can just set up a blog and actually have people read it, got me to revisit a recurrent thought I've had--that George Orwell in 1984 got it half right and half wrong. Orwell's "negative utopia" had ubiquitous "telescreens", something he conceived of as a television set that could both receive and transmit; it could both feed you the government's line, and spy on how closely you were following it. With computers, laptops, web cameras, and everywhere internet access, we're basically there. What Eric Blair (Orwell's real name) couldn't quite see was that all this recieving and transmitting could go in many directions. Being a good socialist, he only saw the central planning model, where "the word" goes out from one location to all, and the return path is from all back to the central location. He didn't (apparently) envision telescreens that were peer-to-peer, to use the term loosely, where any one can see and talk to and write to any other one (or many other ones), where in fact this giant network of two-way telescreens that we call the internet lets us choose from a multiplicity of voices, not be forced to hear just one.

Yeah, ok, the markets need to open back up so I don't get too philosophical . . . .

Yeah, ok, the markets need to open back up so I don't get too philosophical . . . .

Interesting site and post

With the US markets closed today, it might be a good day to catch up on reading, etc. Check out Michael Taylor's TaylorTree site. He's got a lot of good stuff with some interesting insights. He made a comment on the move into electronic medical records and how QSII might benefit from that. He also linked to a fascinating interview of Bob Hoye from institutionaladvisors.com: "The world is long inflation and short the dollar." Definitely some "against the crowd" views there; it's worth the read.

Sunday, February 20, 2005

Sunday Night Charts for February 20, 2005

All weekly charts.

Let's start with a new one.

The Dow Jones Utility Average

Courtesy of stockcharts.com

Trendline intact. Lots of support below based on volume and prior highs. Still a bull run.

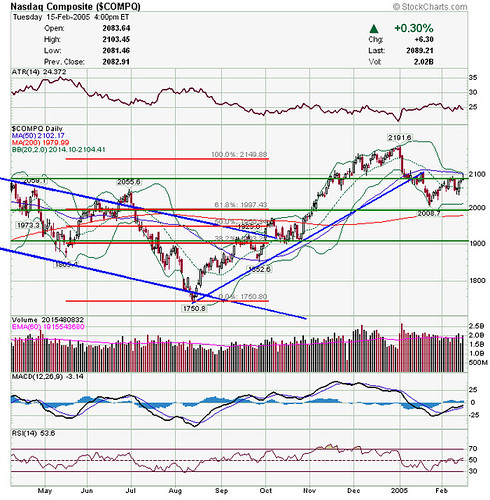

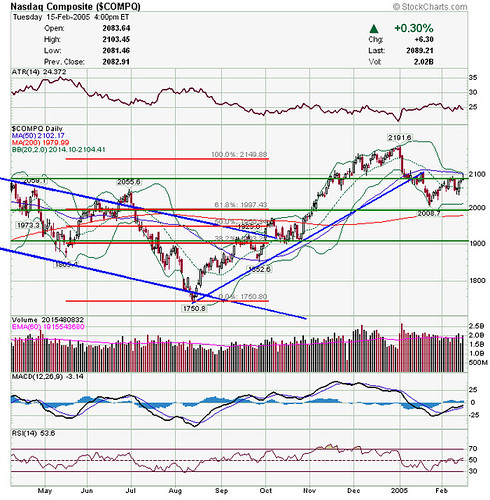

Next is the Nasdaq Composite

Courtesy of stockcharts.com

Despite the action of the past few weeks, the longer term trendline is still intact.

The CRB Weekly

Courtesy of stockcharts.com

I worried here and here about the trend maybe being over, but it looks like temporary violation of the trendline may be reversed. Looks more like the bull is continuing than ending.

As confirmation of the CRB, here is the CME stock chart

Courtesy of stockcharts.com

Despite a nasty gap down on the daily the other day, trendline is intact.

Here is Gold

Courtesy of stockcharts.com

Again, the bull continues.

