Monday, January 31, 2005

Warren Buffett

http://darrenjohnson.blogspot.com/2005/01/wisdom-of-warren-buffett.html

Make sure you read the comments--I love the net--it proves that it takes (at least) two sides to make a market.

Loser List

ADAM above 6

ASTM buy above open 3.45

Next two might be buyable dips for a longer term timeframe

FRE above 65

PCL above 35 or so

Next six are definitely trying to bottom fish-should probably fade me on these;>)

GLG may be finding support at 15.5 or thereabouts

MNG also may be finding support at 1.0-1.1

RIC ditto above 4

VGZ may be also have support at 3.7

SU at 31.5 time for a bounce?

CREE may have found some support at 23.5-24, but I've been wrong on this one before. You should probably check out Thomas Ott at Sixth World on this one, he's had it right and I've had it wrong.

And some odds and ends

GLOW uptrend with a pullback--buy at 2

IDTI has risen right to 200d at 11.77 and congestion. Could go up or down.

OSTK might have found support at 52

SEGU seems to get a bid everytime gets to 7

Sunday, January 30, 2005

Sunday Night Charts for 1/30/05

First is Nasdaq.

courtesy of stockcharts.com

Believe it or not, still an uptrend, bouncing off the trend line I drew previously.

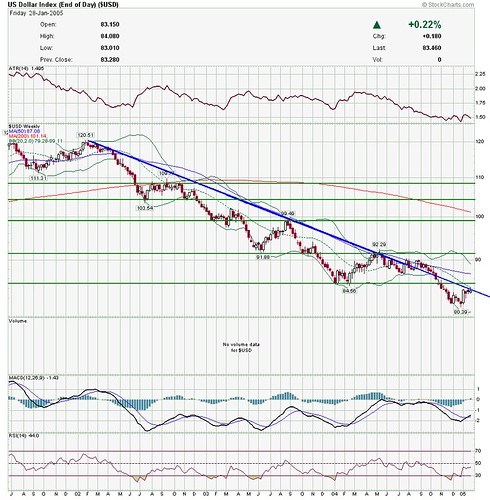

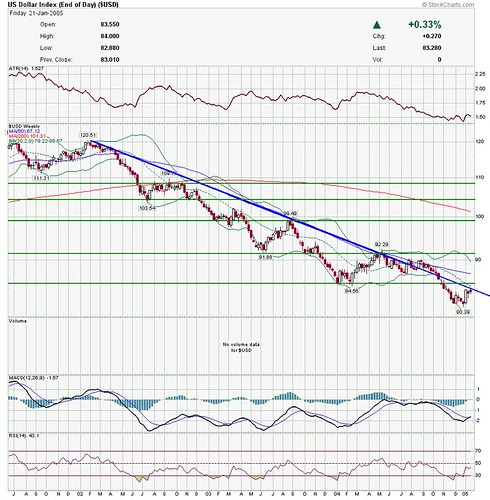

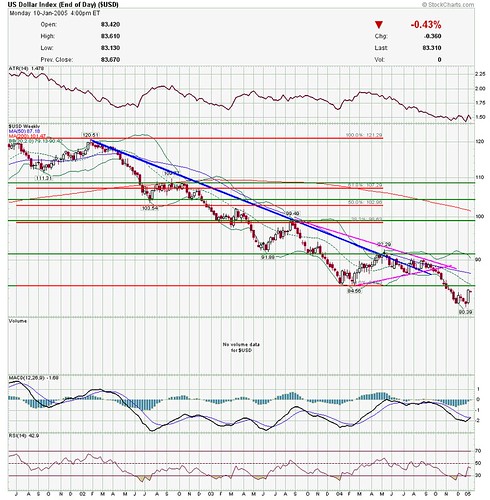

Next is USD

courtesy of stockcharts.com

Still a downtrend, rose to touch the downtrend line, maybe even flirt with breaking it, but like it has done so many times before, and like I said last week and before, I'm looking for the next big move to be down.

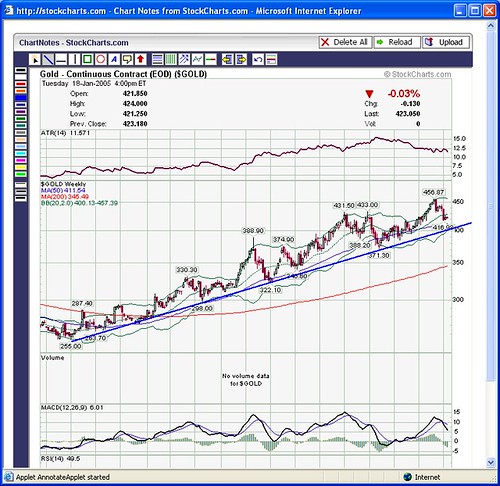

Next is gold.

courtesy of stockcharts.com

still an uptrend. I'm still bullish.

Finally, the CRB.

courtesy of stockcharts.com

If I was going to just look at the chart and have no opinion, I'd almost think commodities were trying hard to break that long uptrend.

Naaaaah! ;>)

Have a great week!!

