Friday, April 29, 2005

Loser List for April 29, 2005

ON THIS DAY IN 1429, JOAN OF ARC DEFEATED THE ENGLISH AT ORLEANS. IN 1862, NEW ORLEANS WAS CAPTURED BY UNION FORCES. JERRY SEINFELD IS 51 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ANX long stop at 2.3

AWA can 4 hold? if so, maybe a nice scoop off the bottom

BWLD short, stop at 32

CCL short weakness, stop at 49

GLW a breakout on a weak day--long, stop at 13

DV long strength, stop at 22.5

IMCL short, stop at 35

ILSE short weakness, stop at 17.5

ITRI a breakout, long stop at 34.5

KRB short, stop at 20

PLLL long strength, stop at 7.5

PRLS breakout above 2.8

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ANX long stop at 2.3

AWA can 4 hold? if so, maybe a nice scoop off the bottom

BWLD short, stop at 32

CCL short weakness, stop at 49

GLW a breakout on a weak day--long, stop at 13

DV long strength, stop at 22.5

IMCL short, stop at 35

ILSE short weakness, stop at 17.5

ITRI a breakout, long stop at 34.5

KRB short, stop at 20

PLLL long strength, stop at 7.5

PRLS breakout above 2.8

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 29, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

IPI long above 0.26

MOBL long above 0.23

SDRT take a flyer above 0.35 I guess

VITS throw a few cents after it above 0.14

How to use this list. And don't forget the disclaimer . . .

IPI long above 0.26

MOBL long above 0.23

SDRT take a flyer above 0.35 I guess

VITS throw a few cents after it above 0.14

How to use this list. And don't forget the disclaimer . . .

Thursday, April 28, 2005

Musings

Lots of really ugly stuff out there. This is a bear market, I guess.

One of these days we'll get a big pop up-- another 200 Dow points/25 SP points or so.

The question will be, what after that--up, or more down.

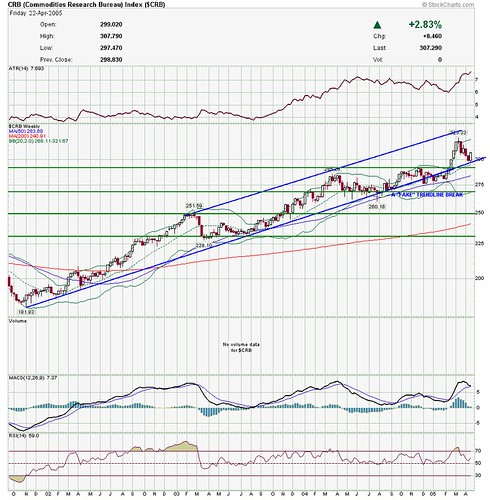

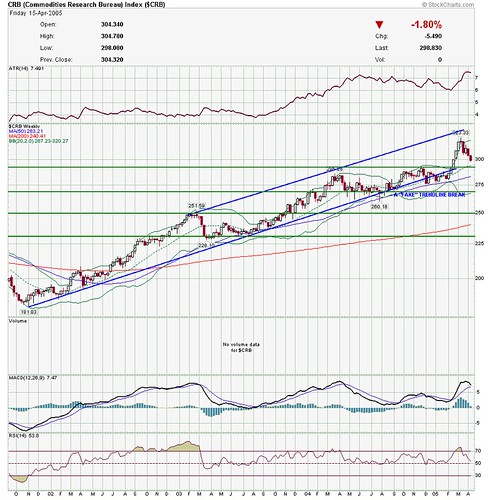

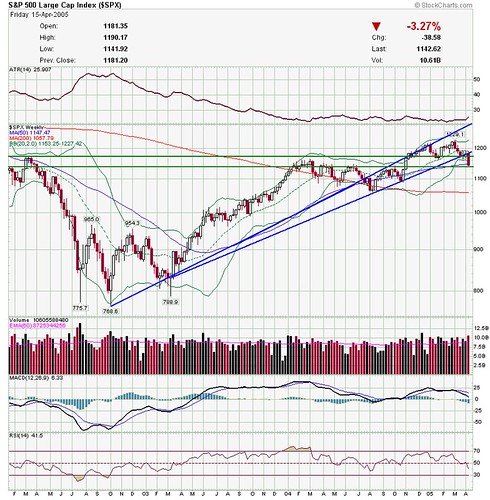

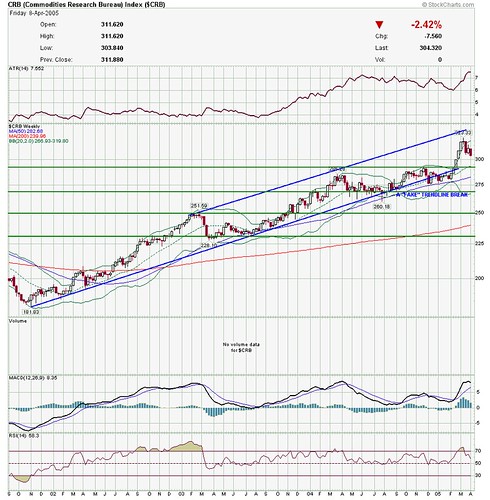

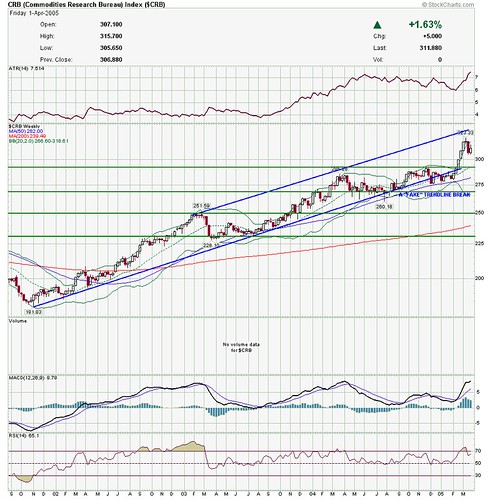

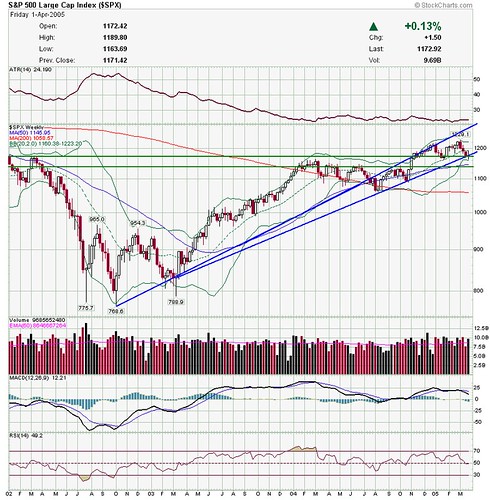

Below is the daily SP chart

courtesy of stockcharts.com

I drew the blue support resistance/lines first. Honest, I did.