Next is West Texas Intermediate Crude (oil, that is, black gold, Texas Tea)

Courtesy of stockcharts.com

Not even really overextended.

However the Oil index, representing oil equities, is a little different story.

Courtesy of stockcharts.com

Definitely overbought, based on the RSI, the Bollinger Bands, the distance above the 50d and 200d, and probably any other criteria known to man. However, overbought can stay overbought for a long time. Additionally, check out late '04--same story, parabolic move up, overbought, but corrected not by dropping but by marching in place. Could the oil stocks correct from here--sure, but it may be by stagnating rather than dropping. It also may occur 10%, 20% above here. Thus, if you're in--trailing stop. If you're out, might want to wait and see.

Finally is the USD

Courtesy of stockcharts.com

continuing its downtrend as I called here and here.

Good luck and have a great week!

Let's start with a new one.

The Dow Jones Utility Average

Courtesy of stockcharts.com

Trendline intact. Lots of support below based on volume and prior highs. Still a bull run.

Next is the Nasdaq Composite

Courtesy of stockcharts.com

Despite the action of the past few weeks, the longer term trendline is still intact.

The CRB Weekly

Courtesy of stockcharts.com

I worried here and here about the trend maybe being over, but it looks like temporary violation of the trendline may be reversed. Looks more like the bull is continuing than ending.

As confirmation of the CRB, here is the CME stock chart

Courtesy of stockcharts.com

Despite a nasty gap down on the daily the other day, trendline is intact.

Here is Gold

Courtesy of stockcharts.com

Again, the bull continues.

Next is West Texas Intermediate Crude (oil, that is, black gold, Texas Tea)

Courtesy of stockcharts.com

Not even really overextended.

However the Oil index, representing oil equities, is a little different story.

Courtesy of stockcharts.com

Definitely overbought, based on the RSI, the Bollinger Bands, the distance above the 50d and 200d, and probably any other criteria known to man. However, overbought can stay overbought for a long time. Additionally, check out late '04--same story, parabolic move up, overbought, but corrected not by dropping but by marching in place. Could the oil stocks correct from here--sure, but it may be by stagnating rather than dropping. It also may occur 10%, 20% above here. Thus, if you're in--trailing stop. If you're out, might want to wait and see.

Finally is the USD

Courtesy of stockcharts.com

continuing its downtrend as I called here and here.

Good luck and have a great week!

Weekend Wazzup for February 20, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here.

Weighing in on the Roundtable today are Tom at Sixth World, Ron Sen, Bill Cara, Kaushik Gala, Levi Bauer , and yours truly. The stock is AAPL, and I think everybody has some useful insights, even if we all pretty much came to the same conclusion.

Speaking of my roundtable brothers, it looks like Tom may have some big news soon. Good luck, Mr. and Mrs. Sixth World!

Ron Sen has changed the name of his blog to Technically Speaking. Ron, I don't care what you call it, it's still great stuff. He had a whole plethora of posts covering a wide range of topics, including many charts. He coined the best nickname this week: "Abby-normal Joseph Cohen."

Bill Cara had, as he usually does, an outstanding review of the week. I was somewhat surprised to see him on the same side of the LEXR trade as Tobin Smith. Maybe I need to look at that one.

Levi the Soothsayer of Omaha had what I consider a model of evaluating a stock--take a look at his review of AAPL.

Moving on and picking a name at random, Roger Nusbaum had a couple very insightful comments--one of them being a more in depth view of something I commented on as well. He also asks if a bell is ringing for Brazil, Russia, India and China. I said it before I'll say it again, I can always count on Roger for insights I don't get elsewhere.

Always providing insight is Chairman MaoXian, whose newsletter came out a day early this weekend. He's not taking more donations for it at this time, but he's still the man! ;>) Check out his chat every weekday 8:30-9:30 Eastern time.

Also check out Byrne's Marketview who has a couple observations on the Verizon-MCI deal.

CommodityTrader noted that the price of copper is nearing an all-time high. (Still hasn't done anything for my position in MKRR, though.)

