I'd been thinking about expanding on my recent post on Buffett and Berkshire, and then along comes BlogginWall Street with the Piggybackers and Are Buffett followers in Denial; and then, whaddya know, I find out Jaloti is one of the bloggers who "continued to praise and idolize Buffett"!

First off, let's get one thing straight--I am all about the goal. When I trade, I want to make money--easy, rough, ugly, pretty, I'll take it any way I can get it. When I blog, I'm all about the traffic, so BlogginWall Street, I don't care what you say about me as long as you get the URL right. (You did, thanks.)

On a more philosophical note, however, I don't disagree with the comments that some part of Buffett/Berkshire's success is marketing and PR; in fact, I advocated that very point here. I said it then, I say it now, Warren Buffett has a gift for sales. However, I maintain that he's a mighty fine value investor and capitol allocator, as well. He makes mistakes, sure, but I think his long track record is pretty good.

As far as my post, showing my "idolatry" for Buffett, as I stated, I was actually mentally expanding on it this morning prior to Bloggin Wall Street taking notice of me. When I said that the whole system as we know it would be in trouble, if in fact Warren Buffett is over the line, I meant it, on a couple different levels. First, Buffett's integrity has never before been seriously questioned. He has a 40+ year public record of doing his duty to his partners and shareholders in an honest and ethical way. If he has been dishonest/unethical, then, wow, he's fooled a lot of people for a long time, and basically, you can't trust anybody. And maybe you can't. And again, if that's the case, I'll never read another 10-K or SEC filing, I'll look at charts exclusively, and even those I'll take with a grain of salt.

The other level I was referring to is the legal one. I have to admit I'm not that smart about a lot of these investigations, but I have a concern sometimes that the fine points of the law are used as a bludgeon by overzealous governmental officials to trap well-meaning individuals who were in the wrong place at the wrong time. Again, Buffett has been very good about knowing just where the legal lines are; if, in this case, he's inadvertantly stepped over the lines that Eliot Sptizer drew after the fact, then no one is safe from crusaders in the government, and this "Spitzer risk" needs to be priced into every publically traded entity in some way. (Note--I realize Spitzer isn't the only one interested in Buffett; I'm using him as an example and for convenience' sake.)

In summary, I think I have my eyes open about Warren Buffett; he's got strengths and weaknesses. However, no one has ever seriously suggested his ethics were a weakness. If, in fact, that is the case, then we're in trouble. If you can't trust Buffett, I'm not really sure who in business you can trust.

Thursday, March 31, 2005

Loser List for March 31, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

HMA long,, stop at 26

IRIS long on strength stop at 10.8

KOSP long, stop at 40

MPWR if it goes up, buy with a stop at 8.4

OMR long, stop at 3.3

ROL long, stop at 18

TRI long, stop 48.5

USEG long on strength, stop 5.65

UBET it's a breakout, above 5.98

APOL short weakness, stop 75

ERTS short weakness, stop at 54.2

MHK short weakness, stop at 86

PH short weakness, stop 61

pennies

CGYN long, stop at 0.49

MJET buy it above 0.32

How to use this list. And don't forget the disclaimer . . .

HMA long,, stop at 26

IRIS long on strength stop at 10.8

KOSP long, stop at 40

MPWR if it goes up, buy with a stop at 8.4

OMR long, stop at 3.3

ROL long, stop at 18

TRI long, stop 48.5

USEG long on strength, stop 5.65

UBET it's a breakout, above 5.98

APOL short weakness, stop 75

ERTS short weakness, stop at 54.2

MHK short weakness, stop at 86

PH short weakness, stop 61

pennies

CGYN long, stop at 0.49

MJET buy it above 0.32

How to use this list. And don't forget the disclaimer . . .

Wednesday, March 30, 2005

A little snapback here

Nice rally here today. I was going to post something pre-open about a possible rally here, but blogspot wouldn't let me. I say that not to claim I called it here, but to put it in perspective. The markets were pretty oversold by lots of different measures; Trader Mike showed a good one. The point is that what to do with a day like today depends on your time frame--if you're very short term, then there are some good longs to catch. If you have a longer time frame, this may be time to sell, depending on how far this goes. On the Nasdaq, for instance, it looks like we've rallied right to resistance, so I wouldn't be a longer term buyer here without more strength.

Loser List for March 30, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

Lots of really crummy looking charts. You're probably best off ignoring this list, and keeping your cash in your pocket.

AEL long stop at 12

GEOI long, stop at 7.87. maybe.

HMA a nice breakout, stop at 25.3

NUCO long, stop at 25

IRIS long, stop at 11

OMR long stop at 3.4

TRI gap up, stop at 48.7

USEG stop at 5.65

BBG short weakness stop at 28.8

SCH be ready to short a solid break of 10

DCX ditto for a break of 44

pennies

ASPC stop at 0.075

JRSE buy above 0.004

LTS breakout stop at 0.70

LTHU keep an eye on it

NVEI a breakout if it can get above 0.187

QTIG breakout above .125

VLTA big gap up, stop at 0.32

How to use this list. And don't forget the disclaimer . . .

Lots of really crummy looking charts. You're probably best off ignoring this list, and keeping your cash in your pocket.

AEL long stop at 12

GEOI long, stop at 7.87. maybe.

HMA a nice breakout, stop at 25.3

NUCO long, stop at 25

IRIS long, stop at 11

OMR long stop at 3.4

TRI gap up, stop at 48.7

USEG stop at 5.65

BBG short weakness stop at 28.8

SCH be ready to short a solid break of 10

DCX ditto for a break of 44

pennies

ASPC stop at 0.075

JRSE buy above 0.004

LTS breakout stop at 0.70

LTHU keep an eye on it

NVEI a breakout if it can get above 0.187

QTIG breakout above .125

VLTA big gap up, stop at 0.32

How to use this list. And don't forget the disclaimer . . .

Tuesday, March 29, 2005

Buffett and Berkshire

Berkshire Hathway has been trading down toward the price that would interest me on word that Buffett himself will be questioned by regulators.

Look, its very simple. Buffett may have his flaws, but he's very aware of where the ethical and legal lines are. If he's over the line, then we've got some EXTREMELY serious problems here--like buy gold and guns because the whole system as we know it is in trouble.

That "end of the world" bet hasn't ever panned out. I think Berkshire will emerge from this ok.

It may trade lower for a while, though.

Look, its very simple. Buffett may have his flaws, but he's very aware of where the ethical and legal lines are. If he's over the line, then we've got some EXTREMELY serious problems here--like buy gold and guns because the whole system as we know it is in trouble.

That "end of the world" bet hasn't ever panned out. I think Berkshire will emerge from this ok.

It may trade lower for a while, though.

Loser List for March 29, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

SCH--little bounce today, but still looking like a short to me. stop at 10.5

MRX, short weakness, stop 31

RSH be ready to short weakness, stop at 26

TOO ditto, stop at 25.5

XPRSA short, stop at 21

WMT is looking like a short if it can't get above 51.2 or so

PRZ buy it if it can stay above 4.93

USEG is right at support, long if it shows strength, stop 5.6

EPAY short,stop at 13.5

FHRX, short stop at 16.2

QSII breakout, stop at 47

Pennies

ASPC long, stop at 0.08

LGOV is a breakout, stop at 0.24

keep an eye out for PTF, PH, PAX, UNP

How to use this list. And don't forget the disclaimer . . .

SCH--little bounce today, but still looking like a short to me. stop at 10.5

MRX, short weakness, stop 31

RSH be ready to short weakness, stop at 26

TOO ditto, stop at 25.5

XPRSA short, stop at 21

WMT is looking like a short if it can't get above 51.2 or so

PRZ buy it if it can stay above 4.93

USEG is right at support, long if it shows strength, stop 5.6

EPAY short,stop at 13.5

FHRX, short stop at 16.2

QSII breakout, stop at 47

Pennies

ASPC long, stop at 0.08

LGOV is a breakout, stop at 0.24

keep an eye out for PTF, PH, PAX, UNP

How to use this list. And don't forget the disclaimer . . .

Monday, March 28, 2005

Random Roger (once again) makes me think

Random Roger had a great post that started with links to two extremes in investing philosophy: anyone can and should manage their own money, and essentially, almost no one can. Roger made some great points, but I'd like to go in a little different direction. The debate, of course, is between "anyone can do well as an active investor" and the "best strategy is to use stable, passive index fund strategies" or "use a professional to make your decisions". I'll suggest that the difference between the two extremes is more one of degree than kind. The Barry Ritholz article made some cogent observations about why most humans suck at investing, but guess what? You gotta make a lot of the same decisions either way. You gotta decide to put your money somewhere. Even if you use passive strategies or a manager, you gotta decide to do that. You gotta pick the strategy or the manager. You gotta decide when and how much. Most important of all, you gotta keep deciding to stay with it, or not. Not to decide is to decide.

Let me give an example. I know a few people who've swallowed the John Bogle/Vanguard Funds/dollar cost average into the indexes koolaid. I shouldn't be perjorative; there's good data that suggests that strategy has merit IF you stick with it, over 20-30-40 years. Guess what? These people pulled money out and/or stopped contributing at the same point in the past 5 years. Was it A) January 2000 or B) July 2002? Take a wild guess. Hey, if you suck, you suck.