ASTM Aastrom Biosciences

Here is my latest ASTM chart.

courtesy of stockcharts.com

I'm still long with a stop below 3. I think there is support below 3--see the fib retracement, as well as the previous high in early January. My only concern is the big overhang (see the price by volume bars) around 4, where previous buyers now holding at a loss may be tempted to get out. If they hang on, its "to the moon, Alice!"

Or not.

Weekend Wazzup

My round-up of this weekend:

Chairman Maoxian's newsletter is out. Slip him a little tip to get it (I'm sure he'd like a Benji but he'll take something smaller). Tell him Jaloti sent you.

Random Roger also has a newsletter ($40USD). He also likes to watch the Fox business block on Saturday morning like I do. It sounds like he saw more of I than I did—I missed Gary B. Smith's comment about fallout shelter stocks.

I managed to catch only a bit of the Business Block this weekend—mostly I was able to catch Jonathan Hoenig—one of my favorites. Jonathan still likes oil, as well as utilities. Specific stocks he mentioned included DUK, GMP, EE. Wayne Rogers mentioned BHP.

I doubt Hoenig is buying MRK, but Bill Cara is. Actually he's writing the April 05 27.5 puts, but he likes the stock. I still think there is a LOT of potential liablility out there from Vioxx, but if you listen to me over Bill Cara you need your head examined.

Trader Mike doesn't need his head examined; he has a nice set of links to IBD articles on when to sell. Trader Mike has been very encouraging to me as a blogger—he's a good, sharp guy and I try to read whatever he writes.

Another site I keep up with is Sixth World—Thomas Ott has also been encouraging of my blogging efforts. His latest scan has picked out NAVR, SWIR, and VRSN as possible plays.

Gala Time has also been scanning and screening—he's options focused, and he's picked up heavy institutional activity in DLQBS, the DELL Feb 42.5 call, FDNK, the FD Feb 55 put, and WMTBJ, the WMT Feb 50 call.

Finally, (and without a good segue) I've added Material Change to the blogs I followed—has to be a good blog—one of his favorites is Jaloti!

Saturday, January 29, 2005

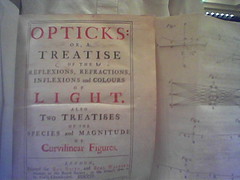

Tufte course notes and review

Summary

Tufte charges $320USD for a roughly 6 hour course. This price includes a copy of 3 of his books “The Visual Display of Quantitative Information”, “Envisioning Information”, and “Visual Explanations” as well as two essays “The Cognitive Style of Powerpoint” and “Sparklines” and a poster. Retail price of these is about $120 USD. I thought there was very little material he presented that you couldn't get from the books or the website, with one exception—the sparklines material. Many of the points he made, while excellent points, sound obvious in cold print, and perhaps they are.

Clearly, the attraction is seeing the man in person, getting to ask him a question at a break, getting him to autograph your book (I did)

Though he is a good speaker, and clearly enjoys teaching, again, I'm not too sure that much is added by hearing him make the points rather than reading them. In fact, I thought his presentation could have been helped by better organization(His books and essays ARE better organized.) The crowd was easily 300 people--the hotel conference room was completely filled. The audience was somewhat diverse, although I got the impression that it was dominated by web designers and other "artists" types, since the vaguely pro-Macintosh and anti-big business sentiments he expressed seemed to go over pretty well.

My money quote: Don't pay your own money for the seminar unless you're a diehard fan—if your employer pays, though, it's a decent day. You're probably better off buying the books, and if you use these links, I can make a couple bucks off it as well.

Tufte hates bullet points, so just to be contrary let me summarize with some bullet points. He also says read books, not notes and took a slap at the many internet summaries of his lectures--saying they have no pictures. Thus I will post at least one picture. My interpretation of his points is in normal type, (my comments are in parenthesis, italicized)

- The important question about showing data is "compared with what?" must show casuality, show mutivariate data.

- There is no relationship between amount of detail and ease of reading. To clarify, add detail.

- "Clutter is a failure of design", not the result of too much data

- FINANCIAL DATA

- The central question, the thinking question of most financial data is what is the change over time?

- Although some advocate include zero on the graph, he says don't look at zero point, look at data.

- Show data horizonatally not reaching to a number which never occurs such as zero.

- Giving your audience the chance to confirm a previously known detail helps your credibility.

- When showing data reflecting money over time, must adjust for inflation(doh!) Must adjust for seasonality, cycles(another doh!)

Don't trust display without footnotes--they show presenter takes care in his craft--embedded footnotes help credibility - Bring causality in with annotation (adding a bunch of notes seems like a recipe for cluttering up a chart to me, but that's what he says) For tables/charts of standard financial data do what New York Times, Wall Street Journal, etc, do,--i.e. don't reinvent the wheel find another successful one “don't get it original get it right”

- That having been said, he shows how he has reinvented the wheel with "sparklines"-best described as little tiny graphs without grids that appear on the same line as text--graphics no longer a special occasion--will be everywhere.(I think this is probably one of the most original ideas I got from the course--that graphics could be right within the text--of course he did show an example of this in Galileo's book, with a little drawing of Saturn right amongst the Italian words. I'll try to enter a good scanned example of sparklines in a day or two)

- He advocated using sparklines in stock/mutual fund summary tables. (I think there may well be some merit in this. He then went on to give a poor/incorrect explanation of “closet index funds”. He also seemed amazed that the stock funds had similar performance—he seemed to think that it was only through sparklines that one would figure out that the average large cap stock funds performance was more correlated with the overall market and thus each. Oh well, he's a design expert, not a market guy.)