Ugly at uglychart also weighs in with his view of AAPL. There has been some good natured back and forth about this. I was also interested to see his review of Shaolin Soccer, a movie that I enjoyed as well.

New on my list of blogs is Stephen Castellano at Reflections on Equity Research--he links to Jaloti, how bad can he be! ;>)

TraderMike has been quiet so far this weekend. He's probably busy reading the rest of us. :>)

Weighing in on the Roundtable today are Tom at Sixth World, Ron Sen, Bill Cara, Kaushik Gala, Levi Bauer , and yours truly. The stock is AAPL, and I think everybody has some useful insights, even if we all pretty much came to the same conclusion.

Speaking of my roundtable brothers, it looks like Tom may have some big news soon. Good luck, Mr. and Mrs. Sixth World!

Ron Sen has changed the name of his blog to Technically Speaking. Ron, I don't care what you call it, it's still great stuff. He had a whole plethora of posts covering a wide range of topics, including many charts. He coined the best nickname this week: "Abby-normal Joseph Cohen."

Bill Cara had, as he usually does, an outstanding review of the week. I was somewhat surprised to see him on the same side of the LEXR trade as Tobin Smith. Maybe I need to look at that one.

Levi the Soothsayer of Omaha had what I consider a model of evaluating a stock--take a look at his review of AAPL.

Moving on and picking a name at random, Roger Nusbaum had a couple very insightful comments--one of them being a more in depth view of something I commented on as well. He also asks if a bell is ringing for Brazil, Russia, India and China. I said it before I'll say it again, I can always count on Roger for insights I don't get elsewhere.

Always providing insight is Chairman MaoXian, whose newsletter came out a day early this weekend. He's not taking more donations for it at this time, but he's still the man! ;>) Check out his chat every weekday 8:30-9:30 Eastern time.

Also check out Byrne's Marketview who has a couple observations on the Verizon-MCI deal.

CommodityTrader noted that the price of copper is nearing an all-time high. (Still hasn't done anything for my position in MKRR, though.)

Ugly at uglychart also weighs in with his view of AAPL. There has been some good natured back and forth about this. I was also interested to see his review of Shaolin Soccer, a movie that I enjoyed as well.

New on my list of blogs is Stephen Castellano at Reflections on Equity Research--he links to Jaloti, how bad can he be! ;>)

TraderMike has been quiet so far this weekend. He's probably busy reading the rest of us. :>)

Roundtable on AAPL

This week's Roundtable stock is AAPL. Joining me in evaluating it are Tom Ott, Kaushik Gala, Levi Bauer, Ron Sen, & Bill Cara. I try pretty hard not to look at my colleagues' evals before I write mine, because I don't want to bias myself. I have to confess this week I glanced at Levi's; frankly, after seeing it I'm tempted to write "just read Levi's write-up, I can't add anything intelligent to that"--he put together a disciplined, thorough, step by step comprehensive look at it that is just outstanding. Nevertheless, I'll try to say something semi-intelligent and vaguely appropriate.

Apple to me is one of those "cult" companies and products. There are fanatics who think Apple's products are "genius", and who think Jobs is a visionary pioneer, and then there are people like me who say, "yeah, that's kinda cool, but Dell makes pretty much the same thing cheaper, and Whizbango makes something similar for a whole lot cheaper."

If this sounds derogatory, I apologize; I don't mean it that way--what I really mean to say is that I just don't get it, it being Apple's products or the company. To me computers become more and more of a commodity every year, and why one product or one company deserves a premium is unclear to me. However, just because I don't "get" something doesn't mean it can't work.

Right now it does look like Apple the stock is commanding a premium compared to other computer manufacturers. It sports a PE of 70, compared to Dell's 30, and the industry average of 24, and a PS of 3.6, compared to Dell's 2 and the industry's 1.5. Yeah, but its a fast grower right now, you say--except that its PEG ratio is 2, compared to Dell's1.1 and the industry's 1.3. Now, I know this is just a cursory look at simple numbers, but sometimes you don't have to put the fat person on a fancy scale to know that he's fat. I don't see any way to call this company a "buy" on a fundamental basis--the time to do that was late '02-early '03 when it was priced in the low teens and, as I recall, had 12 bucks per share in cash. Of course, then there were rumblings that Apple was "over" (that's always the way it is, isn't it?).