Then when I used the fibonacci tool--two of the fib retracements lined up with the S/R lines I drew, confirming their significance.

Bottom line--SP sits above one fib, below another.

Yeah, it could make another run for a new high, but there's a lot of resistance to slog thru on the way--first 1162, then 1175,then 1200. THEN, I'd get bullish.

So, hypothetically, a big 20-25 point SP up day would get within striking distance of 1175. It will happen, one of these days, (of course we may go 20-40 points lower before it does), but the real issue is what happens after then.

It's going to take more than one good day to turn this around.

Good luck, and let's be careful out there.

One of these days we'll get a big pop up-- another 200 Dow points/25 SP points or so.

The question will be, what after that--up, or more down.

Below is the daily SP chart

courtesy of stockcharts.com

I drew the blue support resistance/lines first. Honest, I did.

Then when I used the fibonacci tool--two of the fib retracements lined up with the S/R lines I drew, confirming their significance.

Bottom line--SP sits above one fib, below another.

Yeah, it could make another run for a new high, but there's a lot of resistance to slog thru on the way--first 1162, then 1175,then 1200. THEN, I'd get bullish.

So, hypothetically, a big 20-25 point SP up day would get within striking distance of 1175. It will happen, one of these days, (of course we may go 20-40 points lower before it does), but the real issue is what happens after then.

It's going to take more than one good day to turn this around.

Good luck, and let's be careful out there.

Loser List for April 28, 2005

ON THIS DATE IN 1758, PRESIDENT JAMES MONROE WAS BORN. IN 1789, THERE WAS A MUTINY ON THE HMS BOUNTY. SADDAM HUSSEIN IS 68 AND JAY LENO IS 55 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

BGG short weakness, stop at 33.5

BBW short weakness, stop at 28.5

CTAS short weakness, stop at 39.3

GLW breakout (is anybody still buying these?) long stop at 13

FRX short, stop at 36.2

INSP short, stop at 35.5

LIFC, breakout long above 11

MKTX long strength, stop at 11.5

MTLG short a break of 13

PTMK long strength above 8

PTP short stop at 27

TALK breakout above 7.7

THOR long above 13

UCL short, stop at 56

WOOF breakout long above 23.5

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

BGG short weakness, stop at 33.5

BBW short weakness, stop at 28.5

CTAS short weakness, stop at 39.3

GLW breakout (is anybody still buying these?) long stop at 13

FRX short, stop at 36.2

INSP short, stop at 35.5

LIFC, breakout long above 11

MKTX long strength, stop at 11.5

MTLG short a break of 13

PTMK long strength above 8

PTP short stop at 27

TALK breakout above 7.7

THOR long above 13

UCL short, stop at 56

WOOF breakout long above 23.5

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 28, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

GACF long strength, stop at 0.96

MBTG long strength, stop at 0.50

SDRT long more strength?

How to use this list. And don't forget the disclaimer . . .

GACF long strength, stop at 0.96

MBTG long strength, stop at 0.50

SDRT long more strength?

How to use this list. And don't forget the disclaimer . . .

Wednesday, April 27, 2005

Loser List for April 27, 2005

ON THIS DATE IN 1805, THE US MARINES CAPTURED DERNA, ON "THE SHORES OF TRIPOLI". IN 1884, GREENWICH IS ESTABLISHED AS THE PRIME MERIDIAN. CASEY KASEM IS 73 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

CR above 25.5, it's a long

DITC short weakness, stop about 12.5

FMBI short, stop at 34

GPN long only on strength, stop at 64

GAP still a longer-term long above 15

IMCL short weakness, stop at 36

IPCC short weakness, stop at 32.5

MKTX bottom fishers can go long strength, stop at 12

MKC short weakness, the stop is 35.2

OFG watch and be ready to jump on further weakness

PLLL long strength above 8

PTP short weakness, stop at 27.5

YELL short weakness, stop at 50

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

CR above 25.5, it's a long

DITC short weakness, stop about 12.5

FMBI short, stop at 34

GPN long only on strength, stop at 64

GAP still a longer-term long above 15

IMCL short weakness, stop at 36

IPCC short weakness, stop at 32.5

MKTX bottom fishers can go long strength, stop at 12

MKC short weakness, the stop is 35.2

OFG watch and be ready to jump on further weakness

PLLL long strength above 8

PTP short weakness, stop at 27.5

YELL short weakness, stop at 50

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 27, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

BPTR long above 0.9

FDMLQ long, stop above 0.5

GACF long, stop at 0.96

IPI long above 0.22

ONEI long above 3.09

How to use this list. And don't forget the disclaimer . . .

BPTR long above 0.9

FDMLQ long, stop above 0.5

GACF long, stop at 0.96

IPI long above 0.22

ONEI long above 3.09

How to use this list. And don't forget the disclaimer . . .

Tuesday, April 26, 2005

Mad Money Again

Caught a little "Mad Money" with Cramer today . . .

He told a college student who asked about MSO, "Man, I hope you're sleeping on the first floor of your dorm tonight!"

He likes ALL "I don't think Spitzer's even heard of them!"

He told a college student who asked about MSO, "Man, I hope you're sleeping on the first floor of your dorm tonight!"

He likes ALL "I don't think Spitzer's even heard of them!"

Loser List for April 26, 2005

ON THIS DATE IN 1986, THE CHERNOBYL NUCLEAR PLANT ACCIDENT OCCURRED. IN 2004, THE US GOVERNMENT UNVEILED THE NEW COLORIZED $50 BILL. ACTOR JET LI TURNS 42 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

AFCO long above 25

ASPM short weakness, stop at 27.2

BBT short weakness, stop at 39

JNC long above 33

NDAQ breakout, long, stop at 12

OTEX 14.8 has to hold

PLLL pullback after breakout, long above 9.2

UGI breakout, long, stop at 48.5

WDR short, stop at 18.5

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

AFCO long above 25

ASPM short weakness, stop at 27.2

BBT short weakness, stop at 39

JNC long above 33

NDAQ breakout, long, stop at 12

OTEX 14.8 has to hold

PLLL pullback after breakout, long above 9.2

UGI breakout, long, stop at 48.5

WDR short, stop at 18.5

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 26, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

CALVF double bottom, long strength, stop at 0.08

DNAP breakout, long above 0.29

FDMLQ long stop at 0.50

ISPO long above 0.15

MOBL long above 0.21

ONEI breakout above 3.09

VROTE long above 0.12

How to use this list. And don't forget the disclaimer . . .

CALVF double bottom, long strength, stop at 0.08

DNAP breakout, long above 0.29

FDMLQ long stop at 0.50

ISPO long above 0.15

MOBL long above 0.21

ONEI breakout above 3.09

VROTE long above 0.12

How to use this list. And don't forget the disclaimer . . .