- WEB SITE DESIGN

- He spent some time railing about how we have to spend too much time thinking about operating systems, and applications, when content is what we should care about. It was a veiled anti-Microsoft, anti-software company rant, talking about being exposed to the "marketing experience" in applications and websites. (I thought this was ironic from a guy who's on tour, filling rooms of >300 people at >300 bucks a head, with his acolytes outside selling his books and posters. Don't get me wrong, I think it's great he can make money doing what he's doing--if I ever get the chance to charge a few hundred people a few hundred bucks each to see me do anything, I'll be there. My point is if he can make a buck doing his thing, why shouldn't Microsoft, Adobe etc. make a buck doing theirs?) On to some website nuts and bolts.

- Unfortunately, design often mimics bureaucracy.

- He says, that almost always, the best web site design is to ****get as much upfront as possible**** (very key, I thought, if not obvious) The best sites have 200-300 links on opening screen one should make everything clickable.

- People come to sites for content, not design

- Took a slap at these flash animation logos that open so many corporate sites—he says it must be recognized they're a waste since they all have "skip intro"(He's right of course but isn't it kind of an easy target?) Biggest issue in web site design is allocation of screen real estate. In many ways the computer screen is just another low resolution display like stone was 6000 years ago. Paper has an advantage in that it is higher resolution and portable.(He emphasized over and over the point about the screen being lower resolution. While it is technically true, I wonder about its practical significance. In my daily routine—and I see literally thousands of websites and pieces of paper every week—I never say “let me print that out so I can get a better look at it. Maybe I'm missing his point somehow.)

-

- ANTI-POWERPOINT STUFF

- (This material all comes from his essay “The cognitive style of powerpoint” which can be obtained here. He offers it for sale on his website, but only on paper, not as even a PDF download, because either a) he wants absolute control over the appearance, b) he wants to make a couple bucks, or c) both (and why not?))

- --"a program whose preoccupation with hierarchy is almost medieval"(perhaps the best quote, and best "a-ha" moment for me all day)

(Ironically, one wag has put together a powerpoint version of his essay.) Powerpoint comes with a cognitive style, an attitude, foreshortening of thought, low resolution, is inherently hierarchical, emphasizes decoration and fluff at the expense of content. It is presenter oriented. It probably works for the bottom 10% of presenters because it forces them to have points. - We are used to examining serious things at 24 inches—computer screen, books; Powerpoint is designed to be seen from 20 ft, thus it is inherently low resolution. (Here his points about resolution of computer versus paper are spot-on, I think.) Bullets are often not subject verb--effects without causes.

- Much of his anti-powerpoint stuff uses the examples of NASA powerpoint presentations about the tile damage on the space shuttle columbia—these presentations arguably encouraged the ill-fated decision to let columbia re-enter.

- Incredibly, NASA even gave powerpoint “pitches” to the review board.

- His other point about Powerpoint (and it's a good one) is that it turns everything into marketing--”pitches”

- He's now giving a mandatory course for NASA employees

Anyway, that's my summary. Clearly, the man is brilliant, and he's got a lot that is worthwhile to say about design. His books are impressive, more impressive in my humble opinion, than the course. Any questions or comments? Either comment below, or email me at harryjaloti@hotmail.com

Finally a little something in the hotel lobby.

Perhaps I've been in Arizona too long, but this I thought this was obvious.

Remember . . .

Friday, January 28, 2005

Welcome

Loser list today

Some things I've been inalready have been working out ok, so I'll follow the Jesse Livermore example and make money by sitting, not thinking.

Today

Haven't seen too much in the market to interest me this AM, and it is Friday.

I'll try to get a better connection and post some things later.

Thursday, January 27, 2005

Spam

Of course, the best spam comment line I ever got: "Malinda, if homosexuality is a disease, then lets all call in queer to work tomorrow."

What's the best spam subject line you ever got?

Leave it as a comment or email it to harryjaloti@hotmail.com

Jim Cramer

Anyway, put Cramer on TV and I'll watch.

Yes, I'm sick and I need help.

Loser List for January 27 2005

ASTM--may be a buyable dip if it stays above 3

DCAI--could be a buyable dip above 20 with a stop at 19.5

MDTL--perhaps a buyable pullback at 20 with a stop at 19

Shorts-

ALGN--might take another poke at it if it stays below 8.85

RHAT--downtrend, rising to resistance at 11.3 or so, might be shortable below that

Rollers--

COBZ--buy at 20, sell at 22, lather, rinse, repeat

SU--buy at 32, sell at 35.5, lrr

caveat--I see these last two charts, rolling gently between support and resistance, and figure that when I see the pattern and finally decide to get on the train, then the support won't hold and/or resistance will crack. YMMV.

UPDATE--if you're new to my blog, welcome. Check out my other thoughts here. For some twisted comedy, check this out. Hope to see you again. Email me at harryjaloti@hotmail.com

Wednesday, January 26, 2005

Cheap Stocks

I plan on reviewing them further.