Let's look at some technicals. I think those are a pretty simple stratightforward story as well.

Here is the weekly chart for AAPL

courtesy of stockcharts.com

While it certainly has come real far real fast, I wouldn't short it--its come this far, who's to say it can't go up another 20,30,50, or even 100 points? When a stock has risen like this, I think it's a coin flip as to whether the next 20-30 points will be up or down. Thus, I have no edge in picking the direction here. I will say that a simple glance at the chart shows me support at 60, from the consolidation there, and the fibonacci retracement. If we get a pullback to about 60, and then some strength again, one could justify going long again with a stop just below 60.

The money quote: Any way you look at this one, it's expensive. If you're lucky enough to be in this one from a lot lower, two words: trailing stop. If you're not in this one, I'd stay out. I wouldn't do anything till after a significant correction.

Apple to me is one of those "cult" companies and products. There are fanatics who think Apple's products are "genius", and who think Jobs is a visionary pioneer, and then there are people like me who say, "yeah, that's kinda cool, but Dell makes pretty much the same thing cheaper, and Whizbango makes something similar for a whole lot cheaper."

If this sounds derogatory, I apologize; I don't mean it that way--what I really mean to say is that I just don't get it, it being Apple's products or the company. To me computers become more and more of a commodity every year, and why one product or one company deserves a premium is unclear to me. However, just because I don't "get" something doesn't mean it can't work.

Right now it does look like Apple the stock is commanding a premium compared to other computer manufacturers. It sports a PE of 70, compared to Dell's 30, and the industry average of 24, and a PS of 3.6, compared to Dell's 2 and the industry's 1.5. Yeah, but its a fast grower right now, you say--except that its PEG ratio is 2, compared to Dell's1.1 and the industry's 1.3. Now, I know this is just a cursory look at simple numbers, but sometimes you don't have to put the fat person on a fancy scale to know that he's fat. I don't see any way to call this company a "buy" on a fundamental basis--the time to do that was late '02-early '03 when it was priced in the low teens and, as I recall, had 12 bucks per share in cash. Of course, then there were rumblings that Apple was "over" (that's always the way it is, isn't it?).

Let's look at some technicals. I think those are a pretty simple stratightforward story as well.

Here is the weekly chart for AAPL

courtesy of stockcharts.com

While it certainly has come real far real fast, I wouldn't short it--its come this far, who's to say it can't go up another 20,30,50, or even 100 points? When a stock has risen like this, I think it's a coin flip as to whether the next 20-30 points will be up or down. Thus, I have no edge in picking the direction here. I will say that a simple glance at the chart shows me support at 60, from the consolidation there, and the fibonacci retracement. If we get a pullback to about 60, and then some strength again, one could justify going long again with a stop just below 60.

The money quote: Any way you look at this one, it's expensive. If you're lucky enough to be in this one from a lot lower, two words: trailing stop. If you're not in this one, I'd stay out. I wouldn't do anything till after a significant correction.

Saturday, February 19, 2005

Fox Saturday Morning "Business Bloc" for February 19, 2005

Fox News Channel' s "Cost of Freedom" Saturday Morning shows--

All four shows had a lot of the usual pointless back and forth macro talk--housing- is it a bubble, is tech coming or going, etc. A lot of this seems to be the same-old same-old every week, so I basically ignore most of it unless there is some unusual insight (rare) and concentrate on the specific stock mentions.