Monday, April 25, 2005

Loser List for April 25, 2005

ON THIS DATE IN 1859, GROUND WAS BROKEN FOR THE SUEZ CANAL. IN 1959, THE ST. LAWRENCE SEAWAY OPENED FOR SHIPPING. AL PACINO TURNS 65 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ATN may have found a bottom, long strength, stop at 11.5

ACL a breakout, long, stop at 92

AFCO pullback after a breakout, long above 24.2

ADM might be a long if 19.8 holds

ASPM short it, stop at 26.6

AVID short, stop at 53

BIOI long with a stop at 9

CACH double bottom, long with a stop at 11.3

CSH short weakness, stop at 17.3

CELG breakout, long above 38.5

CR triple bottom. If 25.7 holds, it's a long

DV long above 22

HMA long above 24.5

IPCC short weakness, stop at 32.3

LPNT long, stop at 41.8

AOS short, stop at 30

SSNC breakout, long above 25

TRI long above 49

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ATN may have found a bottom, long strength, stop at 11.5

ACL a breakout, long, stop at 92

AFCO pullback after a breakout, long above 24.2

ADM might be a long if 19.8 holds

ASPM short it, stop at 26.6

AVID short, stop at 53

BIOI long with a stop at 9

CACH double bottom, long with a stop at 11.3

CSH short weakness, stop at 17.3

CELG breakout, long above 38.5

CR triple bottom. If 25.7 holds, it's a long

DV long above 22

HMA long above 24.5

IPCC short weakness, stop at 32.3

LPNT long, stop at 41.8

AOS short, stop at 30

SSNC breakout, long above 25

TRI long above 49

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 25, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

DNAP long above 0.017

GACF long above 0.96

KWBT long strength above .04

NEOM breakout, long above 0.5

SUPR long above 0.05

How to use this list. And don't forget the disclaimer . . .

DNAP long above 0.017

GACF long above 0.96

KWBT long strength above .04

NEOM breakout, long above 0.5

SUPR long above 0.05

How to use this list. And don't forget the disclaimer . . .

Sunday, April 24, 2005

Sunday Night Charts for April 24, 2005

Let's start with the weekly chart of the Nasdaq.

Courtesy of stockcharts.com

Pretty much right at longer term support. If this holds, might be good for another upswing--but it will have to plow through some congestion.

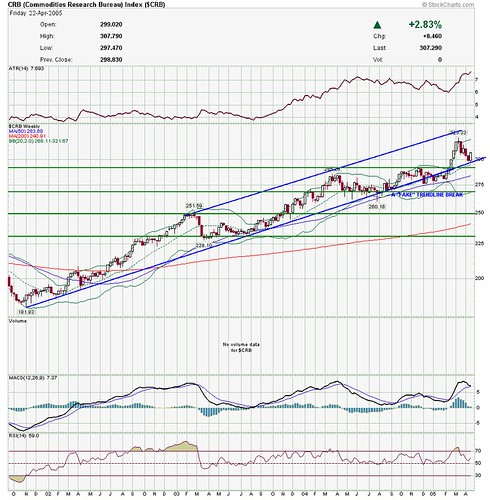

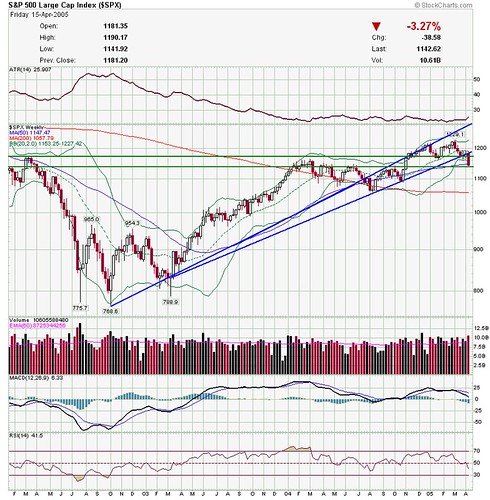

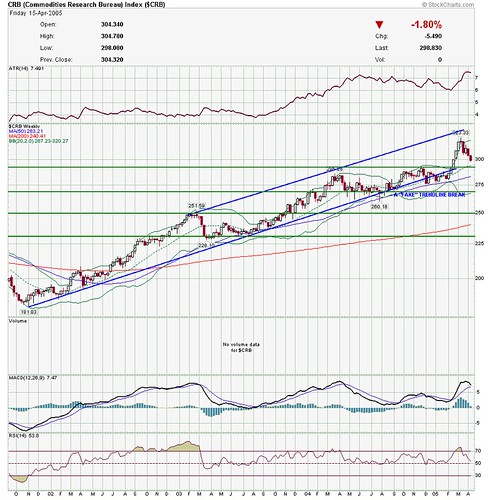

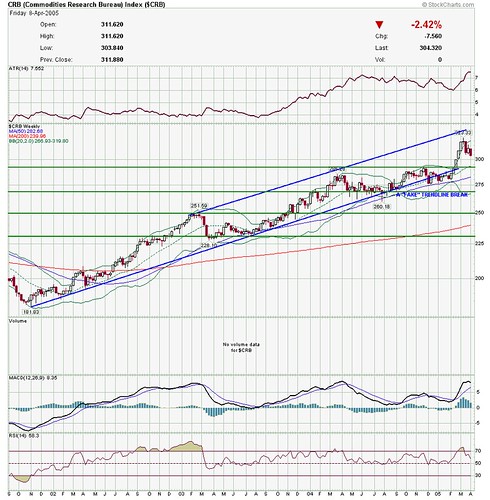

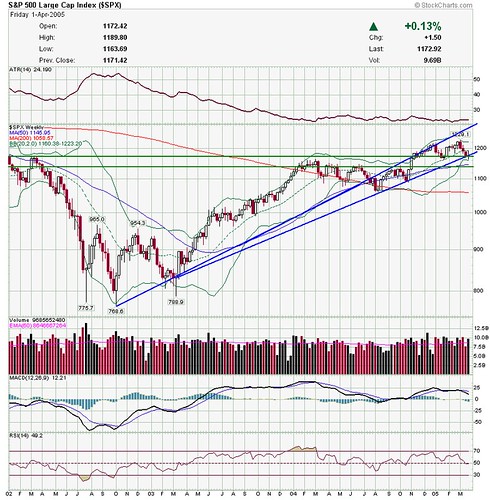

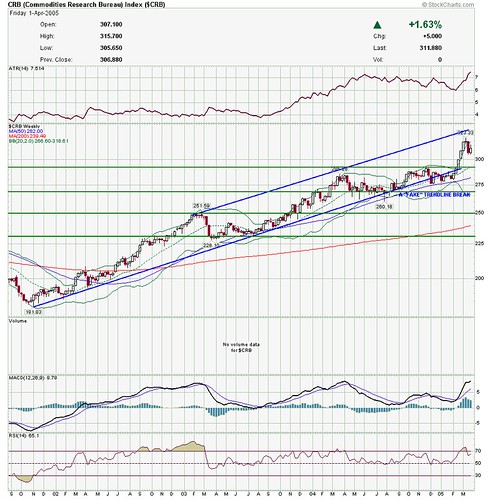

Next is the CRB

Courtesy of stockcharts.com

Nice bounce off the uptrend line.