PSEC

ISH

DRRA

OTT

APNI

watchlist for january 25

LONGS

NFI at 44.5 is right at a fib retracement--I may add some here

CNR at 1.32 is pausing after a breakout--may also add here.

PCL at 35--this is timber, one of my long term holdings--I consider this a buyable dip

ATVI at 21.5--may be a buy with a stop at 21

CEDC at 31.1 --looks like a buyable dip with a stop at 30 or so

DESC looks good above 3 with a stop about 2.75

GLOW, similarly at 2.25 with a stop about 2

SHORTS

RIMM looks like its rolling over--short at 70 with a stop at 72

ALGN at 8.85 broke down to a new low

As always, do your own DD, make your decisions, and the disclaimer

Tuesday, January 25, 2005

Welcome

Let me also take this chance to thank the fine sites that have linked to me, such as Trader Mike, Sixth World, and Phat Investor. (Love that word, phat, its a really --- phat word.)

Regulation SHO and Naked Short Selling

At any rate, the comprehensive explanation of the whole thing is here. From the regs:

Perhaps more useful is, can you play this? The thinking seems to be, if a stock appears on the list, there was naked shorting, which will have to be covered, thus there will be a short squeeze, so the play is when a stock appears on the list, go long for the pop that will occur as the naked shorts cover. I'm not really sure this is happening. Random Roger had a comment to a post on his site where the commenter indicated this was happening with a particular issue. Perhaps so.

I did a quick and dirty little experiment. I went thru the AMEX threshold list of issues that meet the SHO criteria for today. I found about 70. Curiously, many of them were iShares. I only found a handful(7) that had significant moves (defined by eyeballing the chart--no I didn't use numbers--I told you this was quick and dirty). Of these, only one, GFX, had a big move that seemed at all temporally related to being listed on the Regulation SHO threshold list.

Anyhow, if you want to keep track of these, here is the NYSE list, the Nasdaq list, and the AMEX list.

MONEY QUOTE--by my quick and dirty eyeballing of some AMEX stocks, getting listed on the SHO threshold list doesn't seem to be a catalyst for a quick short term move.

Loser's picks for today

VGZ might be "bottom-pickable" above 3.5

ADAM is a breakout at 5.25, if you're in to buying breakouts

ASTM might be a pullback buy above 3.5

DECK--35 is key, if it holds, it might be a buy

PLUM could be a pullback buy above 4.6

RMI looks like it might have support at 3.5

The Potty Bowl???

I have to link this one here--some Arizona weirdness, to be sure.

I can't find any odds on tradesports, though, as to who's favored in the Go!Wipe!Flush!Wash!Dry! obstacle course.

You can't make this stuff up.

Besides, this is a chance to shamelessly plug my alter ego blog, devoted to general nonsense.

Monday, January 24, 2005

Thinking or Not

It's an important question: is it useful for me to try to learn from the successful traders, or not?

Another very pretty chart

courtesy of stockcharts.com

This is the iShares TIPS ETF.

Its been a buy everytime it gets to that uptrend line.

I'm glad to have had some money in this one, but as always, position sizing is key, right?

Sunday, January 23, 2005

Sunday Night Charts

I'm going to try to set back and look at a little bigger picture tonight.

First the Nasdaq. This is a weekly chart of the COMPQ.

courtesy of stockcharts.com

There is a long term uptrend since fall 02 that is still in place, barely. If this uptrend line doesn't hold (and let's face it, where exactly this line is drawn is a little subjective--some versions have it violated already), there isn't much support--its look out below from a technical standpoint.

Next is the USD

courtesy of stockcharts.com

I've shown this chart before, but it bears repeating, because it really is a beautiful chart. The USD keeps coming up to resistance, touching it, maybe even caressing it a bit, flirting with breaking through, and then breaks down to a new low. This pattern will repeat, of course, until it stops.

Next is the CRB commodities.

courtesy of stockcharts.com

Nice uptrend--but could it be that this long uptrend is being broken??

Could be. But I'll wait a little bit--again, I consider these lines to be a little subjective and "fuzzy".

Finally is Gold.

courtesy of stockcharts.com

Uptrend still intact, although not much room to manuever.

CONCLUSION

Uptrends in Nasdaq, Gold and CRB still intact, downtrend in USB still intact

BUT it won't take much for any of these to be violated.

Interesting that all of these are close to their trend lines.

We'll see what next week and another bar will bring.

Gala Time

Thanks for the summary Gala.

I may own or be short or have no position in any stocks mentioned in this blog, and otherwise all elements of the disclaimer are still operative.

Weather in the desert

Sorry about that.

sunny and 70 in the desert today.

Saturday, January 22, 2005

Efficient Markets

I love markets.

Friday, January 21, 2005

Thursday, January 20, 2005

Loser List

SINA--looks like a short to me below 28 or so.

CME--a buyable dip if it stays above 200.

PAAS-has languished for a while. Might be at some support at 14.5.

AACC-thinly traded, so be careful. Might be a buyable dip above 20. Or not.

PLUM--mentioned in the Chairman's chat today. I also saw some fundie posts about it (I forget where)--although I'm sure the fundie guys think its overvalued now. Might be a buy above 5.

SIRI--again as mentioned in the Maoxian chat, looks like it is going to 4--although who knows, maybe it will go to 10 first.