Bulls and Bears

Had a "Scoreboard" segment which was a review of guests' previous picks, good and bad. The two most interesting things in this segment were 1) they generally only talk about stocks with a market cap greater than 500 million on this show, so they had to make exceptions for KKD and LEXR; and 2) nobody said anything about a stop loss being important in the case of some of these bad picks. As for specifics, Tobin Smith scored with picking MSO but now says sell it; also had picked LEXR (loser) but said he's buying it again(he said it has $2 in cash per share). Scott Bleier had a winner with LSS and currently says hold it; his big loser was GNSS. Perma-bull Joe Battipaglia picked NMGa which he says is still a hold but he had said avoid EK which subsequently racked up some gains.(Kinda ironic that the perma-bull's "avoid" pick was a winner.) Pat Dorsey picked NOK which he called still a hold but had picked KKD last May(he said he missed some warning signs). Gary Kaltbaum had a winner in MAR (still a hold) but a loser in LLY.

In the predictions segment Tobin Smith called for a test of the Nasdaq bottom and then a rally, Joe Battipaglia said buy SGP and BMY, Pat Dorsey liked DV and Gary Kaltbaum said MSFT will sink.

Cavuto

Lots of pointless macro talk but this interesting exchange in regard to the housing bubble question-- Ben Stein said there is a shortage of home inventory in Southern California, and Jim Rogers compared that to when the pundits said there was a shortage of stock in 1968, right at the top. Next was a segment on how well C, TYC, TWX have done since scandals and bad news. Rogers says buy ABB and short FNM and the homebuilders but Charles Payne says go long FNM. (Insert your favorite comment about it takes two sides to make a market) Payne also recommended RHI.

Forbes on Fox

Had a rather non-specific discussion about whether cable companies or phone companies were a better buy. Mentioned as a speculative buy was CHTR , as a possible takeover was CMCSA, also mentioned was VZ, supposedly cheap at 13x earnings.

Cashin In

Wayne Rogers says oil, gas and natural resources are still strong and he mentioned PKZ, PTR, BR, VLO, BHP saying he owns them all. He also mentioned TSRA. Jonathan Hoenig says utilites and reinsureance are the trends he sees. As usual he managed to mention a number of tickers he owns in passing: PBR E COP BP XOM RD. (In case it isn't clear I appreciate this--I watch these shows to get specific stocks to look into). His featured pick was Brazilian utility ELP and he also mentioned SBS CPL CIG. When he was challenged that their dividends were realtively low, he said he owns them for the capital appreciation more than the divys. Danielle Hughes picked ERICY and said she owns it. Jonas Max Ferris picked BCS, in part because he believes them to be in the running to manage private social security accounts. Wayne Rogers liked the stock and said it has a great website. Ferris also picked ANPI as a speculation for drug coated stents--he's looking for a surprise on earnings next week.

All four shows had a lot of the usual pointless back and forth macro talk--housing- is it a bubble, is tech coming or going, etc. A lot of this seems to be the same-old same-old every week, so I basically ignore most of it unless there is some unusual insight (rare) and concentrate on the specific stock mentions.

Bulls and Bears

Had a "Scoreboard" segment which was a review of guests' previous picks, good and bad. The two most interesting things in this segment were 1) they generally only talk about stocks with a market cap greater than 500 million on this show, so they had to make exceptions for KKD and LEXR; and 2) nobody said anything about a stop loss being important in the case of some of these bad picks. As for specifics, Tobin Smith scored with picking MSO but now says sell it; also had picked LEXR (loser) but said he's buying it again(he said it has $2 in cash per share). Scott Bleier had a winner with LSS and currently says hold it; his big loser was GNSS. Perma-bull Joe Battipaglia picked NMGa which he says is still a hold but he had said avoid EK which subsequently racked up some gains.(Kinda ironic that the perma-bull's "avoid" pick was a winner.) Pat Dorsey picked NOK which he called still a hold but had picked KKD last May(he said he missed some warning signs). Gary Kaltbaum had a winner in MAR (still a hold) but a loser in LLY.

In the predictions segment Tobin Smith called for a test of the Nasdaq bottom and then a rally, Joe Battipaglia said buy SGP and BMY, Pat Dorsey liked DV and Gary Kaltbaum said MSFT will sink.