Gold.

Courtesy of stockcharts.com

Ditto.

VIX

Courtesy of stockcharts.com

Most significant jump in fear in quite a while. Even after pullback, still above the long term downtrend line.

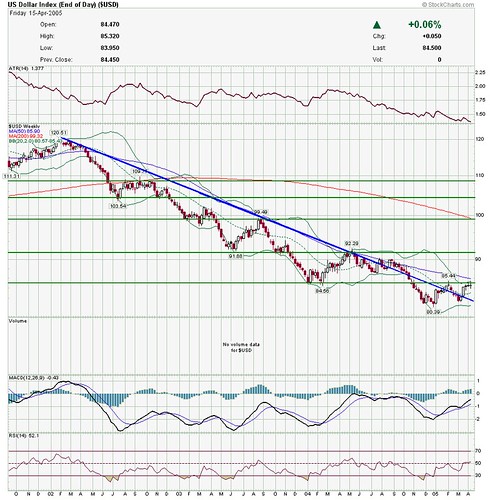

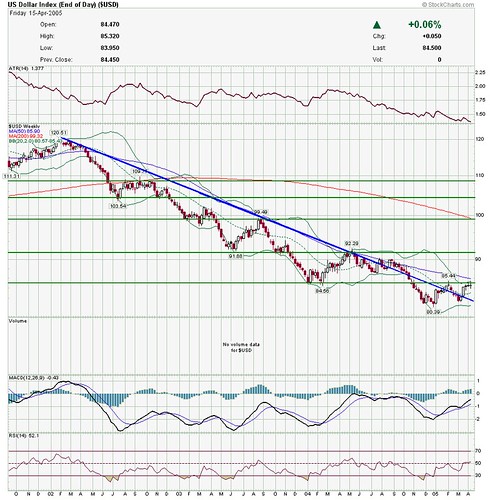

USD

Courtesy of stockcharts.com

Kind of in no man's land, really. Has broken the downtrend, but I wouldn't really call the downtrend "over" till it can convincingly break above the last intermediate high (which is the same as a previous low) at above 85.

Black gold--WTIC.

Courtesy of stockcharts.com

If it clears that double top, we could be in for another leg up.

Next is the CME

Courtesy of stockcharts.com

This one is looking like it could be a short, but not just yet--still too much of an uptrend.

TNX

Courtesy of stockcharts.com

Still falling long term rates.

Have a great week everyone!

Courtesy of stockcharts.com

Pretty much right at longer term support. If this holds, might be good for another upswing--but it will have to plow through some congestion.

Next is the CRB

Courtesy of stockcharts.com

Nice bounce off the uptrend line.

Gold.

Courtesy of stockcharts.com

Ditto.

VIX

Courtesy of stockcharts.com

Most significant jump in fear in quite a while. Even after pullback, still above the long term downtrend line.

USD

Courtesy of stockcharts.com

Kind of in no man's land, really. Has broken the downtrend, but I wouldn't really call the downtrend "over" till it can convincingly break above the last intermediate high (which is the same as a previous low) at above 85.

Black gold--WTIC.

Courtesy of stockcharts.com

If it clears that double top, we could be in for another leg up.

Next is the CME

Courtesy of stockcharts.com

This one is looking like it could be a short, but not just yet--still too much of an uptrend.

TNX

Courtesy of stockcharts.com

Still falling long term rates.

Have a great week everyone!

Weekend Wazzup for April 24, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here.

Channel surfing in the blogsphere, Ron Sen quotes Alan "the Flip-Flopper" Greenspan, and mulls over the previous week. His Chart Student site reviews, oddly enough, a whole slew of charts, including utilities and the gold ETF. Galatime is discounting one screen but starting another. Tom Ott at Sixth World comments on the VIX and his updated stock screens. Bill Cara reviews the week and talks about "amalgamation" at the Nasdaq and the NYSE. Taylor Tree made some comments about keeping it simple, stupid.

We're still awaiting the return of Stockcoach . Shiau Street is currently down due to compatibility issues. Byrne's Marketview is on a brief break. And the Soothsayer of Omaha has been quiet this week as well.

Stephen Castellano at Reflections on Equity Research has some good examples of equity research reports and a short primer on how they are written. Chairman MaoXian is still around--check out his chat every weekday 4:30-5:30 Eastern time. TraderMike comments on how excited they got on CNBC with a 200 point move in the Dow. Random Roger and Roberto Pedone of Nasdaq trader are now both part of Trader'sLive. Random Roger is continuing his blog and had his usual big picture post, including some comments on GM.

In all honesty, I'm still not sure what to think about the Present Moment Trading Campaign by Market Monk. Check it out and judge for yourself. Ugly at uglychart had a good introduction to the Firefox browser, (if you don't know about Firefox, you should). His "remainder" contest for stock market blogs continues. As I posted yesterday, I encourage everyone to vote for "Billy Joe".

The Alchemy of Trading usually has a good Sunday night overview. Watch for it. Also watch for the LBR group's Sunday night chat--they usually have some good stuff.

Channel surfing in the blogsphere, Ron Sen quotes Alan "the Flip-Flopper" Greenspan, and mulls over the previous week. His Chart Student site reviews, oddly enough, a whole slew of charts, including utilities and the gold ETF. Galatime is discounting one screen but starting another. Tom Ott at Sixth World comments on the VIX and his updated stock screens. Bill Cara reviews the week and talks about "amalgamation" at the Nasdaq and the NYSE. Taylor Tree made some comments about keeping it simple, stupid.

We're still awaiting the return of Stockcoach . Shiau Street is currently down due to compatibility issues. Byrne's Marketview is on a brief break. And the Soothsayer of Omaha has been quiet this week as well.

Stephen Castellano at Reflections on Equity Research has some good examples of equity research reports and a short primer on how they are written. Chairman MaoXian is still around--check out his chat every weekday 4:30-5:30 Eastern time. TraderMike comments on how excited they got on CNBC with a 200 point move in the Dow. Random Roger and Roberto Pedone of Nasdaq trader are now both part of Trader'sLive. Random Roger is continuing his blog and had his usual big picture post, including some comments on GM.

In all honesty, I'm still not sure what to think about the Present Moment Trading Campaign by Market Monk. Check it out and judge for yourself. Ugly at uglychart had a good introduction to the Firefox browser, (if you don't know about Firefox, you should). His "remainder" contest for stock market blogs continues. As I posted yesterday, I encourage everyone to vote for "Billy Joe".

The Alchemy of Trading usually has a good Sunday night overview. Watch for it. Also watch for the LBR group's Sunday night chat--they usually have some good stuff.