I suppose you can argue that with a passive approach, or a manager, you have fewer decisions to make. Still, in finance, as in the rest of life, all it takes is one or two really bad decisions at the wrong time to screw you up good.

Whatever approach one picks, you have to learn not to suck.

Rule #1 Don't lose money

Rule #2 Dont forget rule #1.

Let me give an example. I know a few people who've swallowed the John Bogle/Vanguard Funds/dollar cost average into the indexes koolaid. I shouldn't be perjorative; there's good data that suggests that strategy has merit IF you stick with it, over 20-30-40 years. Guess what? These people pulled money out and/or stopped contributing at the same point in the past 5 years. Was it A) January 2000 or B) July 2002? Take a wild guess. Hey, if you suck, you suck.

I suppose you can argue that with a passive approach, or a manager, you have fewer decisions to make. Still, in finance, as in the rest of life, all it takes is one or two really bad decisions at the wrong time to screw you up good.

Whatever approach one picks, you have to learn not to suck.

Rule #1 Don't lose money

Rule #2 Dont forget rule #1.

Loser List for March 28, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

Long list today . . . I'm gonna look at them really carefully before doing anything--some of these charts are almost "too good"

GSIC short weakness, stop at 13.5

BBG short weakness, stop 28.5

SCH short a break of 10

DCX short a break of 44

ERTS short a break of 54.5

FMBI went right down and closed at the previous low of 32.02. Where now?

MKC short weakness stop at 35.4

MRX short weakness stop 30.5

MDTL short weakness, stop 15

ALAN might be a long if it stays above 1.00

BE buy strength, stop at 8.35

CPC still waiting to see some strength, 16.9 is the stop

CVO if you buy breakouts, here it is, stop at 4.1

CBAG long stop at 2.1

LEXR might be a look stop at 5.8

NUCO breakout stop at 25

PRZ another breakout above 4.5

USU long stop at 16.5

pennies

ASPC it has "space" and "com" in its name. Long, stop at 0.78

CGYN long, stop at 0.5

How to use this list. And don't forget the disclaimer . . .

Long list today . . . I'm gonna look at them really carefully before doing anything--some of these charts are almost "too good"

GSIC short weakness, stop at 13.5

BBG short weakness, stop 28.5

SCH short a break of 10

DCX short a break of 44

ERTS short a break of 54.5

FMBI went right down and closed at the previous low of 32.02. Where now?

MKC short weakness stop at 35.4

MRX short weakness stop 30.5

MDTL short weakness, stop 15

ALAN might be a long if it stays above 1.00

BE buy strength, stop at 8.35

CPC still waiting to see some strength, 16.9 is the stop

CVO if you buy breakouts, here it is, stop at 4.1

CBAG long stop at 2.1

LEXR might be a look stop at 5.8

NUCO breakout stop at 25

PRZ another breakout above 4.5

USU long stop at 16.5

pennies

ASPC it has "space" and "com" in its name. Long, stop at 0.78

CGYN long, stop at 0.5

How to use this list. And don't forget the disclaimer . . .

Sunday, March 27, 2005

Sunday Night Charts for March 27, 2005

Let's start with the Nasdaq. Weekly chart.

Courtesy of stockcharts.com

Solid break of that trendline. If it doesn't stop here, could be down to 1900.

Next is VIX

Courtesy of stockcharts.com

A little pop, and fade. Still no real fear.

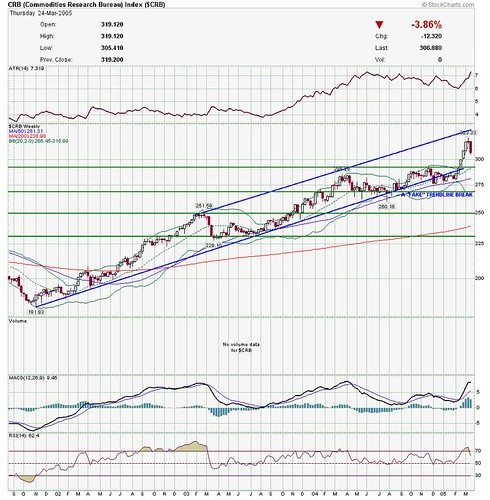

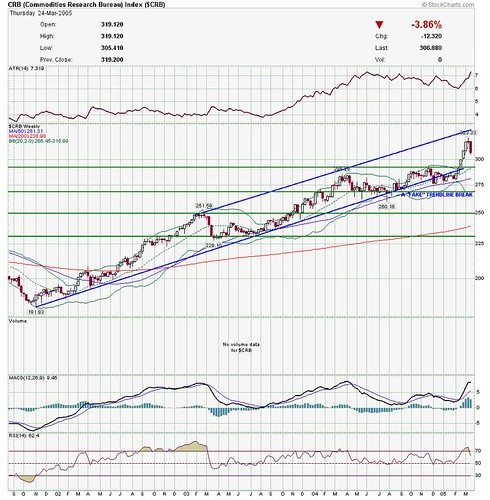

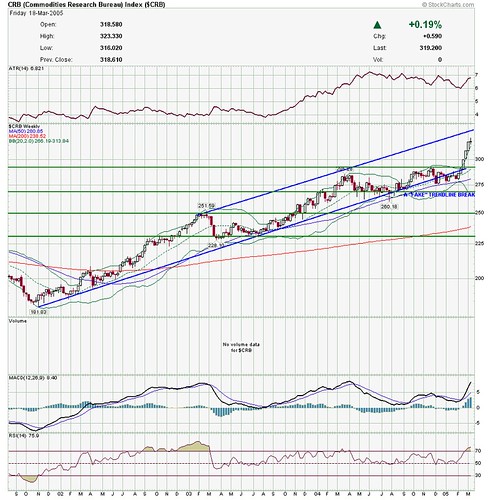

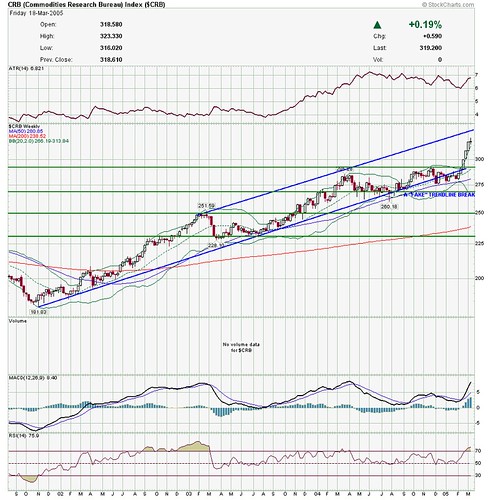

Now, the CRB

Courtesy of stockcharts.com

Despite the drop, still a solid uptrend.

Next is gold.

Courtesy of stockcharts.com

Dropped right to solid support. If this doesn't hold . . . . . . . .

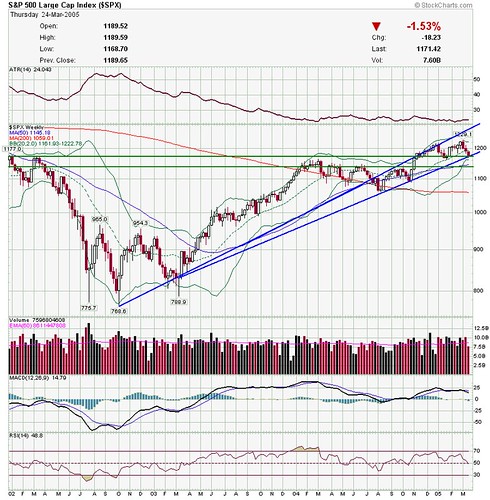

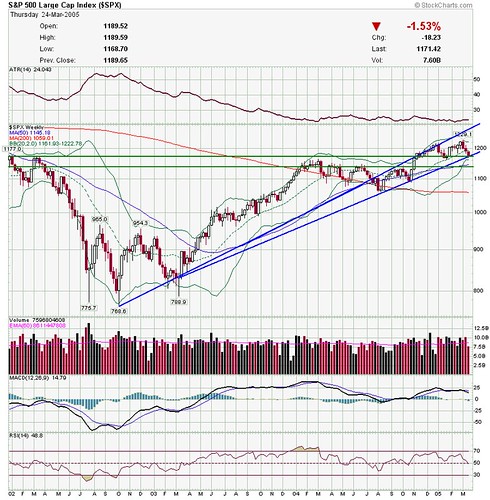

S & P

Courtesy of stockcharts.com

Has also dropped to solid support.

WTIC

Courtesy of stockcharts.com

Right at a double top.

TNX

Courtesy of stockcharts.com

Would you believe, declining interest rates?