Based on the last couple days, though, you're probably best off if you fade me.

Wednesday, January 19, 2005

RSS feed to keep up with the Rothschild's et al

NOTE-I already posted this here and forgot all about it. Man, I guess I am a loser. . .

Wheat and "Liquid Metal"

SSKWF, the Saskatchewan wheat pool, a play on a commodity, but maybe an M&A target as well?

LQMT, which makes something called "liquid metal" which Samsung apparently uses.

Both of these come from the excellent DYDD site.

As the site says, Do Your Own Due Diligence.

These are probably wholly unsuitable stocks that are going to zero.

Gold charts

The daily

courtesy of stockcharts.com

The trendline is just barely intact. Really need to see a move upward from here.

The weekly

courtesy of stockcharts.com

(Take a moment to appreciate this chart. It really is a beautiful chart)

The trendline is solidly intact.

My conclusion--the long term bull market in gold is still running. This may well prove to be a buyable dip.

Tuesday, January 18, 2005

Gold, Random Roger, etc

update on CREE

I indicated I might go long about 25, believing it was at support there.

Today, I haven't gone long. I'll post a revised chart after the close, but taking a close look at the chart today, I'm putting the support right about 25.5-25.8, and taking into account yesterday's heavy volume, the price by volume bars show a lot of volume right below 25. With that gap down to below the 200-d, and the fact that it has traded below its open all day, I really need to see a strong close above 26.35 (today's open) to go long here.

Film at 11.

WSJ on the falling dollar

Well, its official, then. I'm no longer very worried about this scenario. If this meme can become so widespread that it makes it to the front page of the Wall Street Journal, for goodness sake, it has already been so thoroughly discounted by the marketplace as to be unlikely. My bias has always been that the more everyone can see it coming, the less likely it is to happen, Richard Russell and the Mishedlo board at the Fool notwithstanding.

Plus I think there's only a couple million guys over at the Yahoo boards telling each other they suck who believe this as well . . .

Monday, January 17, 2005

CREE

I'm trying to post an annotated chart with price by volume, but I'm having "issues." I'll try again later.

US College Financial Aid

Today's thought is on position sizing

If it goes up, your position was too small.

(can't remember who I stole this from . . .)

Sunday, January 16, 2005

Technicians vs. Fundamentalists

I think both technicals and fundamentals can work (or not work). Again, as I mentioned in the previous post, I think the real issue is having a thesis, and most importantly having a plan for what will make you decide that your thesis is wrong. I think the beauty of the technical approach, if you have good discipline, is that if the stock moves against you, you get out and preserve your capital for another day. In the fundamental approach, its fine to "average down", but again you have to have a plan ahead of time--will you average down to zero? What if you are wrong and are left with worthless stock? Will that cost you a significant chunk of capital?

True fundamental story--a few years back there was a small chain of home improvement stores called Home Base--kind of like Home Depot. The stores themselves weren't bad. The stock was in the toilet, and selling for less than the cash and assets on hand--the breakup value of the company, presumably, was worth more than the market capitalization. What's more, the CEO bought a huge block of stock in the market with his own money (not cashing in options). How could you lose--a classic Ben Graham/Warren Buffett cigar butt, with heavy insider buying. By now, you know the rest of the story--company tried to re-engineer themselves, spent their cash, and went bankrupt. You can always be wrong.

Bottom line, sometimes I buy/sell on the technicals, sometimes on the fundamentals, but I always have a plan ahead of time.

Loser

Seriously, evaluate what I say in the context of your knowledge and experience.

"Long term" outlook and timeframes

Previously, I've given my "long-term" view that equities will go down, at least on an inflation adjusted basis. By "long-term", I mean 10-15 years or so. If so, why do I talk stocks all the time? Because its all about the time frame. If you are looking to buy individual stocks and sell them after a few days, weeks, months, or even a couple years, you may do very well. If on the other hand you have a 30-50 year (or greater) time frame, where you can leave the money alone till the end of that time, the historical evidence is pretty good that buying and forgetting a broad basket of equities will do okay. If, however, you expect to dollar cost average into an index fund and get 10% returns and retire rich in 10 years, I think you will be sorely disappointed.

Why do I believe this? History. The historical evidence, in this country, shows alternating periods, of about 10-20 years or so, of rising equity prices alternating with equity prices going nowhere or down. The periods of rising equities start with low valuations and run till valuations are high, and then the bear kicks in and equities fall till the valuations are low (or stand still till earnings rise enough to make the valuations low). Roughly, bull market in the 1920s, bear until mid-1940's, bull 1946-1966, bear 1966 to 1982, bull 1982-2000, bear 2000-?. Michael Alexander in his excellent book Stock Cycles, goes into this in some detail and fleshes out some reasons why this may be so.

The other reason I believe this is that there is just too much of "the crowd" in index funds. When John Bogle pioneered the idea of dollar cost averaging into "the market" via low expense index funds, it was a great idea because it was new, simple, and most of all, it was historically a great time to do this (1970's) because stocks were at low valuations and thus we had a great bull market ahead. Now, with equities still at historically high valuations, I think just blindly DCA'ing into indexes is a sure way to throw money away unless your time frame is 30-50 years, i.e. long enough that you can ride out this present cycle. Let me add that when I say your time frame is X number of years, I don't mean just are you going to live that long, I mean you don't need to touch the money, principal, interest, any of it, for X number of years--because that is really the key--to be able to ride out the lows in valuation until they start to rise again.