Saturday, April 23, 2005

Uglychart's remainder contest

Regular readers of this and other financial blog may be aware of uglychart's ongoing "remainder" contest. Right now there is a tight four-way race going on. This is America, and nobody can tell you how to vote. Nevertheless, in a brazen attempt to show the power of my blog ;>) I'd like to encourage everyone to go here and vote for "Billy Joe".

Thanks.

Thanks.

Fox Saturday Morning "Business Bloc" for April 23, 2005

Fox News Channel' s "Cost of Freedom" Saturday Morning shows--

Bulls and Bears started with the Trading Pit discussing what happens next. Tobin Smith called the bottom this week. . .Gary Kaltbaum on the other hand said the top happened weeks ago and we're going lower. He said there were high volume declines and low volume rallies, and the huge up day on Thursday is indicative of the sharp rallies that occur in a bear market. Herman Cain said he is a bulldog in between the bulls and bears and said this is the time to look at undervalued compaines, naming WHR. Gary B. Smith thinks there's a little more downside and then up, saying he would look at tech. Scott Bleier said the markets are going maybe 2% lower, then "buy everthing in sight." Pat Dorsey got "excited" when things were lower, saying there were some bargains, naming IGT, and EBAY. In the Stock Xchange, mergers were discussed. Pat mentioned STLD as a steel takeover target. Gary K. says steel is "over" and prefers ATVI as a takeover. Toby mentioned ATI because of titanium. Scott said DRS because defense is "bulletproof". In the ChartMan segment, Gary B. said GM is at very long term support--buy on Monday with a stop at 24 (he says he owns it). Toby said it's going bankrupt--buy it when it comes out of bankruptcy. His other pick was GOOG--he said it's been basing while the market is going down, and it's going to 250. In Predictions Gary K says the Dow is going to 9K before 11K, Pat says buy CME--it is cheap and he owns it; Gary B says buy DAL "it's down for stupid reasons"--it doubles in a year; Scott says buy LSI it will be up 30% by fall. Toby says buy FO and sell BUD.

Cavuto on Business started with the Bottom Line discussing Social Security. Lots of jibba jabba. Jim Rogers said if you are under 40, you'll never see social security. Gregg Hymowitz said "rich people" shouldn't get social security (that's great, because it's always the other guy who's rich). Bob Froehlich said the best investment opportunities will be outside the United States. In the More for you money segment Danielle Hughes said buy EBAY to retire rich. The great DVR moment was when Hymowitz asked her what the multiple of EBAY was, she hesitated and said, "You got me, but it's down 40% and at a 52 week low." Okay, thanks Dani. Bob F. says buy CHL--world's largest cell phone provider with 200 million subscribers. Gregg Hymowitz says buy C and Jim Rogers says he's shorting it. Rogers says buy hard assets and airlines. In the Buy Monday segment, more jibba jabba-- market up, jibba, market down, jabba, commodities, jibba, overseas, jabba. Pointless. In Fox on the spot, Bob F. says one more interest rate hike, and the Fed is done, so buy financials. Jim says the NYSE is over, and sell AX, Dani says buy AX.

Forbes on Fox started with a discussion of are we in a Boom or Bust. Even if they solved the question of whether the economy is strong, that doesn't tell me what the markets will do. Lots of arm waving. Some pointless out of context statistics--36% of SP 500 companies' profits come from financing activites; sales at SP500 companies have gone up 12%, but profits have gone up 93%. Whatever. The Flipside discussed Asia as the next big threat. More arm waving. The insights were not much deeper than "It would be bad if China invaded Taiwan" "Yeah, and they'd lose all their trading partners so they won't". The Informer segment mentioned ADP, CREE, MSFT and DLM without much rhyme or reason that I could see. In the Makers and Breakers segment, Jack Ablin of Harris Private Bank recommended PFE. Yoda's younger brother Jim Michaels liked it as well. Ablin also picked CMX.

Cashin' In started with a discussion of the death tax. Lots of political arm waving. Very little to trade off of. Wayne Rogers said he's short some things but refused to name them. In Best Bets, Wendell Perkins of Johnson Family Mutual Funds is buying the TRB, Wayne Rogers is buying NXTP , Jonathan Hoenig still thinks utilities are the only real strong segment of the market, and mentioned SO. In the money mail segment, the first question was what's the most important thing to look for in a stock. Wayne said he looks at the technicals--(although, interestingly, he says this assumes that the fundamentals are good as well) volume, institutional support, formation of a base. Jonathan says he looks at price--likes to see a stock that is doing well but the herd hasn't noticed it yet. The next question was about F and the other automakers. Everyone agreed they are in bad shape without much analysis. The final question was about the NYSE merger. Jonathan mentioned MKTX as a stock he's been looking at but hasn't bought yet. In the Stock of the Week, Wendell Perkins was pimping JPM saying it has a lot of upside if rates don't rise much (which he thinks they won't). Jonathan pointed out that the Johnson family funds own a lot of banks, and Wendell agreed saying they like the sector.

Bulls and Bears started with the Trading Pit discussing what happens next. Tobin Smith called the bottom this week. . .Gary Kaltbaum on the other hand said the top happened weeks ago and we're going lower. He said there were high volume declines and low volume rallies, and the huge up day on Thursday is indicative of the sharp rallies that occur in a bear market. Herman Cain said he is a bulldog in between the bulls and bears and said this is the time to look at undervalued compaines, naming WHR. Gary B. Smith thinks there's a little more downside and then up, saying he would look at tech. Scott Bleier said the markets are going maybe 2% lower, then "buy everthing in sight." Pat Dorsey got "excited" when things were lower, saying there were some bargains, naming IGT, and EBAY. In the Stock Xchange, mergers were discussed. Pat mentioned STLD as a steel takeover target. Gary K. says steel is "over" and prefers ATVI as a takeover. Toby mentioned ATI because of titanium. Scott said DRS because defense is "bulletproof". In the ChartMan segment, Gary B. said GM is at very long term support--buy on Monday with a stop at 24 (he says he owns it). Toby said it's going bankrupt--buy it when it comes out of bankruptcy. His other pick was GOOG--he said it's been basing while the market is going down, and it's going to 250. In Predictions Gary K says the Dow is going to 9K before 11K, Pat says buy CME--it is cheap and he owns it; Gary B says buy DAL "it's down for stupid reasons"--it doubles in a year; Scott says buy LSI it will be up 30% by fall. Toby says buy FO and sell BUD.