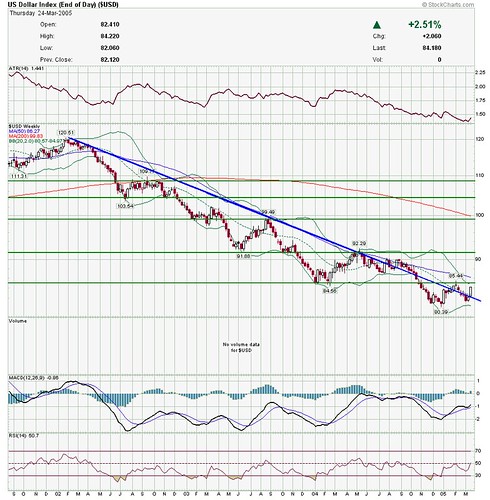

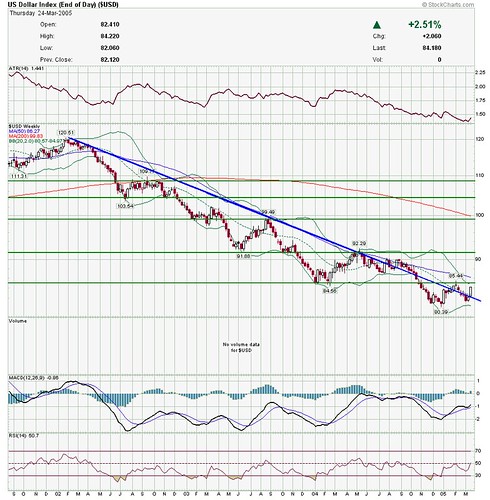

Finally, Warren Buffett's favorite short, the USD

Courtesy of stockcharts.com

A change in trend? Not till it solidly breaks above about 85.

Have a great week everyone!

Courtesy of stockcharts.com

Solid break of that trendline. If it doesn't stop here, could be down to 1900.

Next is VIX

Courtesy of stockcharts.com

A little pop, and fade. Still no real fear.

Now, the CRB

Courtesy of stockcharts.com

Despite the drop, still a solid uptrend.

Next is gold.

Courtesy of stockcharts.com

Dropped right to solid support. If this doesn't hold . . . . . . . .

S & P

Courtesy of stockcharts.com

Has also dropped to solid support.

WTIC

Courtesy of stockcharts.com

Right at a double top.

TNX

Courtesy of stockcharts.com

Would you believe, declining interest rates?

Finally, Warren Buffett's favorite short, the USD

Courtesy of stockcharts.com

A change in trend? Not till it solidly breaks above about 85.

Have a great week everyone!

Weekend Wazzup for March 27, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here. Ugly at uglychart has a running "survivor" contest for stock market blogs --Jaloti made a great run at it this week, but it looks like Fat Pitch Financials closed strong this weekend and has a big lead. Vote early and often!

Chairman MaoXian is off on an extended trip to the motherland, but eventually he'll be back with his newsletter and his chat. Stockcoach is also still off on an extended break--I'll be waiting for both of these guys to get back, and I'm sure a lot of others will as well.

Ron Sen has spun off his charting to a new site. Galatime mentioned some managed options trading in Australia, as well as a book review and some new blogs. Tom Ott at Sixth World links to his stock scans, and highlights that great trade in HANS. Bill Cara once again presents an outstanding review of the week. The Soothsayer of Omaha got back from Chicago and looked at what Mr. Market is saying.

Taylor Tree will post later today or tomorrow, I just know it, so check him out when he does. Stephen Castellano at Reflections on Equity Research had some nice stuff on Finance XML, which segues right into his Open Source equity project, GEM research. Check it out! TraderMike linked to Jim Cramer's 25 rules of investing. (Moses only brought 10 commandments, but Cramer has 25 rules? I'm not surprised.) Byrne's Marketview linked to a fascinating article about a man who has saved billions of lives, but most (including me) have never heard of him. He also mentioned Google's 20% rule, another thing I hadn't heard about.

Random Roger made comments about firefighting, Jim Cramer, and GM's debt. Stephen Vita at the Alchemy of Trading highlighted what the big boys are doing(Hint--they're signalling "BUY"). Check out Shiau Street, and his great new idea, a Wiki for stocks!

Have a great week everybody!!

Chairman MaoXian is off on an extended trip to the motherland, but eventually he'll be back with his newsletter and his chat. Stockcoach is also still off on an extended break--I'll be waiting for both of these guys to get back, and I'm sure a lot of others will as well.

Ron Sen has spun off his charting to a new site. Galatime mentioned some managed options trading in Australia, as well as a book review and some new blogs. Tom Ott at Sixth World links to his stock scans, and highlights that great trade in HANS. Bill Cara once again presents an outstanding review of the week. The Soothsayer of Omaha got back from Chicago and looked at what Mr. Market is saying.

Taylor Tree will post later today or tomorrow, I just know it, so check him out when he does. Stephen Castellano at Reflections on Equity Research had some nice stuff on Finance XML, which segues right into his Open Source equity project, GEM research. Check it out! TraderMike linked to Jim Cramer's 25 rules of investing. (Moses only brought 10 commandments, but Cramer has 25 rules? I'm not surprised.) Byrne's Marketview linked to a fascinating article about a man who has saved billions of lives, but most (including me) have never heard of him. He also mentioned Google's 20% rule, another thing I hadn't heard about.

Random Roger made comments about firefighting, Jim Cramer, and GM's debt. Stephen Vita at the Alchemy of Trading highlighted what the big boys are doing(Hint--they're signalling "BUY"). Check out Shiau Street, and his great new idea, a Wiki for stocks!

Have a great week everybody!!

Saturday, March 26, 2005

Fox Saturday Morning "Business Bloc" for March 26, 2005

Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- Bulls and Bears started with the Trading Pit segment, discussing the fact that April has been the best performing month for the Dow over the past 55 years, with an average 1.9% gain. So the question, is a rally coming --Bob Froelich from Scudder Investments said yes , Tobin Smith and Chris Russo said maybe yes but it might be a head fake, Pat Dorsey and Scott Bleier said no (Bleier also mentioned he's short TOL). In the Lightning round, discussing C: Froehlich and Dorsey were bulls, Toby, Bleier and Russo were bears. On XOM: Toby, Russo, and Froehlich were bulls, Bleier and Dorsey were bears. On GE: Froehlich was the lone bull, all the others were bears. MSFT: Dorsey and Froehlich were bulls, Bleier, Toby and Russo were bears. In the Stock Xchange segment, Toby picked USU uranium (the one Herb Greenberg hates and Cramer likes), Froehlich picked BUD, Bleier picked COHR--largest manufacuter of lasers in the world--he owns it, Dorsey picked FHN, a regional bank paying 4%, and Russo picked KOMG. In predictions, Bleier says oil has picked for the year, and autos to head up--buy DCX. Dorsey says buy UPS sell FDX, Bob Froehlich says buy KO, Russo says buy MVL on Monday. Toby says SFD for Easter. Pat Dorsey got the line of the day-- "Does anyone else see the irony in a ham stock from Tobin?"

Cavuto on Business started with a discussion of whether the fact that rising gas prices haven't yet hurt the market is bullish. I find it hard to see much value in these discussions, when debates occur over easily verifiable facts--"the money supply is contracting" "no it isn't". The More for Your Money segment discussed possible take over targets-- Charles Payne picked EMC; Jon Najarian picked TSO; Perma-bull Joe Battipaglia says regional bank ASO (but doesn't own it); Ben Stein says WM. Cavuto went Head to Head with former "Governor Moonbeam" and current Oakland Mayor Jerry Brown about government regulation of health care. Oddly enough, Brown defended more regulation, and Cavuto argued for less. In Fox on the Spot, perma-bull Joe Battipaglia says market up 10% up in April, Meredith Whitney says boom in housing prices is over, Jon Najarian says Pontiac or Buick may be dumped, GM may sell off GMAC, and thus GM is a buy and he owns it. Ben Stein says interest rates will stay low, buy stocks. Payne says dump oil stocks, a 10% correction is coming. Cavuto says more people will make living wills (wow, out on a limb there)

Forbes on Fox started with the Flipside, which discussed rising college costs. It is a fact, and a big concern, but once again there was disagreement over basic facts ("More kids are getting grants than loans" "No they aren't"). The only novel (though convoluted) point I heard was that the problem is that employers use college degrees as a credential, even when it really isn't relevant to necessary skills. Again, little useful information. In Focus discussed social security reform and the consensus was that private accounts are probably not going to happen. The Informer segment discussed rising gas prices. VLO was mentioned because they are good at refining "sour crude" lower grade crude that not all refiners can handle. PKZ was also mentioned. The Makers and Breakers segment featured Adam Bold, who was pushing CAMOX (has beaten S&P every year of its existence) and FFSCX, a small cap fund.

Cashin' In for the umpteenth time discussed whether there was a housing bubble. Wayne Rogers and Herb Greenberg said there is. Scary fact--in some sections of California, only 18% of households can afford a new home. In the Best Bets segment, Jonas Max Ferris picked WMT, but Jonathan Hoenig and Wayne Rogers said its dead money (Rogers said TGT might be better in this sector). Rogers picked PG as a defensive play, Hoenig said it was a good defensive pick, like CLX and PYX. Hoenig's pick was SNE, but said NWS was better in that sector. In the Money Mail segment, Wayne Rogers was asked what he looks for in a stock making a bottom. He said he looks for a drying up in volume, a formation like a double bottom , or cup with handle, then a rising price with rising volume. Hoenig says he still owns SPI as well as other international utilities. In the Stock of the Week segment, Wendell Perkins of Johnson Family mutual funds picked WYE and Wayne Rogers liked it.