Cavuto

Lots of pointless macro talk but this interesting exchange in regard to the housing bubble question-- Ben Stein said there is a shortage of home inventory in Southern California, and Jim Rogers compared that to when the pundits said there was a shortage of stock in 1968, right at the top. Next was a segment on how well C, TYC, TWX have done since scandals and bad news. Rogers says buy ABB and short FNM and the homebuilders but Charles Payne says go long FNM. (Insert your favorite comment about it takes two sides to make a market) Payne also recommended RHI.

Forbes on Fox

Had a rather non-specific discussion about whether cable companies or phone companies were a better buy. Mentioned as a speculative buy was CHTR , as a possible takeover was CMCSA, also mentioned was VZ, supposedly cheap at 13x earnings.

Cashin In

Wayne Rogers says oil, gas and natural resources are still strong and he mentioned PKZ, PTR, BR, VLO, BHP saying he owns them all. He also mentioned TSRA. Jonathan Hoenig says utilites and reinsureance are the trends he sees. As usual he managed to mention a number of tickers he owns in passing: PBR E COP BP XOM RD. (In case it isn't clear I appreciate this--I watch these shows to get specific stocks to look into). His featured pick was Brazilian utility ELP and he also mentioned SBS CPL CIG. When he was challenged that their dividends were realtively low, he said he owns them for the capital appreciation more than the divys. Danielle Hughes picked ERICY and said she owns it. Jonas Max Ferris picked BCS, in part because he believes them to be in the running to manage private social security accounts. Wayne Rogers liked the stock and said it has a great website. Ferris also picked ANPI as a speculation for drug coated stents--he's looking for a surprise on earnings next week.

Friday, February 18, 2005

Thanks

I'd just like to take a moment to thank everyone who's sent a tip, everyone who's sent an email, or posted a comment and especially everyone who's just stopped by and looked at a page or two on my site. I started this effort as a way to just get my thoughts and plans down in black and white as a way to help me in my trading; I continue to be pleasantly surprised, gratified and flattered that so many people actually are reading what I write.

I'm going to keep writing, and I hope y'all keep reading.

Thanks again.

I'm going to keep writing, and I hope y'all keep reading.

Thanks again.

TA vs. FA

Byrne had a thought provoking post about Technical Analysis. He certainly is pretty open minded about it for a fundamentals guy. I sorta agree and sorta disagree with him though. Money quote: "One of the crucial differences between fundamentals and technicals in this respect is that fundamental analysis is about taking a lot of data and applying a few rules, whereas technical analysis involves a little data (prices and volume) and a lot of rules. "

Certainly, TA only uses price and volume as data--everything else is derived from that. As for a lot of rules, I think that depends on the implementation. Certainly there are a lot of rules out there, but I'm not sure that the successful use of TA depends on using a lot of them--in fact quite the contrary; I think the more successful TA traders use only a few simple rules.

He also said, "However, most of what it (technical analysis) offers is the same thing fundamental analysis offers: Confidence. I'll go out on a limb and hypothesize that whether or not there's any real science behind the discipline of picking stocks, people who are confident that they're right (and can admit it when they're wrong) will do better than the rest." Mostly, I agree with this--especially with the "can admit it when they're wrong" part. I think an essential component of any successful approach is that you pick some criteria by which your thesis will be proven wrong, and set up a contingency plan for what you will do then (i.e., close your position).

In my view what makes TA useful is that to, some degree, EVERYBODY trades on price. The Warren Buffetts of the world say, I'm buying KO below 40 and not a penny more--so the technician says the volume coming in and every dip below 40 get pushed back up to form a nice hammer or whatever you're calling the formation(support). The average Joe trader says I'm underwater on INTC, so everytime it gets back to my entry point at 24, I'm gonna sell and use the money for table dances (note, NOT a work-safe link) and booze. This shows up on the chart as well(resistance.) Oversimplified, but you get the idea.