Cavuto on Business started with the Bottom Line discussing Social Security. Lots of jibba jabba. Jim Rogers said if you are under 40, you'll never see social security. Gregg Hymowitz said "rich people" shouldn't get social security (that's great, because it's always the other guy who's rich). Bob Froehlich said the best investment opportunities will be outside the United States. In the More for you money segment Danielle Hughes said buy EBAY to retire rich. The great DVR moment was when Hymowitz asked her what the multiple of EBAY was, she hesitated and said, "You got me, but it's down 40% and at a 52 week low." Okay, thanks Dani. Bob F. says buy CHL--world's largest cell phone provider with 200 million subscribers. Gregg Hymowitz says buy C and Jim Rogers says he's shorting it. Rogers says buy hard assets and airlines. In the Buy Monday segment, more jibba jabba-- market up, jibba, market down, jabba, commodities, jibba, overseas, jabba. Pointless. In Fox on the spot, Bob F. says one more interest rate hike, and the Fed is done, so buy financials. Jim says the NYSE is over, and sell AX, Dani says buy AX.

Forbes on Fox started with a discussion of are we in a Boom or Bust. Even if they solved the question of whether the economy is strong, that doesn't tell me what the markets will do. Lots of arm waving. Some pointless out of context statistics--36% of SP 500 companies' profits come from financing activites; sales at SP500 companies have gone up 12%, but profits have gone up 93%. Whatever. The Flipside discussed Asia as the next big threat. More arm waving. The insights were not much deeper than "It would be bad if China invaded Taiwan" "Yeah, and they'd lose all their trading partners so they won't". The Informer segment mentioned ADP, CREE, MSFT and DLM without much rhyme or reason that I could see. In the Makers and Breakers segment, Jack Ablin of Harris Private Bank recommended PFE. Yoda's younger brother Jim Michaels liked it as well. Ablin also picked CMX.

Cashin' In started with a discussion of the death tax. Lots of political arm waving. Very little to trade off of. Wayne Rogers said he's short some things but refused to name them. In Best Bets, Wendell Perkins of Johnson Family Mutual Funds is buying the TRB, Wayne Rogers is buying NXTP , Jonathan Hoenig still thinks utilities are the only real strong segment of the market, and mentioned SO. In the money mail segment, the first question was what's the most important thing to look for in a stock. Wayne said he looks at the technicals--(although, interestingly, he says this assumes that the fundamentals are good as well) volume, institutional support, formation of a base. Jonathan says he looks at price--likes to see a stock that is doing well but the herd hasn't noticed it yet. The next question was about F and the other automakers. Everyone agreed they are in bad shape without much analysis. The final question was about the NYSE merger. Jonathan mentioned MKTX as a stock he's been looking at but hasn't bought yet. In the Stock of the Week, Wendell Perkins was pimping JPM saying it has a lot of upside if rates don't rise much (which he thinks they won't). Jonathan pointed out that the Johnson family funds own a lot of banks, and Wendell agreed saying they like the sector.

Friday, April 22, 2005

Loser List for April 22, 2005

ON THIS DATE IN 1889, THE OKLAHOMA LAND RUSH BEGAN; IN 2004, FORMER NFL PLAYER PAT TILLMAN WAS KILLED IN ACTION IN AFGHANISTAN. TODAY GLEN CAMPBELL IS 69, AND PETER FRAMPTOM IS 55.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ARLP short weakness, stop at 62

AEL a triple top? short weakness, stop at 13

PLB 27 has to hold

ASPM also a triple top? short weakness, stop at 26.5

CACH bottom fish? long stop at 11.3

CCL sell it, stop at 50.3

CR another bottom dweller off of a triple low, stop at 25.8

FRX short weakness, stop at 36.5

FBR go long strength, stop at 13

GM 200 point day in the Dow, and GM could only manage 0.19? short it.

HDI I think the bagholders start trying to get out, short it, stop at 49 or so

IGI short, stop at 29

ITRI long stop at 31

MKC 35 separates the short from the long here

NICE a nice breakout--long above 37

CKH short weakness, stop at 61.6

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ARLP short weakness, stop at 62

AEL a triple top? short weakness, stop at 13

PLB 27 has to hold

ASPM also a triple top? short weakness, stop at 26.5

CACH bottom fish? long stop at 11.3

CCL sell it, stop at 50.3

CR another bottom dweller off of a triple low, stop at 25.8

FRX short weakness, stop at 36.5

FBR go long strength, stop at 13

GM 200 point day in the Dow, and GM could only manage 0.19? short it.

HDI I think the bagholders start trying to get out, short it, stop at 49 or so

IGI short, stop at 29

ITRI long stop at 31

MKC 35 separates the short from the long here

NICE a nice breakout--long above 37

CKH short weakness, stop at 61.6

How to use this list. And don't forget the disclaimer . . .

Arch Crawford

Arch Crawford was just on CNBC. If you don't know, he combines technical analysis with astrology to make market calls. Hey, whatever works.

He is still 200% short, and says we are at the end of a cyclical bull inside of a secular bear.

If you are skeptical, Regis says Arch is the only guy who knows what's going on.

He is still 200% short, and says we are at the end of a cyclical bull inside of a secular bear.

If you are skeptical, Regis says Arch is the only guy who knows what's going on.

Reloading

I'm skeptical of the rally yesterday.

A lot of charts I follow basically rallied right up to resistance.

I'm using today to reload some shorts on my loser list.

Your mileage may vary, and, as always, I may change my mind at any moment.

A lot of charts I follow basically rallied right up to resistance.

I'm using today to reload some shorts on my loser list.

Your mileage may vary, and, as always, I may change my mind at any moment.

Penny Losers for April 22, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

BPTR long, stop at 0.8

EZEN long above 1.84

IBAS long strength above 2.31

MBTG if its strong, I'm long

How to use this list. And don't forget the disclaimer . . .

BPTR long, stop at 0.8

EZEN long above 1.84

IBAS long strength above 2.31

MBTG if its strong, I'm long

How to use this list. And don't forget the disclaimer . . .

Thursday, April 21, 2005

A quick note at the open

Yesterday's action, with the bounce in the AM and selloff in the PM, was really ugly.

The pop in the futures this morning may be real, but make it prove itself.

I haven't said it for a long time, but this is a good day to remember the Trader Mike Rule #1--i.e. wait to buy above the 10 AM (eastern) high, to make the rally prove itself.

The pop in the futures this morning may be real, but make it prove itself.

I haven't said it for a long time, but this is a good day to remember the Trader Mike Rule #1--i.e. wait to buy above the 10 AM (eastern) high, to make the rally prove itself.

Loser List for April 21 2005

TODAY IS APRIL 21--ON THIS DAY IN 1836, GENERAL SAM HOUSTON DEFEATED THE MEXICANS AT THE BATTLE OF SAN JACINTO. IN 1980, ROSIE RUIZ WON THE NEW YORK MARATHON BY TAKING THE SUBWAY. TODAY IS HRH QUEEN ELIZABETH'S 79TH BIRTHDAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ALGN short on weakness, stop at 9--only on weakness!

ARLP short weakness, stop at 60.4

BBV short, stop at 16

BGG the bottom fishers should buy, stop at 33

CLS another one of those "short below 12, long above 13" deals

FDRY short, stop at 9.6

JNC gonna break, one way, one of these days . .