Thus, to try to put it together, if you have money that you will "need" in 5, 10, or perhaps even 15-20 years, I think you have to be more of a trader. You have to be willing to 1) have a thesis for why a stock will go up, 2) decide at what point your thesis will be proven wrong, and 3) be willing to cut your losses when your thesis is wrong. This last point, cutting your losses, I think leads into another point about technical v. fundamental analysis, which simplistically, is the difference between, when prices go down, do you sell to cut your losses, or do you buy because its a better bargain. I think actually I should expand upon that in a future post, but for now I'll say again, you need to decide in advance on what will make you decide that your thesis is wrong. Obviously, if you are trading on the technicals, it will be purely a matter of price that changes your thesis; if you trade on the fundamentals, then its a matter of has the valuation story changed. However, if your thesis is fundamental, then I think money management is even more important; you have to accept that you may be wrong on your thesis, the bargain may be a bargain because it is going to go bankrupt, and if you lose all of this investment, it doesn't break you.

In future posts I intend to 1)expand on the technical v. fundamental idea, 2) talk about what kinds of equities I believe are exceptions(hubris alert!!!) and may be able to outperform over the next few years, and 3) talk about other asset classes--commodities, etc.

couple more sites I read

Saturday, January 15, 2005

Ugly

another site

sounds like a great weekend . .

The man is one of my heroes.

Fox Saturday Morning "Business Bloc"

My observations for today--

Perma-bull Joe Battipaglia was on--he was gone from the airwaves for a while, and now I've seen him quite a bit lately. Why do I think that is a sign of a top?

Jim Rogers was on, as usual, plugging his book and pushing commodities and natural resources. I guess I agree to a degree, considering my positions in gold and oil.

Some specific ideas

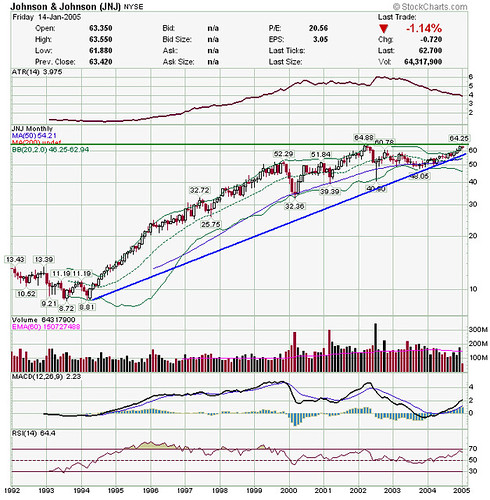

JNJ--Gary B. Smith showed a long term chart of JNJ and pushed it as a long term buy and hold (which he almost never does). I think JNJ is a "great company" though that doesn't always mean "great stock." I do have a long term position in JNJ, though. Gary's chart looked great, with JNJ staying above a long-term trendline. My chart doesn't look as good, and arguably shows JNJ making a double top. Unfortunately, I'm having trouble posting my annotated chart right now but I hope to have it up a little later.

XTO, an oil and gas explorer, was also mentioned, getting a mixed review. I do like oil and gas, I think its hard to go to wrong with it over the next few months and years, although some concerns were raised about its corporate governance.

TXI, Texas Industries, a supplier of building materials, was mentioned as a play on rebuilding after all the natural disasters here and elsewhere recently. Although this sounds like the broken window fallacy, while the economy as a whole won't be better off because of natural disasters, certainly some segment may benefit at the expense of others.

NSC, Norfolk Southern was mentioned by Wayne Rogers, who has come up with some good picks in the past.

Jonathan Hoenig mentioned floating rate funds, closed-end funds holding corporate debt where the rates rise with rising interest rates. He mentioned these before at the start of the interest rate rising cycle, and they haven't fared too well from there. The concept is appealing, but I always feel I don't really understand them too well--they don't seem to track interest rates as you would think they should. At any rate, he mentioned VVR, PFL, FRB. Others in this group that I have owned are PPR and TLI.

Anyway, I hope to post some charts later.

13Fs

Scanning the 13Fs yesterday night, I noticed a filing from GMO, Grantham Mayo VanOtterloo, home of Jeremy Grantham who always has some interesting things to say about the market. (Link might require registration). There were a number of large foreign positions in their filing-- America Movil (AMX, Mexican cellphones), China Mobile Hong Kong (CHL, Chinese cellphones), China Telecom (CHA, more Chinese cellphones), Grupo Financiaro Galicia (GGAL, Argentinian bank) Sk Telecom Ltd (SKM, South Korean cellphones, Telefonos De Mexico S A (TMX, Mexican telecom), and Votorantim Celulose E Papel Sa(VCP, Brazilian paper)

Movies

Napoleon Dynamite and Harold and Kumar go to White Castle.

Neither one is everyone's cup of tea, but I laughed like crazy.

Friday, January 14, 2005

AM watchlist

SGP looks like there is some support right at 20, but I'm a little nervous buying after a 2 gap downs like it had.

AACC has broken out above a previous high and might be a buy above 21.5.