Cavuto on Business started with a discussion of whether the fact that rising gas prices haven't yet hurt the market is bullish. I find it hard to see much value in these discussions, when debates occur over easily verifiable facts--"the money supply is contracting" "no it isn't". The More for Your Money segment discussed possible take over targets-- Charles Payne picked EMC; Jon Najarian picked TSO; Perma-bull Joe Battipaglia says regional bank ASO (but doesn't own it); Ben Stein says WM. Cavuto went Head to Head with former "Governor Moonbeam" and current Oakland Mayor Jerry Brown about government regulation of health care. Oddly enough, Brown defended more regulation, and Cavuto argued for less. In Fox on the Spot, perma-bull Joe Battipaglia says market up 10% up in April, Meredith Whitney says boom in housing prices is over, Jon Najarian says Pontiac or Buick may be dumped, GM may sell off GMAC, and thus GM is a buy and he owns it. Ben Stein says interest rates will stay low, buy stocks. Payne says dump oil stocks, a 10% correction is coming. Cavuto says more people will make living wills (wow, out on a limb there)

Forbes on Fox started with the Flipside, which discussed rising college costs. It is a fact, and a big concern, but once again there was disagreement over basic facts ("More kids are getting grants than loans" "No they aren't"). The only novel (though convoluted) point I heard was that the problem is that employers use college degrees as a credential, even when it really isn't relevant to necessary skills. Again, little useful information. In Focus discussed social security reform and the consensus was that private accounts are probably not going to happen. The Informer segment discussed rising gas prices. VLO was mentioned because they are good at refining "sour crude" lower grade crude that not all refiners can handle. PKZ was also mentioned. The Makers and Breakers segment featured Adam Bold, who was pushing CAMOX (has beaten S&P every year of its existence) and FFSCX, a small cap fund.

Cashin' In for the umpteenth time discussed whether there was a housing bubble. Wayne Rogers and Herb Greenberg said there is. Scary fact--in some sections of California, only 18% of households can afford a new home. In the Best Bets segment, Jonas Max Ferris picked WMT, but Jonathan Hoenig and Wayne Rogers said its dead money (Rogers said TGT might be better in this sector). Rogers picked PG as a defensive play, Hoenig said it was a good defensive pick, like CLX and PYX. Hoenig's pick was SNE, but said NWS was better in that sector. In the Money Mail segment, Wayne Rogers was asked what he looks for in a stock making a bottom. He said he looks for a drying up in volume, a formation like a double bottom , or cup with handle, then a rising price with rising volume. Hoenig says he still owns SPI as well as other international utilities. In the Stock of the Week segment, Wendell Perkins of Johnson Family mutual funds picked WYE and Wayne Rogers liked it.

Friday, March 25, 2005

Loser List for March 25, 2005

There is no loser list today--the US markets are closed for Jaloti's birthday.

Seriously, they are closed for Good Friday, but it IS Jaloti's birthday today.

To answer the inevitable question:

"Old enough to know better" :>)

Seriously, they are closed for Good Friday, but it IS Jaloti's birthday today.

To answer the inevitable question:

"Old enough to know better" :>)

Thursday, March 24, 2005

Cramer's Mad Money

Got a chance to catch Jim Cramer's Mad Money again today.

Quote of the day:"One day when you get inside my head--which would really be incredible because there's about 40 other guys in there right now. . . "

in the contrary indicator department: Cramer says trade out of NFI and get into NLY.

He likes USU, but Herb Greenberg doesn't. What to do, what to do. . .

Quote of the day:"One day when you get inside my head--which would really be incredible because there's about 40 other guys in there right now. . . "

in the contrary indicator department: Cramer says trade out of NFI and get into NLY.

He likes USU, but Herb Greenberg doesn't. What to do, what to do. . .

PTIE

Check out the yahoo PTIE board for an interesting discussion of a tiny pharma with new results out today. Jaloti may even post there!

Loser List for March 24, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

For a variety of reasons, including the doji in the tenyear note, the gap and crap in the VIX, and the fact that the 36 "line in the sand" in the QQQQ held, I think we may get a bounce today, Jim Cramer notwithstanding. If we gap open today, remember the Trader Mike rule, and wait to buy above the 10 AM high.

BBG short with a stop at 28

DCX be ready to short that break of 44

ERTS short a break of 55

IFOX buy strength, stop 15.7

MHK short, stop 86

PLMO breakout--stop at 25

ARS long, stop at 24.6

AHOM breakout, stop 4.10

APYM, long, stop at 1.96

CPC wait for strength, stop at 16.9

GEOI buy on strength, stop at 8.7

ROL no longer rolling, it's breaking out- stop at 18

JBL buy only on strength, stop at 27

PECS sell weakness, stop at 12.5

ABLE long, stop at 11.5

PTA maybe long? stop at 2.25

pennies--

HRCT on strength

TLEI if it can hold 0.30

How to use this list. And don't forget the disclaimer . . .

For a variety of reasons, including the doji in the tenyear note, the gap and crap in the VIX, and the fact that the 36 "line in the sand" in the QQQQ held, I think we may get a bounce today, Jim Cramer notwithstanding. If we gap open today, remember the Trader Mike rule, and wait to buy above the 10 AM high.

BBG short with a stop at 28

DCX be ready to short that break of 44

ERTS short a break of 55

IFOX buy strength, stop 15.7

MHK short, stop 86

PLMO breakout--stop at 25

ARS long, stop at 24.6

AHOM breakout, stop 4.10

APYM, long, stop at 1.96

CPC wait for strength, stop at 16.9

GEOI buy on strength, stop at 8.7

ROL no longer rolling, it's breaking out- stop at 18

JBL buy only on strength, stop at 27

PECS sell weakness, stop at 12.5

ABLE long, stop at 11.5

PTA maybe long? stop at 2.25

pennies--

HRCT on strength

TLEI if it can hold 0.30

How to use this list. And don't forget the disclaimer . . .

Wednesday, March 23, 2005

Jim Cramer's Mad Money

I finally caught a bit of Jim Cramer's Mad Money show on CNBC.

It's like Cramer on crack.

If you like Cramer, if you're entertained by him, as I am, you'll get a kick out of it.

If you dislike him, don't even bother.

It wasn't on five minutes when he provided a great line.

A caller asked about KKD.

Cramer's answer(screaming of course), "Buffett said he liked it, the stock went from 5 to 9--will somebody please ring the cash register on this one? When they find that wharehouse of 1998 donuts, you won't regret it."

???!!??!!! What the heck does that mean?

If, like me, you think Cramer is a contrary indicator, some specifics:

1) He says LEXR is up after hours and will jump tomorrow--he says sell it.

2) He says his thesis is to sell the drugs, buy the smokestacks. He also says if he's right, YELL and Chevron get bought tomorrow, if he's wrong, MRK and PFE.

3)He closed the show with the quote, "The market is the most oversold it's been in a year-- if you're still selling stocks please take a break --it could jump here."

FWIW

It's like Cramer on crack.

If you like Cramer, if you're entertained by him, as I am, you'll get a kick out of it.

If you dislike him, don't even bother.

It wasn't on five minutes when he provided a great line.

A caller asked about KKD.

Cramer's answer(screaming of course), "Buffett said he liked it, the stock went from 5 to 9--will somebody please ring the cash register on this one? When they find that wharehouse of 1998 donuts, you won't regret it."

???!!??!!! What the heck does that mean?

If, like me, you think Cramer is a contrary indicator, some specifics:

1) He says LEXR is up after hours and will jump tomorrow--he says sell it.

2) He says his thesis is to sell the drugs, buy the smokestacks. He also says if he's right, YELL and Chevron get bought tomorrow, if he's wrong, MRK and PFE.

3)He closed the show with the quote, "The market is the most oversold it's been in a year-- if you're still selling stocks please take a break --it could jump here."

FWIW

Latest on the Remainder Contest

After falling behind yesterday evening, Jaloti roars back to a commanding lead in the financial blog remainder contest on ugly's site.

My traffic is up significantly, too.

Thanks all you nice people

. . . who can't read and vote at the same time. :>)

Maybe I'll start a little poll, about whether I should be a gracious loser, or an angry, bitter one . . . which answer will get me more traffic?

My traffic is up significantly, too.

Thanks all you nice people

. . . who can't read and vote at the same time. :>)

Maybe I'll start a little poll, about whether I should be a gracious loser, or an angry, bitter one . . . which answer will get me more traffic?

Loser List for March 23, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

36 looks to be the line in the sand on the QQQQ

CRME short, stop at 7

DCX short a break of 44

GM--if it can't get and stay above 30, its a short

MTSN short below 8

MRX short, stop at 30

ADBE might be a long stop at 66

CPC watch for strength, stop at 17

GPN breakout, stop at 60

OMR long stop at 3.5

USEY breakout above 1.69

UNP breakout, stop at 67.5

TKF has pulled back to the trendline at about 15.5

NEM looks like a buy above 42.5

pennies

DTMG, long stop at .10

SAMC breakout above 0.88

How to use this list. And don't forget the disclaimer . . .