Certainly, TA only uses price and volume as data--everything else is derived from that. As for a lot of rules, I think that depends on the implementation. Certainly there are a lot of rules out there, but I'm not sure that the successful use of TA depends on using a lot of them--in fact quite the contrary; I think the more successful TA traders use only a few simple rules.

He also said, "However, most of what it (technical analysis) offers is the same thing fundamental analysis offers: Confidence. I'll go out on a limb and hypothesize that whether or not there's any real science behind the discipline of picking stocks, people who are confident that they're right (and can admit it when they're wrong) will do better than the rest." Mostly, I agree with this--especially with the "can admit it when they're wrong" part. I think an essential component of any successful approach is that you pick some criteria by which your thesis will be proven wrong, and set up a contingency plan for what you will do then (i.e., close your position).

In my view what makes TA useful is that to, some degree, EVERYBODY trades on price. The Warren Buffetts of the world say, I'm buying KO below 40 and not a penny more--so the technician says the volume coming in and every dip below 40 get pushed back up to form a nice hammer or whatever you're calling the formation(support). The average Joe trader says I'm underwater on INTC, so everytime it gets back to my entry point at 24, I'm gonna sell and use the money for table dances (note, NOT a work-safe link) and booze. This shows up on the chart as well(resistance.) Oversimplified, but you get the idea.

A little housekeeping about the Loser List

Every day I post the "Loser List". I give it this name because I call myself Just Another Loser On The Internet. This is a list that I work off of to make trades, based mostly on technicals. Usually, I am looking at something that is trending, has moved against the trend ("pulled back", if in an uptrend), and is now resuming its trend. (Otherwise known as "buying strength on weakness" or "selling weakness on strength".)My time frame is nearly always at least a couple days, and sometimes much longer.

It certainly is not a recommendation to buy or sell, because, after all, if you remember from the disclaimer, I am not a registered investment advisor and thus could not make such recommendations. Obviously, anybody has to due their own due diligence and look at all the factors that might be important to them in buying or selling a stock. So, take the names you see on my list, and use them as a starting point for your own evaluation. Or maybe you should just fade me, that might be a plan . . . ;>)

It certainly is not a recommendation to buy or sell, because, after all, if you remember from the disclaimer, I am not a registered investment advisor and thus could not make such recommendations. Obviously, anybody has to due their own due diligence and look at all the factors that might be important to them in buying or selling a stock. So, take the names you see on my list, and use them as a starting point for your own evaluation. Or maybe you should just fade me, that might be a plan . . . ;>)

MSFT shows its m4d sk1llz

Very interesting to see article at Microsoft.com on l33t ( pronounced "leet"in case you didn't know), also known as "hackz0r" or "h4kz0r" ("hack-sore"). If you didn't know what the kids these days are up to, this is a bit of an introduction. It did sort of remind me a bit of my parents' generation passing information to each other about what us kids were up to ("Marijuana is referred to by many names: maryjane, hash, reefer, pot, stash, lid, key") of course, they would get the syntax wrong, and leave out the latest names. There always seems to be an element of "those kids have their own lingo to hide their shenanigans from us" and that's probably true. Frankly (and to get semi-serious for only a minute I promise) as the parent of a teenager I worry very little about what he does on the internet; with only a few exceptions (writing viruses, etc.) they don't get into trouble or run into harm on the net, its when they leave the net and go out into the real world and get wasted, drive cars, play grab-ass and try to get into each other's pants that the real trouble happens.

The more time they spend on the net calling each other "n00b" and discussing their "m4d sk1lz", the less time they have to get into real trouble.

The more time they spend on the net calling each other "n00b" and discussing their "m4d sk1lz", the less time they have to get into real trouble.

Loser List for February 18, 2005

ADAM--buyable dip?- stop at 5.5

DDDC-buyable pullback? stop at 5

CTIC fake out break out? (thanks makin) short below 10?

GTEL--want to play a BB penny--buy the pullback, stop at 0.25--or you could spend the money on booze, it'd probably be more rewarding

CTCHC--another penny, stop at 0.65