I'm not very enthused about either of these. I'll probably trim some positions that are going nowhere. For some reason I'm not real eager to hold too much through this weekend, although I don't have any rational reason to feel that way.

Thursday, January 13, 2005

mystery stock

Today

Ugly had an interesting pick--RICK, although I'm not sure whether it was for a day trade or a table dance.

Fascinating

Wednesday, January 12, 2005

Not much today

ATR

Why should I care? Timeframes. If my timeframe is more than a couple days, and my trailing stop is within the ATR, then I stand a good chance of getting stopped out just by the normal back and forth movement of the stock.Maybe this is obvious to everyone else, but its something I need to keep working on -- I've gotten needlessly stopped out by normal volatility because I didn't pay enough attention to the ATR.

Tuesday, January 11, 2005

Congrats to the Chairman

Assuming the date of birth is the 11th, the youngster shares an auspicious birthday with the architect of the USA financial system Alexander Hamilton.

Bearish?. . .

chart courtesy of stockcharts.com

Lots of bearish sentiment out there, including RandomRoger and ugly at uglychart.

The Naz is bending that support I pointed out. I think of support and resistance as bands with some "give" rather than hard thin lines, so I could see things bouncing from here. If it doesn't bounce, its down to 2050, 2000, or even lower.

Time for the Disclaimer

-All information on www.jaloti.com and jaloti.blogspot.com is for entertainment purposes only. No trading advice is being given; it couldn't be, because the author of this website is not a Registered Investment Advisor. Investing is all about taking risks. Short term trading in stocks, options and futures contracts is very risky and large sums of money can be lost. If you can't handle losing all your money, bury it in the backyard, at night, when you're sure your neighbors aren't looking. Make sure, 'cause otherwise the next night they'll dig it up and you'll lose it all anyway. If you want a government guaranteed rate of return, go to the bank and get a savings account, or maybe a CD if you don't need the money to buy smokes right away. If you want to invest, do your own research, make your own choices, and be responsible for your own decision, and therefore your own gains and losses. It is possible to do better or worse than Jaloti. Past performance is never a guarantee that future results will match it. But, whatever you do, don't do what I'm doing, cause after all, I call myself JustAnotherLoserOnTheInternet, so you'd be a bigger loser, or a fool, to emulate what some loser on the Internet is doing, right? I mean, you don't even know me. Jaloti is not liable for any losses incurred in trading by readers of this blog. Do not taunt happy fun ball.

-I may have a position in any stock, option, commodity, future or whatever I mention and those positions may change at any time. Some of the stocks, options, commodites, or futures that I mention may be small illiquid ones that can be changed by mentions on the internet, so be careful!

-Actually, I don't really care what you do, as long as you don't try to sue me.

Tuesday's watchlist

Most seem to fit in the category of pullback to support after a breakout.

RMI, a pick of ugly at uglychart.com, has broken out, and now pulled back to just above its previous high. I think its a long above 3.5.

STEM, mentioned in the Chairman's chat the other day, has pulled back to just above a penultimate high of 4.8.

XMSR, the rich man's SIRI, is just above a previous high of 31.5.

All look like low risk entry points, with stops just below the old highs.

Barely out of the shower. . .

If you google Chairman MaoXian item number 3 is Jaloti. Cool!!

There is apparently some sort of fantasy stock market for weblogs, and jaloti is listed. Also cool.

Jaloti is apparently also a city in India. Very cool!!

Monday, January 10, 2005

Pretty good day today

I bought WILCF, an ADR of an Israeli grocer, at a split adjusted $2. It closed today around $5. I've been tempted to sell many times along the way but didn't. I'm still holding.

courtesy of stockcharts.com

Social Security "Privatization"

I suspect Roger and I may be far apart on this issue, but I want to hear what he and everyone else has to say about it.

Thanks for bringing it up.

Gold and USD

Look at the USD chart here.

courtesy of stockcharts.com

Look at it in conjunction with the gold chart below and here.

As I mentioned before, USD is just below what I expect will be resistance, and gold is right at what I expect will prove to be support.

Gold has moved up at least in part, because the dollar is going down.

What this means is I'm probably a little early buying GLD--more certainty could be obtained by waiting for gold support to hold, and dollar resistance to hold. However, when gold moves, its been moving quickly, and being early may benefit me here.

Or, I could be wrong and support/resistance may not hold. I won't wait for much of a downward move to get out of GLD.

Gold chart

Courtesy of stockcharts.com

Here is the aforementioned daily chart for gold. I see support right under 420 or so--and in fact I picked up some GLD, seeing this as a low risk entry. Drop below 418 and I'm out.

Monday AM observations

Gold is at a medium term support line. If I have the courage of my convictions, this 42 might be a good level to pick up the gold ETF, GLD.

USD continues to bounce up. Long term chart shows that after each decline, it recovers to at or below the level of the penultimate low. If that pattern holds, I'd look for the USD to climb to about 84.5-85 or so before it declines again. If it breaks 85 solidly, maybe the long dollar decline has halted.

TIP, the TIPS ETF, is slightly below the uptrend line. Will it hold?

I haven't identified much other than GLD as a possible play today.