36 looks to be the line in the sand on the QQQQ

CRME short, stop at 7

DCX short a break of 44

GM--if it can't get and stay above 30, its a short

MTSN short below 8

MRX short, stop at 30

ADBE might be a long stop at 66

CPC watch for strength, stop at 17

GPN breakout, stop at 60

OMR long stop at 3.5

USEY breakout above 1.69

UNP breakout, stop at 67.5

TKF has pulled back to the trendline at about 15.5

NEM looks like a buy above 42.5

pennies

DTMG, long stop at .10

SAMC breakout above 0.88

How to use this list. And don't forget the disclaimer . . .

Tuesday, March 22, 2005

The Next Spitzer?

Check this out.

So let me get this straight--the Massachusetts SecState, because he is "charged with protecting Massachusetts Gillette shareholders who will have to vote on the PG/G deal", subpoenas documents, hires a consultant to look at them, and decides that PG lowballed it, and that the G shareholders deserve more.

Maybe Steve Castellano or Byrne or Levi or one of you smart guys can help me out on this one.

What's this guy's angle?

Is he playing the Spitzer card? Running for governor?

Or just trying to help holders of G in MA?

So let me get this straight--the Massachusetts SecState, because he is "charged with protecting Massachusetts Gillette shareholders who will have to vote on the PG/G deal", subpoenas documents, hires a consultant to look at them, and decides that PG lowballed it, and that the G shareholders deserve more.

Maybe Steve Castellano or Byrne or Levi or one of you smart guys can help me out on this one.

What's this guy's angle?

Is he playing the Spitzer card? Running for governor?

Or just trying to help holders of G in MA?

Remainder contest

and Jaloti takes the lead!

I want to thank the voters . . .

who obviously can't blog and chew gum at the same time;>)

(I'm trying for a magnanimous ad hominem)

I want to thank the voters . . .

who obviously can't blog and chew gum at the same time;>)

(I'm trying for a magnanimous ad hominem)

Fed Day

is always such a roller coaster; unfortunately it's like Space Mountain--you can't really see the track ahead too well, so you don't know which way the violent turns are going to go. Stephen Vita tried to game it out; like Yogi says, "Predicting is hard, especially when it concerns the future."

Maybe one of these days I'll adopt a "no trading on fed days" rule.

Maybe one of these days I'll adopt a "no trading on fed days" rule.

PTIE

is a micro cap pharma with a couple interesting drugs. There are some real downsides. Maybe the risk reward is ok. I got into a discussion with some folks about it on the Yahoo board.

I'm not sure why I'm posting here, to link to myself on Yahoo.

Sometimes it just be's that way.

I'm not sure why I'm posting here, to link to myself on Yahoo.

Sometimes it just be's that way.

DEA agent shoots self to demonstrate gun safety to 4th graders

Basically, that sums it up.

Just because you remove the clip, doesn't mean there isn't a round in the chamber.

A good workman knows his tools, or something like that.

Click this link. Requires windows media player.

Just because you remove the clip, doesn't mean there isn't a round in the chamber.

A good workman knows his tools, or something like that.

Click this link. Requires windows media player.

Financial blog Remainder

Looks like Jaloti is coming up fast in uglychart's "remainder" poll.

This is one of those "gee, I wish I'd thought of that" ideas--great job, ugly.

I stick to my position that publicity is publicity as long as they spell your URL correctly, as I am getting traffic right from that page.

My only reason to not get voted off is that once voted off, the link on that page becomes dead.

If voted off, I promise to milk it for all it's worth, whether that means tossing off thinly veiled ad hominems or being magnanimous, or both; whatever will get me the most traffic.

So click here and vote!

This is one of those "gee, I wish I'd thought of that" ideas--great job, ugly.

I stick to my position that publicity is publicity as long as they spell your URL correctly, as I am getting traffic right from that page.

My only reason to not get voted off is that once voted off, the link on that page becomes dead.

If voted off, I promise to milk it for all it's worth, whether that means tossing off thinly veiled ad hominems or being magnanimous, or both; whatever will get me the most traffic.

So click here and vote!

Loser List for March 22, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

I gotta have some names to look at, but boy, do I feel uncertain about which way--I feel like a lot of stuff could go 5% either way . . . That's the value of a well-chosen routine--when in doubt, stick to it. . .

ROL is rolling between 16 and 18--if 18 holds its a short, otherwise . . .

AHM short weakness, stop at 29

AVID might be a short, stop 60

MRX another maybe short, stop 30.2

RSH short weakness, stop 26

ANX breakout. stop at 1.35

ARS breakout, stop 24.8

BE breakout, stop 8.38

CPC pullback after a breakout, might be worth a poke if it stays above 17

JBL long stop 27

pennies

CGYN breakout stop at 0.5

GOTC long, stop 0.11

HRCT long stop 0.11

MBTG long, stop 0.44

How to use this list. And don't forget the disclaimer . . .

I gotta have some names to look at, but boy, do I feel uncertain about which way--I feel like a lot of stuff could go 5% either way . . . That's the value of a well-chosen routine--when in doubt, stick to it. . .

ROL is rolling between 16 and 18--if 18 holds its a short, otherwise . . .

AHM short weakness, stop at 29

AVID might be a short, stop 60

MRX another maybe short, stop 30.2

RSH short weakness, stop 26

ANX breakout. stop at 1.35

ARS breakout, stop 24.8

BE breakout, stop 8.38

CPC pullback after a breakout, might be worth a poke if it stays above 17

JBL long stop 27

pennies

CGYN breakout stop at 0.5

GOTC long, stop 0.11

HRCT long stop 0.11

MBTG long, stop 0.44

How to use this list. And don't forget the disclaimer . . .

Monday, March 21, 2005

Loser List for March 21, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

take a look with a value eye at MACE, CNRM, PTIE, AACC, GFCI

SCHL breakout, stop at 37.7

PRGS breakout, stop at 24.2

CTAS short below 41.5

FNF short a break of 40

RSH short, stop at 26

ADBE long with a stop aat 65

ASTE long stop at 20.4

BE breakout, stop at 8.3

CECO short weakness with a stop at 38

CPC keep an eye on it--if it can stay above 18, might be worth another ride

JBL long only if strong, stop 27

JSDA ditto, stop 4.88

MPET long stop at 1.68

RVI breakout if it can stay above 9.7

USEG long stop 5.2

ASR long stop at 28.5

pennies --Ron Sen stop reading now, and everyone else, too, for that matter.

CTCHC support at 0.69

LRLSQ stop at 0.18

How to use this list. And don't forget the disclaimer . . .

take a look with a value eye at MACE, CNRM, PTIE, AACC, GFCI

SCHL breakout, stop at 37.7

PRGS breakout, stop at 24.2

CTAS short below 41.5

FNF short a break of 40

RSH short, stop at 26

ADBE long with a stop aat 65

ASTE long stop at 20.4

BE breakout, stop at 8.3

CECO short weakness with a stop at 38

CPC keep an eye on it--if it can stay above 18, might be worth another ride

JBL long only if strong, stop 27

JSDA ditto, stop 4.88

MPET long stop at 1.68

RVI breakout if it can stay above 9.7

USEG long stop 5.2

ASR long stop at 28.5

pennies --Ron Sen stop reading now, and everyone else, too, for that matter.

CTCHC support at 0.69

LRLSQ stop at 0.18

How to use this list. And don't forget the disclaimer . . .

Sunday, March 20, 2005

Poor Charlie's Almanack Redux

Back here I pointed out the forthcoming Poor Charlie's Almanack, a compilation of the wit and wisdom of Charles T. Munger, the Vice Chairman of Berkshire Hathaway. Anumati rightly pointed out that much of this material is on the web already--being the cheap b*st*rd that I am I knew that. (Also mentioned was that a couple of the talks apparently appeared in Damn Right, the Munger biography. ) So I've taken this as a challenge, and tried to compile what I've found on the web. Here's what I've found so far--the numbers correspond to the table of contents listed here. There is also this speech here and here, which so far I haven't quite matched up to the table of contents.

7. Philanthropy Round Table

8.The Great Financial Scandal of 2003

9.Academic Economics

10.The Psychology of Human Misjudgment--this one was on Whitney Tilson's website, but it now says he removed it at Munger's request, I suspect because it is being updated/revised/whatever for the book. I have the pdf that Whitney posted originally; I won't post it if Whitney was asked to remove it, but I will email a copy if asked.

I'll let you all know if I find any more.

7. Philanthropy Round Table

8.The Great Financial Scandal of 2003

9.Academic Economics

10.The Psychology of Human Misjudgment--this one was on Whitney Tilson's website, but it now says he removed it at Munger's request, I suspect because it is being updated/revised/whatever for the book. I have the pdf that Whitney posted originally; I won't post it if Whitney was asked to remove it, but I will email a copy if asked.

I'll let you all know if I find any more.

Sunday Night Charts for March 20, 2005

Let's start with the Nasdaq. Weekly chart.

Courtesy of stockcharts.com

Has clearly broken that trendline.

Next is the CRB

Courtesy of stockcharts.com

Still a strong uptrend.

Now look at the VIX

Courtesy of stockcharts.com

Little bounce this week, but still no real fear.

Next is gold.

Courtesy of stockcharts.com

Looks like it's pulled back to support. If it holds, buy.