NCI buy the bounce stop at 23.5

ODFL short stop at 29

OEH long above 26

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ALGN short on weakness, stop at 9--only on weakness!

ARLP short weakness, stop at 60.4

BBV short, stop at 16

BGG the bottom fishers should buy, stop at 33

CLS another one of those "short below 12, long above 13" deals

FDRY short, stop at 9.6

JNC gonna break, one way, one of these days . .

NCI buy the bounce stop at 23.5

ODFL short stop at 29

OEH long above 26

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 21, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

BMGX long strength, stop at 0.74

SMTR long strength above 0.083

TBIO long above 0.91

How to use this list. And don't forget the disclaimer . . .

BMGX long strength, stop at 0.74

SMTR long strength above 0.083

TBIO long above 0.91

How to use this list. And don't forget the disclaimer . . .

Wednesday, April 20, 2005

BRK again

That BRK is starting to look mighty tasty, and I took a nibble . . .

I think it may get even tastier (i.e. lower) from here . . .

So if I think it's going lower, why would I buy here?

Good question.

I can always be wrong; even though I think it's going lower, if I don't pick up a little here, and then it rockets up, I'd kick myself for missing it at these levels.

So I guess this is a "I don't want to kick myself" buy.

I think it may get even tastier (i.e. lower) from here . . .

So if I think it's going lower, why would I buy here?

Good question.

I can always be wrong; even though I think it's going lower, if I don't pick up a little here, and then it rockets up, I'd kick myself for missing it at these levels.

So I guess this is a "I don't want to kick myself" buy.

BRK

Berkshire Hathaway is trading just a hair above where I said I'd start to get interested.

I have a "hunch" it will be lower before its much higher, but who knows?

I have a "hunch" it will be lower before its much higher, but who knows?

Loser List for April 20, 2005

TODAY IS APRIL 20--IN 1836, THE TERRITORY OF WISCONSIN WAS ESTABLISHED, AND IN 1889, ADOLF HITLER WAS BORN. ACTOR GEORGE TAKEI ("MR. SULU") IS 68 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ADBE above 60, long and strong, below 58, short it

ARLP short weakness, stop at 60

ADM long strength, stop at 20

AVID short weakness, stop at 52.5

CMRG long above 7

DRI long above 30

FBR still looking to bottom fish this one above 14 . . .

GAP long, stop at 15

HTLD short weakness below 19

IPCC short weakness, stop at 32.5

ILSE long, stop at 16

JNC is gonna break one way or another, long above 35

OTEX another bottom fish, long strength stop at 14.8

OEH long strength, stop at 26.2

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ADBE above 60, long and strong, below 58, short it

ARLP short weakness, stop at 60

ADM long strength, stop at 20

AVID short weakness, stop at 52.5

CMRG long above 7

DRI long above 30

FBR still looking to bottom fish this one above 14 . . .

GAP long, stop at 15

HTLD short weakness below 19

IPCC short weakness, stop at 32.5

ILSE long, stop at 16

JNC is gonna break one way or another, long above 35

OTEX another bottom fish, long strength stop at 14.8

OEH long strength, stop at 26.2

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 20, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

BMGX long above 0.77

BSKO long stop at 1.2

CYDS long above 1.00

FDMLQ long above 0.6

OCCM long above 0.26

How to use this list. And don't forget the disclaimer . . .

BMGX long above 0.77

BSKO long stop at 1.2

CYDS long above 1.00

FDMLQ long above 0.6

OCCM long above 0.26

How to use this list. And don't forget the disclaimer . . .

Tuesday, April 19, 2005

Loser List for April 19, 2005

TODAY IN HISTORY--IN 1775, THE BATTLES OF LEXINGTON AND CONCORD WERE FOUGHT; IN 1933, THE UNITED STATES WENT OFF THE GOLD STANDARD.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ATRS short stop at 20

ASMI short, stop at 15

CDWC short, stop at 56

DRI long above 30

FMBI short, stop at 32

FBR any bottom fishers here? long above 14

IRIS long above 13

ILSE short weakness, stop at 15.8

LNN short, stop at 20

MHK short it--stop at 81

MGI short weakness, stop at 18.7

PDC looks pretty good, long, stop at 12.5

ROL long strength, stop at 18

TWP another bottom dweller, long strength, stop at 39

WDC long, stop at 12

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ATRS short stop at 20

ASMI short, stop at 15

CDWC short, stop at 56

DRI long above 30

FMBI short, stop at 32

FBR any bottom fishers here? long above 14

IRIS long above 13

ILSE short weakness, stop at 15.8

LNN short, stop at 20

MHK short it--stop at 81

MGI short weakness, stop at 18.7

PDC looks pretty good, long, stop at 12.5

ROL long strength, stop at 18

TWP another bottom dweller, long strength, stop at 39

WDC long, stop at 12

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 19, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

BMGX long above 0.74

FDMLQ long, stop at 0.48

FRNS long above 8.1

GACF long above 0.95

IBAS long, stop at 2.3

KWBT long strength above 0.05

SMTR long above 0.08

How to use this list. And don't forget the disclaimer . . .

BMGX long above 0.74

FDMLQ long, stop at 0.48

FRNS long above 8.1

GACF long above 0.95

IBAS long, stop at 2.3

KWBT long strength above 0.05

SMTR long above 0.08

How to use this list. And don't forget the disclaimer . . .

Monday, April 18, 2005

Today

Not very convincing action today so far--I haven't really done much of anything in the way of "big moves".

Caught some CNBC from time to time today--there seemed to be even more than the usual "happy talk"--on at least one occasion, the Dow was described as being up when the on-screen ticker showed it red, etc. I did catch Art Cashin, who unfortunately is never on long enough. He talked about the "cocktail napkin chartists" on the floor looking at 1140 on the S&P as the line to watch, and that if that was violated, there was a lot more downside. The other thing he mentioned that is being noticed is the weakness in transports and commodities, and the slowdown in companies that ship commodities, make everyone thing there is some sort of global slowdown out there.

I got a nice note from a reader who asks if my view of Berkshire has changed, since it is trading down toward the 2800 for B shares that I identified as a level that would get me interested. In short, I still view weakness in BRK as a buying opportunity.

Caught some CNBC from time to time today--there seemed to be even more than the usual "happy talk"--on at least one occasion, the Dow was described as being up when the on-screen ticker showed it red, etc. I did catch Art Cashin, who unfortunately is never on long enough. He talked about the "cocktail napkin chartists" on the floor looking at 1140 on the S&P as the line to watch, and that if that was violated, there was a lot more downside. The other thing he mentioned that is being noticed is the weakness in transports and commodities, and the slowdown in companies that ship commodities, make everyone thing there is some sort of global slowdown out there.