What I follow

One is Jonathan Hoenig. He's not your average portfolio manager. He's got some worthwhile insights about trading, and also comes up with some interesting picks that you won't hear about anywhere else. He writes a weekly column for smartmoney.com that appears on Tuesdays, and an archive is here. It's mostly a pay site, but his columns are free after a week or so, and his picks tend to be more medium to long term anyway-no real day trades.

John Hussman runs Hussman funds, and he's got a pretty good record over the last few years. He also has insights that are not the "same old-same old", and seems to come from kind of a combination of technical and fundamental analysis, taking into account both earnings and price action. He writes a weekly report that appears on Mondays, and the archive is here.

Ugly at uglychart.com is somebody I've started following as well. He hooked me this morning with his Dr. Alexander Elder quote about being a loser.

I'll add more later.

Sunday, January 09, 2005

Congrats

I'd try to make some sort of smarmy comment in Mandarin, but the Chairman has already corrected my pinyin once, so I'll just leave it at zaijian!

Sunday Afternoon

Saturday, January 08, 2005

Friday, January 07, 2005

Random Roger

I don't have any answers, BTW.

Bloglines

Thursday, January 06, 2005

Stuff

Oil seems to have found some support

I see some support for the Naz right under 2100, where it is right now. If this doesn't hold look out.

I'm toying with long OTE above 8.4, long ABXA above 8, long OSTK above 62.

Got GOOG 195 puts yesterday--so far its okay.

Wednesday, January 05, 2005

today's short list

Might get back in NFI.

will keep an eye on long CKCM above 14.5, CRNT above 6, and, especially, WEB looks good above 10.5.

MaoXian chat

Tuesday, January 04, 2005

watchlist

GOOG can't stay above 200. Time for puts?? (As if I didn't lose enough last time).

Looking to get back in NFI.

December-January

Monday, January 03, 2005

Today . . .

BGO, already in it, if it stays above 2.95 or so I may add more.

NEM--if it stays about 42.5-43 I'll consider it, but I don't want to get overweight in gold.

GOOG--I guess I must be obsessed with shorting it. I still believe the thesis that the lockup release will drive it down. At any rate, around 200 is a top, so if it can't crack above it solidly, I may pick up puts.

NFI--been in it, stopped out last week, may get in again if it stays above 48 or so.

Scaling

I know, maybe this is trivial, or maybe everyone else has figured this out already, but it is a new insight for me.

Sunday, January 02, 2005

Novelty

So . . . what I'm interested in, is getting something (facts, analysis, thinking, advice, suggestions) that you don't see everywhere else. That's where the real value added is. What's really a waste is PAYING for the same old, same old. This is where Richard Russell is right about a lot of the other old-line newsletter writers. There's a lot of people on the net giving away a different angle--why would I pay for the party line?

Amusing

I was just re-reading some of Malcolm Gladwell's old articles and I came across one of his I had forgotten about: a profile of pitchman Ron Popeil. It is wonderful reading, better, I'll argue, than Gladwell's current fondness for faux academicism that has captured so many people's attention. This anecdote about Popeil's approach to pitching his GLH hairspray is a nice case in point:

But now that [Popeil] had told me about GLH it was unthinkable that he would not also show me its wonders. He walked quickly over to a table at the other side of the room, talking as he went. "People always ask me, `Ron, where did you get that name GLH?' I made it up. Great-Looking Hair." He picked up a can. "We make it in nine different colors. This is silver-black." He picked up a hand mirror and angled it above his head so that he could see his bald spot. "Now, the first thing I'll do is spray it where I don't need it." He shook the can and began spraying the crown of his head, talking all the while. "Then I'll go to the area itself." He pointed to his bald spot. "Right here. O.K. Now I'll let that dry. Brushing is fifty per cent of the way it's going to look." He began brushing vigorously, and suddenly Ron Popeil had what looked like a complete head of hair. "Wow," I said. Ron glowed. "And you tell me `Wow.' That's what everyone says. `Wow.' That's what people say who use it. `Wow.' If you go outside"--he grabbed me by the arm and pulled me out onto the deck--"if you are in bright sunlight or daylight, you cannot tell that I have a big bald spot in the back of my head. It really looks like hair, but it's not hair. It's quite a product. It's incredible. Any shampoo will take it out. You know who would be a great candidate for this? Al Gore. You want to see how it feels?" Ron inclined the back of his head toward me. I had said, "Wow," and had looked at his hair inside and outside, but the pitchman in Ron Popeil wasn't satisfied. I had to feel the back of his head. I did. It felt just like real hair.

Books

More directly relevant to investing is Marty Whitman's Value Investing, which I'm working on right now. Whitman, of course, is the man at Third Avenue Funds, a value shop. There are many insights in here that I haven't come across elsewhere. One of my favorites is his critique of EMH. He points out that the problem with EMH is that it assumes everyone is what he calls an "OPMI"--outside passive minority investor, his term for a non-control investor who is just buying and selling shares in a market. Now that's most of us, but it ignores the fact that there are other people, who can get something else out of the deal, what Whitman calls "SOTT" or something off the top, i.e. control investors who can give themselves salary, benefits, options, fees, etc. out of the whole thing, regardless of what the stock price is. Its more complicated than this, of course, but the basic point that its a wider world than just what the NYSE or NASDAQ quote is, I think is a very important point to ponder.