Berkshire Hathaway, A shares, monthly chart

Courtesy of stockcharts.com

I only do this because using TA on Berkshire drives the true believers nuts. Looks like support about 84000. (Hey, at least it's a long term chart) Seriously, I laid out my criteria for buying Berkshire here.

Finally, Warren Buffett's favorite short, the USD

Courtesy of stockcharts.com

A little bounce to the downtrend line, but still a downtrend.

Have a great week everyone!

Courtesy of stockcharts.com

Has clearly broken that trendline.

Next is the CRB

Courtesy of stockcharts.com

Still a strong uptrend.

Now look at the VIX

Courtesy of stockcharts.com

Little bounce this week, but still no real fear.

Next is gold.

Courtesy of stockcharts.com

Looks like it's pulled back to support. If it holds, buy.

Berkshire Hathaway, A shares, monthly chart

Courtesy of stockcharts.com

I only do this because using TA on Berkshire drives the true believers nuts. Looks like support about 84000. (Hey, at least it's a long term chart) Seriously, I laid out my criteria for buying Berkshire here.

Finally, Warren Buffett's favorite short, the USD

Courtesy of stockcharts.com

A little bounce to the downtrend line, but still a downtrend.

Have a great week everyone!

Poor Charlie's Almanack

Alright, Buffett/Munger fans--listen up. If, like me, you think the Mung-man is underappreciated compared to Buff-Daddy, then check this out. A new book is out, with the collected wisdom of Charlie T. Excerpts are available here. If you want to slip jaloti a couple bucks, you can order it from Amazon here.

I'm getting in line for this one.

I'm getting in line for this one.

Weekend Wazzup for March 20, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here.

Stephen Vita at Alchemy of Trading is pimping his Sunday PM posts --I know I'll be checking them out and you should too. Some impending absences are notable: Chairman MaoXian, whose chat every weekday 8:30-9:30 Eastern time is how I usually start my day, will be off to the motherland (fatherland?) for several weeks. His blogging likely will be curtailed, but his audience will wait for him. Stockcoach has his weekly summary, as well as a sign-off for a while due to some issues. All the best to ya, man. The Soothsayer of Omaha is also taking a bit of a break but will be back next week. Ron Sen takes no breaks this weekend; I count TWENTY posts yesterday--start with the Komodo dragon and just keep reading. Let me highlight a post on NFI, a stock I've followed for a while; as a well as a post on a non-financial, but very important and serious matter that Ron knows something about. Ron, if you say it I want to hear it. Taylor Tree and I are not in sync temporally--he posts good stuff early in the week, after I've written this; so let me just point to earlier in the week to his canary in the coal mine post--I linked to it once before but it deserves a couple links at least. Stephen Castellano at Reflections on Equity Research highlighted Fidelity's plans to start an institutional money management company. To add to the canary in the coal mine metaphor, I'd ask, do they open new units closer to the bottom, or the top? Bill Cara posts his customary review of the week. I can't do it just in one sentence, but I will say he thinks somebody's getting screwed. Byrne's Marketview isn't out to screw anybody, but AFP thinks Google News is, Byrne's take, like mine, is that publicity's publicity as long as they spell your URL right. Galatime posted some thorough reviews of option trades, including a summary of back testing option screens. Good stuff as usual. Sixth World Gazette has some eclectic stuff--he's sitting on a big wad of cash, and there are lots of posts on New Jersey politics--makes me glad I don't live in Jersey! . Random Roger has his big picture for the week. Trader Mike posted the morning of St. Patrick's day that the technicals continue to break down. And finally, the Uglychart "survivor" contest for stock market blogs is in its third week--make sure you vote!

Stephen Vita at Alchemy of Trading is pimping his Sunday PM posts --I know I'll be checking them out and you should too. Some impending absences are notable: Chairman MaoXian, whose chat every weekday 8:30-9:30 Eastern time is how I usually start my day, will be off to the motherland (fatherland?) for several weeks. His blogging likely will be curtailed, but his audience will wait for him. Stockcoach has his weekly summary, as well as a sign-off for a while due to some issues. All the best to ya, man. The Soothsayer of Omaha is also taking a bit of a break but will be back next week. Ron Sen takes no breaks this weekend; I count TWENTY posts yesterday--start with the Komodo dragon and just keep reading. Let me highlight a post on NFI, a stock I've followed for a while; as a well as a post on a non-financial, but very important and serious matter that Ron knows something about. Ron, if you say it I want to hear it. Taylor Tree and I are not in sync temporally--he posts good stuff early in the week, after I've written this; so let me just point to earlier in the week to his canary in the coal mine post--I linked to it once before but it deserves a couple links at least. Stephen Castellano at Reflections on Equity Research highlighted Fidelity's plans to start an institutional money management company. To add to the canary in the coal mine metaphor, I'd ask, do they open new units closer to the bottom, or the top? Bill Cara posts his customary review of the week. I can't do it just in one sentence, but I will say he thinks somebody's getting screwed. Byrne's Marketview isn't out to screw anybody, but AFP thinks Google News is, Byrne's take, like mine, is that publicity's publicity as long as they spell your URL right. Galatime posted some thorough reviews of option trades, including a summary of back testing option screens. Good stuff as usual. Sixth World Gazette has some eclectic stuff--he's sitting on a big wad of cash, and there are lots of posts on New Jersey politics--makes me glad I don't live in Jersey! . Random Roger has his big picture for the week. Trader Mike posted the morning of St. Patrick's day that the technicals continue to break down. And finally, the Uglychart "survivor" contest for stock market blogs is in its third week--make sure you vote!

Friday, March 18, 2005

Friday AM

TGIF

Could be an interesting day today. Ending the week on a big high or low might be significant(or not--how's that for hedging).

At least this weekend it'll be harder to lose money with the markets closed.

Anybody reading this right now (about 8:40 AM eastern) should go right now to the Chairman's chat. That's an order.

Could be an interesting day today. Ending the week on a big high or low might be significant(or not--how's that for hedging).

At least this weekend it'll be harder to lose money with the markets closed.

Anybody reading this right now (about 8:40 AM eastern) should go right now to the Chairman's chat. That's an order.

Loser List for March 18, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

CENT long,stop at 43.5

PTA long, stop at 2.25

X long, stop at 54

ARS long, stop at 24.5

CPC a breakout if it can stay above 17

CMVT, a breakout, pulled back, a buy if it stays above 25

OMR long stop 3.2

WSTM long above 5.13

RGF short, stop 33

TELK short a break of 15

CPL long, stop at 20

How to use this list. And don't forget the disclaimer . . .

CENT long,stop at 43.5

PTA long, stop at 2.25

X long, stop at 54

ARS long, stop at 24.5

CPC a breakout if it can stay above 17

CMVT, a breakout, pulled back, a buy if it stays above 25

OMR long stop 3.2

WSTM long above 5.13

RGF short, stop 33

TELK short a break of 15

CPL long, stop at 20

How to use this list. And don't forget the disclaimer . . .

Thursday, March 17, 2005

the Chairman, newspapers, and the web

Chairman MaoXian had a thought provoking post today linking to an article about newspapers and free web access. The gist of the original link seemed to be that newspapers are losing paid circulation to free web access of their content. The Chairman, (I think) disagrees and thinks they only get more readers with free web content. I guess I disagree with the specifics, but basically agree with the general point. I do agree with the Chairman that paid web access is a pain (I'm a cheap bastard too) and short-sighted, but I suspect it does cost the papers paid subscribers. I mean, look at the numbers presented for the NY Times--their subscribers are down, in a country/world with ever-expanding population and resources. However, the issue may not be that people are deciding, do I pay for the paper NYT or read it online. No, I think the larger issue is that there are so many free sources of information, most of them online, that people think why should I pay for it?

By and large, I think people want nuggets of information; they don't want the NYT or the WSJ per se, they want the nuggets. If they can get the same nuggets for free, why pay? I think on a small scale, a paper loses paid readers when they put their content out for free, but they have no choice, really; whether they charge or not, they may be losing "eyeballs" to some other nugget provider. It's like when AOL tried to persist in their proprietary content as the internet grew; eventually, they figured out there was just too much good free stuff out there, that nobody really cared about their unique AOL stuff, and so they just became an access provider, really.

The challenge for newspapers (and everybody, really, including me and the Chairman) is with all the ways to get free nuggets, how do you distinguish yourself so that people gotta have your nuggets?

By and large, I think people want nuggets of information; they don't want the NYT or the WSJ per se, they want the nuggets. If they can get the same nuggets for free, why pay? I think on a small scale, a paper loses paid readers when they put their content out for free, but they have no choice, really; whether they charge or not, they may be losing "eyeballs" to some other nugget provider. It's like when AOL tried to persist in their proprietary content as the internet grew; eventually, they figured out there was just too much good free stuff out there, that nobody really cared about their unique AOL stuff, and so they just became an access provider, really.

The challenge for newspapers (and everybody, really, including me and the Chairman) is with all the ways to get free nuggets, how do you distinguish yourself so that people gotta have your nuggets?

Loser List for March 17, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ABLE may have found support,at 8.5

BOOM wait for a bounce, might be a buy with a stop at 29.4

CLF keep an eye on it, 69.6 may be support

HANS is this the pullback, support at 54? I don't know

PTA long, stop at 2.25

ELP long support at 4.5

CPC nice breakout, stop at 15.7

IVX long, stop at 18.36

LFB, a breakout, stop at 18.4

OMR, breakout, stop 3.1

OPNT, stop at 8.5

GM think about a short, stop 30

pennies

JSDA a breakout, long, stop at 4.88

CTCHC let's see if 0.70 holds

PMU, long stop at 0.75

DTMG long, stop at .125

GDVI stop at 0.06

GRSU stop at 0.026

MBTG, stop 0.4

Keep an eye out for IGR, LGF, MACE, and look at the chart of WNHL and be glad you aren't in it. (Hopefully there's more to that story, like special divys, and not just old-fashioned capital destruction. Yowsaa!)

How to use this list. And don't forget the disclaimer . . .

ABLE may have found support,at 8.5

BOOM wait for a bounce, might be a buy with a stop at 29.4

CLF keep an eye on it, 69.6 may be support

HANS is this the pullback, support at 54? I don't know

PTA long, stop at 2.25

ELP long support at 4.5

CPC nice breakout, stop at 15.7

IVX long, stop at 18.36

LFB, a breakout, stop at 18.4

OMR, breakout, stop 3.1

OPNT, stop at 8.5

GM think about a short, stop 30

pennies

JSDA a breakout, long, stop at 4.88

CTCHC let's see if 0.70 holds

PMU, long stop at 0.75

DTMG long, stop at .125

GDVI stop at 0.06

GRSU stop at 0.026

MBTG, stop 0.4

Keep an eye out for IGR, LGF, MACE, and look at the chart of WNHL and be glad you aren't in it. (Hopefully there's more to that story, like special divys, and not just old-fashioned capital destruction. Yowsaa!)

How to use this list. And don't forget the disclaimer . . .

Wednesday, March 16, 2005

Let's see a show of hands--Who lost money today?

(my hand is up)

That's what I thought. If you made some money today, great, you don't need to hear from me. (You should be giving me advice.) I lost money today. These are the kind of days that can make or break you--and I don't just mean in a monetary sense, I mean in a psychological sense. In my opinion, the most important thing for times like this is to have a plan ahead of time, a plan that is constructed in calm, rational times, that you will stick to and execute in more emotional times like this. Maybe you've got stops in place. Maybe you're one of those crazy value guys that might buy on a day like this, when something gets cheap enough for you. (I must confess I thought Berkshire was heading in that direction, for me, today. Maybe another day.) The point is to have it planned ahead of time--don't decide on a day like today, when things are breaking down all over, that it's time to buy or sell or whatever. You might get lucky, but you probably won't. You've got to know ahead of time at what price you want to buy or sell. Stephen Vita has a great quote from Pit Bull about how when you feel like you want to puke, that's the time to double your position. That may or may not be what you need to do, but again, figure that out ahead of time, in the clear light of day.

Plan your trade.

Trade your plan.

Preserve your capital, because tomorrow is another day.

The only advice I give my oldest son about women is "There are plenty of carp in the river." The same is true of stocks--there's always another play.

That's what I thought. If you made some money today, great, you don't need to hear from me. (You should be giving me advice.) I lost money today. These are the kind of days that can make or break you--and I don't just mean in a monetary sense, I mean in a psychological sense. In my opinion, the most important thing for times like this is to have a plan ahead of time, a plan that is constructed in calm, rational times, that you will stick to and execute in more emotional times like this. Maybe you've got stops in place. Maybe you're one of those crazy value guys that might buy on a day like this, when something gets cheap enough for you. (I must confess I thought Berkshire was heading in that direction, for me, today. Maybe another day.) The point is to have it planned ahead of time--don't decide on a day like today, when things are breaking down all over, that it's time to buy or sell or whatever. You might get lucky, but you probably won't. You've got to know ahead of time at what price you want to buy or sell. Stephen Vita has a great quote from Pit Bull about how when you feel like you want to puke, that's the time to double your position. That may or may not be what you need to do, but again, figure that out ahead of time, in the clear light of day.

Plan your trade.

Trade your plan.

Preserve your capital, because tomorrow is another day.

The only advice I give my oldest son about women is "There are plenty of carp in the river." The same is true of stocks--there's always another play.

Loser List for March 16, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

Going thru the charts, I see some impressive breakdowns and lots of lower lows. I don't want to sound too much like Stephen Vita, (what the heck, why not?) but its some pretty scary stuff. I'm kinda nervous about buying some of these longs, even with strength. Be careful out there.

BZH buy if strength, stop about 155

CLF. long if strong, stop 69

DESC long, stop about 3.75

PTA long with a stop a 2.25

RESC long, stop about 22.4

TZOO short a break, stop at 50

ARS yowsaa--take some play money and buy, stop at 24.6

ASTE another breakout long,stop 20.4

CPC long stop 15.7

DRRX long stop 3.6

MWPR long stop at 8

OMR, long stop 3

F a short, stop at 12.5

VGZ, long, stop at 4

KKD reload the shorts, stop about 8.5

pennies--only a little less exciting than throwing your money into the sea-

ACKO--it might be fun while it lasts, stop at 0.5

GRSU breakout over 3 cents!

MVOG long stop at 3 (dollars for this one)

MBTG long, stop at 0.33

SPCI buy it before the hoarders do, long stop at .025

TSNU buy stop 1.35

How to use this list. And don't forget the disclaimer . . .

Going thru the charts, I see some impressive breakdowns and lots of lower lows. I don't want to sound too much like Stephen Vita, (what the heck, why not?) but its some pretty scary stuff. I'm kinda nervous about buying some of these longs, even with strength. Be careful out there.

BZH buy if strength, stop about 155

CLF. long if strong, stop 69

DESC long, stop about 3.75

PTA long with a stop a 2.25

RESC long, stop about 22.4

TZOO short a break, stop at 50

ARS yowsaa--take some play money and buy, stop at 24.6

ASTE another breakout long,stop 20.4

CPC long stop 15.7

DRRX long stop 3.6

MWPR long stop at 8

OMR, long stop 3

F a short, stop at 12.5

VGZ, long, stop at 4

KKD reload the shorts, stop about 8.5

pennies--only a little less exciting than throwing your money into the sea-

ACKO--it might be fun while it lasts, stop at 0.5

GRSU breakout over 3 cents!

MVOG long stop at 3 (dollars for this one)

MBTG long, stop at 0.33

SPCI buy it before the hoarders do, long stop at .025

TSNU buy stop 1.35

How to use this list. And don't forget the disclaimer . . .

Tuesday, March 15, 2005

Loser List for March 15, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

PLUM may have found some support at 4.5

RIG long , stop at 47

RIMM I'd be looking to short a dip on this, stop at 68

GEOI breakout, long above 9

PBR long, only if it shows strength, stop 44

MKRR long if it can stay above 1.6

pennies

PMU buy the breakout above 0.76

AGFL at some point will pull back?

DTMG long, stop .1

EZEN breakout above 1.8

FNPR support at 0.35

How to use this list. And don't forget the disclaimer . . .

PLUM may have found some support at 4.5

RIG long , stop at 47

RIMM I'd be looking to short a dip on this, stop at 68

GEOI breakout, long above 9

PBR long, only if it shows strength, stop 44

MKRR long if it can stay above 1.6

pennies

PMU buy the breakout above 0.76

AGFL at some point will pull back?

DTMG long, stop .1

EZEN breakout above 1.8

FNPR support at 0.35

How to use this list. And don't forget the disclaimer . . .

Monday, March 14, 2005

Canary in coal mine singing K.C. and the Sunshine Band

TaylorTree had an excellent post this morning about whether we're in for a repeat of the '70's. No, not disco, platform shoes, and mood rings, but stagnant equities, hot commodities, and an iminent apocalypse. Essentially, I've sort of argued the same point, and so have others, but Taylor used a little different method of analysis--demographics, and old Business Week editions. It's really a good read.

Let me lay out my own thesis--history doesn't repeat tiself, but it does rhyme. The Dow flirted with 1000 at the end of the 1960s. The first Dow close above 1000 was in 1972. The last Dow close below 1000 was 1982. In the same way, the first Dow close above 10000 was 1999. In my view, the last Dow close below 10000 will be somewhere between 2010 and 2015.

Let me lay out my own thesis--history doesn't repeat tiself, but it does rhyme. The Dow flirted with 1000 at the end of the 1960s. The first Dow close above 1000 was in 1972. The last Dow close below 1000 was 1982. In the same way, the first Dow close above 10000 was 1999. In my view, the last Dow close below 10000 will be somewhere between 2010 and 2015.

Loser List for March 14, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

*SU buy above 37.5

AKS might be a buy if 12.5-13 holds

CENT might be a buyable pullback, stop at 44

CLF, buy, stop at 69.5

DESC, buy with a stop about 3.75

KMRT broke out of the box. Darvas would buy it.

MW ditto

NAT found support at 45?

TGA--support about 5.9?

CPL long above 21.5

GMP long above 29.8

KO buy it "for the long term" on any pullback

CNR might be a buy with a stop at 1.59

Pennies --real casino stuff. Instead of buying these, click the tip jar for jaloti.

**FNPR buy above 0.35

*GEOI a buy above 6.2

CTCHC buy, stop at 0.7

TLEI buy above 0.45

AGFL another breakout above 3.5

DTMC a breakout above 0.1

EZEN buy above 1.65

RIRI buy above 0.27

How to use this list. And don't forget the disclaimer . . .

*SU buy above 37.5

AKS might be a buy if 12.5-13 holds

CENT might be a buyable pullback, stop at 44

CLF, buy, stop at 69.5

DESC, buy with a stop about 3.75

KMRT broke out of the box. Darvas would buy it.

MW ditto

NAT found support at 45?

TGA--support about 5.9?

CPL long above 21.5

GMP long above 29.8

KO buy it "for the long term" on any pullback

CNR might be a buy with a stop at 1.59

Pennies --real casino stuff. Instead of buying these, click the tip jar for jaloti.

**FNPR buy above 0.35

*GEOI a buy above 6.2

CTCHC buy, stop at 0.7

TLEI buy above 0.45

AGFL another breakout above 3.5

DTMC a breakout above 0.1

EZEN buy above 1.65

RIRI buy above 0.27

How to use this list. And don't forget the disclaimer . . .

Sunday, March 13, 2005

Sunday Night Charts for March 13, 2005

Let's start with the old favorite.

Nasdaq. Weekly chart.

Courtesy of stockcharts.com

Boy, it's caught between a trendline and a resistance line. Let's look at it in another view. This is the Nasdaq, daily chart.

Courtesy of stockcharts.com

I still say, 2090-2100 is key on this one--if it can break above it and hold, it may run up for awhile--if it can't it's look out below.

Oil is on everybody's mind--let's first look at West Texas Intermediate Crude

Courtesy of stockcharts.com

Uptrend, pretty strong move the last couple weeks, but bumping up against a double top. If it can't crack this, maybe a rest for a while--the support in the low 40's looks strong.

Next is the Index of Oil stocks--the OIX

Courtesy of stockcharts.com

Well, we all knew that parabolic up move couldn't last. Where will the downmove find support? Remember, don't try to catch a falling knife--wait for it to bounce, or better yet come to rest.

Next is a new one--the VIX

Courtesy of stockcharts.com

No fear here. The downtrend will continue until it reverses.

And in the continuing saga of commodities, the CRB

Courtesy of stockcharts.com

After a little fake out, the uptrend continues with a vengeance.

Finally, Warren Buffett's favorite short, the USD

Courtesy of stockcharts.com

The downtrend continues.

Have a great week everyone!

Nasdaq. Weekly chart.

Courtesy of stockcharts.com

Boy, it's caught between a trendline and a resistance line. Let's look at it in another view. This is the Nasdaq, daily chart.

Courtesy of stockcharts.com

I still say, 2090-2100 is key on this one--if it can break above it and hold, it may run up for awhile--if it can't it's look out below.

Oil is on everybody's mind--let's first look at West Texas Intermediate Crude

Courtesy of stockcharts.com

Uptrend, pretty strong move the last couple weeks, but bumping up against a double top. If it can't crack this, maybe a rest for a while--the support in the low 40's looks strong.

Next is the Index of Oil stocks--the OIX

Courtesy of stockcharts.com

Well, we all knew that parabolic up move couldn't last. Where will the downmove find support? Remember, don't try to catch a falling knife--wait for it to bounce, or better yet come to rest.

Next is a new one--the VIX

Courtesy of stockcharts.com

No fear here. The downtrend will continue until it reverses.

And in the continuing saga of commodities, the CRB

Courtesy of stockcharts.com

After a little fake out, the uptrend continues with a vengeance.

Finally, Warren Buffett's favorite short, the USD

Courtesy of stockcharts.com

The downtrend continues.

Have a great week everyone!

Fox Saturday Morning "Business Bloc" for March 12, 2005 Part Deux

Forbes on Fox and Cashin In were pre-empted yesterday for breaking news. The segments were replayed today, and this is my summary. The first part of the cost of Freedom suumary is here.

Forbes on Fox's The Informer segment mentioned that new legislation is apparently being proposed that will make it hard for "deadbeats" to walk away from credit card debt. While this sounds like it might be good for credit card issuers, the panelists couldn't agree, and the consensus was that credit card issuers such as KRB, COF C and PVN should be either bought or sold. Michael Thomsett in the Makers and Breakers segment mentioned FITB but the panelists thought it was too expensive; he also mentioned PAYX and the panelists liked it.

Cashin' In started with a discussion about whether CEOs make too much money. Wayne Rogers made some good points about CEOs being paid off by the compensation committee whether the stock is performing or not. Price Headley gave the bottom line--if the stock is performing, nobody cares about the compensation. As usual, no insights were given about how to trade this one. In the Best Buys segment, dealing with former high-flying stocks, Price Headley mentioned MSTR but says he doesn't own it now. Wayne Rogers suggested AKAM. Jonathan Hoenig says SBSA is worth a look, but Rogers mentioned UVN as better in this sector. Adam Lashinsky suggested SNDK. In the mail segment, water transportation stocks were discussed, both Rogers and Hoenig threw out a list of names-VLCCF, CKH, TNP, OSG, MMLP, ATB, that they have been in and out of. In the final segment, John Curran was plugging DVN.Why not?

Forbes on Fox's The Informer segment mentioned that new legislation is apparently being proposed that will make it hard for "deadbeats" to walk away from credit card debt. While this sounds like it might be good for credit card issuers, the panelists couldn't agree, and the consensus was that credit card issuers such as KRB, COF C and PVN should be either bought or sold. Michael Thomsett in the Makers and Breakers segment mentioned FITB but the panelists thought it was too expensive; he also mentioned PAYX and the panelists liked it.

Cashin' In started with a discussion about whether CEOs make too much money. Wayne Rogers made some good points about CEOs being paid off by the compensation committee whether the stock is performing or not. Price Headley gave the bottom line--if the stock is performing, nobody cares about the compensation. As usual, no insights were given about how to trade this one. In the Best Buys segment, dealing with former high-flying stocks, Price Headley mentioned MSTR but says he doesn't own it now. Wayne Rogers suggested AKAM. Jonathan Hoenig says SBSA is worth a look, but Rogers mentioned UVN as better in this sector. Adam Lashinsky suggested SNDK. In the mail segment, water transportation stocks were discussed, both Rogers and Hoenig threw out a list of names-VLCCF, CKH, TNP, OSG, MMLP, ATB, that they have been in and out of. In the final segment, John Curran was plugging DVN.Why not?

Weekend Wazzup for March 13, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here.

Bill Cara once again presents an very thorough review of the week. The very provocative money quote: "I have one thing to say to the buyers of stock on Friday March 4; if you were solicited by a broker to buy MSO stock at $36 that day, and you can prove (probably easily) that your brokerage firm sold stock from their inventory position that day, you have a 100 percent chance of winning a lawsuit. Get a lawyer." I wish Bill would tell us what he really thinks! Like he did when he talked about being voted off the blog island last week in Uglychart's running "survivor" contest for stock market blogs. Don't take it personally, Bill, I think the number of votes reflects the number of readers, or something; interestingly, I think Random Roger had only a single digit number of votes last week, and now has a huge lead. All I know is Jaloti is getting hits right from the contest--publicity is publicity as long as they spell your URL correctly. (That's J A L O T I--it is not my real name, it is short for Just another loser on the internet, in case anyone hasn't figured that out yet.) At any rate, whether he gets voted off or not, Random Roger had a Big Picture post on investing (or not investing) in currencies and commodities. He says he believes in keeping it as simple as possible, and doing what you are comfortable with. Good advice for most everything, frankly. Always full of good advice is Stephen Vita at Alchemy of trading. He had a nice chart of TOL breaking a trend line, and he also previews a post for tonight. (I guess he knows something about marketing as well as trading;>)). Stockcoach had some interesting comments about checking your portfolio mulitple times a day even if you're not a daytrader. (If I'm not mistaken Nassim Nicholas Taleb has written something about this as well.) Moving on, Taylor Tree made some comments about Galatime's covered call work. Sounds like Taylor's posting is inhibited by his day job. I can sympathize, mate--good luck. Gala had some interesting more general posts on options--keep it up Gala, both the general and the specifics! Stephen Castellano at Reflections on Equity Research had a few interesting posts--thoughts on TiVo (I love my TiVo, except that MY TiVo isn't a TiVo, it's a Cox DVR, which I think in some way makes his point), about how you don't need to give yourself an MI to be a good analyst (it doesn't even help) and about the always intriguing RFID. Byrne's Marketview has also been busy, opining on the Warner Music IPO, the FERC nullifying Enron contracts, the Five Dumbest Things from thestreet.com, a dot.con job, and more of the Qwest-MCI-Verizon love triangle. The Soothsayer of Omaha, besides tipping us to the Mark Cuban portfolio revelation, also offered a slightly different perspective on oil prices. TraderMike reflected on a wild Friday, (in the markets, that is). Chairman MaoXian's newsletter came out today. Check out his chat every weekday 8:30-9:30 Eastern time, often you'll find a loser there.

Ron Sen has been quiet other than one thought-provoking post; maybe it has something to do with a basketball tournament?. Sixth World's Gazette has also been quiet so far this weekend(probably busy reading the rest of us ;>)).

Have a great week, everybody!