I got a nice note from a reader who asks if my view of Berkshire has changed, since it is trading down toward the 2800 for B shares that I identified as a level that would get me interested. In short, I still view weakness in BRK as a buying opportunity.

Loser List for April 18, 2005

ON THIS DATE IN 1775, PAUL REVERE MADE HIS RIDE. CONAN O'BRIEN IS 42 TODAY.

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

short of the day--RKH--regional bank ETF--short, stop at 130

ACN short below 22.6

API buy above 2.

ANX breakout buy above 2.55

*AVY short a break of 53

CTR short, stop at 27.5

CLS short, stop at 12

CVO long, stop at 7.75

CLHB short, stop at 16.8

CREE short weakness, stop at 25.6

DDIC long, stop at 3.05

*FLIR short, stop at 24.7

GAP buy above 15

HCA long strength, stop at 55

LFG short, stop at 50

MDR long stop at 20.3

MRX short, stop at 30

ROL long, stop at 18.4

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

short of the day--RKH--regional bank ETF--short, stop at 130

ACN short below 22.6

API buy above 2.

ANX breakout buy above 2.55

*AVY short a break of 53

CTR short, stop at 27.5

CLS short, stop at 12

CVO long, stop at 7.75

CLHB short, stop at 16.8

CREE short weakness, stop at 25.6

DDIC long, stop at 3.05

*FLIR short, stop at 24.7

GAP buy above 15

HCA long strength, stop at 55

LFG short, stop at 50

MDR long stop at 20.3

MRX short, stop at 30

ROL long, stop at 18.4

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 18, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

APYM a bounce off 2 might be buyable

BSKO long strength stop at 1.25

GNOLF long, stop at 0.3

KWBT long above 0.05

MJET long? stop at 0.72?-- ahhh, it's no more a crap shoot than the rest of these

OWENQ what the heck, take a poke at it above 5

How to use this list. And don't forget the disclaimer . . .

APYM a bounce off 2 might be buyable

BSKO long strength stop at 1.25

GNOLF long, stop at 0.3

KWBT long above 0.05

MJET long? stop at 0.72?-- ahhh, it's no more a crap shoot than the rest of these

OWENQ what the heck, take a poke at it above 5

How to use this list. And don't forget the disclaimer . . .

Sunday, April 17, 2005

The week ahead

Everyone else is commenting on what they see ahead, I might as well also ;>)

Obviously, the market will continue to go down, until it goes up again--the three questions are how far down, how long till it turns, and once it turns, how far will it go up?

Since the answers are ultimately unknowable, a lot depends on your time frame, your trading/investing style, and risk tolerance.

Technical analysis, sentiment readings, and even fundamental analysis can identify opportunities, and maybe give an "edge", but ultimately it is risk management that separates the winners from losers over the long term.

The charts of the Nasdaq and the SP500 that I posted show the possibility of a bounce off support. I may buy this, I may not. A lot depends on the early action. If hypothetically, I do buy, you can bet it will be on a tight stop. But even if I do buy, and we get a good bounce, then what? Is it back up to new highs--or will this be a dead cat bounce prior to another ride down?

I've had the view for a long time that over the next few years, equities were headed nowhere. I repeat my previous view that just as the first Dow breach of 1000 and the last were about 16 years apart, I expect the last Dow close under or near 10000 to occur somewhere in the 2012-2017 range. Thus, my bias is to always expect more on the downside with this market. I have to try real hard to be objective, and not let this bias blind me to what is going on.

So what sorts of things this week would I be looking for? The most obvious sign of a "bottom" would be a big sell off, a further VIX spike, and a sudden intra-day reversal, in both indices and the VIX, on big volume. While that happened back in summer '02, it might be a little too obvious. One thing I haven't quite seen yet is a real crescendo of fear--I haven't seen too many calls for Dow 6K or 7K, or sub-1K Naz, or Maria Bartiromo saying we should all short stocks. Jim Cramer IS calling for you to bottom fish. Too many people, in fact, seem to be looking for the start of a rally here.

In short, while I'm ready to buy, if that's called for, I'm still skeptical.

The most important thing, as always, protect your capital, so you can stay in the game.

They say they never ring a bell at the bottom or the top. I'll tell you what--if I'm really convinced that we've seen "the big bottom", I'll ring the bell right here. Promise :>)

Obviously, the market will continue to go down, until it goes up again--the three questions are how far down, how long till it turns, and once it turns, how far will it go up?

Since the answers are ultimately unknowable, a lot depends on your time frame, your trading/investing style, and risk tolerance.

Technical analysis, sentiment readings, and even fundamental analysis can identify opportunities, and maybe give an "edge", but ultimately it is risk management that separates the winners from losers over the long term.

The charts of the Nasdaq and the SP500 that I posted show the possibility of a bounce off support. I may buy this, I may not. A lot depends on the early action. If hypothetically, I do buy, you can bet it will be on a tight stop. But even if I do buy, and we get a good bounce, then what? Is it back up to new highs--or will this be a dead cat bounce prior to another ride down?

I've had the view for a long time that over the next few years, equities were headed nowhere. I repeat my previous view that just as the first Dow breach of 1000 and the last were about 16 years apart, I expect the last Dow close under or near 10000 to occur somewhere in the 2012-2017 range. Thus, my bias is to always expect more on the downside with this market. I have to try real hard to be objective, and not let this bias blind me to what is going on.

So what sorts of things this week would I be looking for? The most obvious sign of a "bottom" would be a big sell off, a further VIX spike, and a sudden intra-day reversal, in both indices and the VIX, on big volume. While that happened back in summer '02, it might be a little too obvious. One thing I haven't quite seen yet is a real crescendo of fear--I haven't seen too many calls for Dow 6K or 7K, or sub-1K Naz, or Maria Bartiromo saying we should all short stocks. Jim Cramer IS calling for you to bottom fish. Too many people, in fact, seem to be looking for the start of a rally here.

In short, while I'm ready to buy, if that's called for, I'm still skeptical.

The most important thing, as always, protect your capital, so you can stay in the game.

They say they never ring a bell at the bottom or the top. I'll tell you what--if I'm really convinced that we've seen "the big bottom", I'll ring the bell right here. Promise :>)

Sunday Night Charts for April 17, 2005

Let's start with the weekly chart of the Nasdaq.

Courtesy of stockcharts.com

Uptrend is broken, has pulled back to support, a bounce here could be buyable.

Now here is the S&P 500

Courtesy of stockcharts.com

Similarly, significant drop, but has pulled back to support. Two indices at a buyable support--but ONLY if they show strength

Next is the CRB

Courtesy of stockcharts.com

A pullback here, but still a solid uptrend--and, this actually looks more buyable than the equities, since the uptrend is still intact.

Gold.

Courtesy of stockcharts.com

Hugging that uptrend line. Probably a good low risk entry here.

VIX

Courtesy of stockcharts.com

Finally a big spike in fear, but by historical standards, not that much of a spike.

Now the continuing saga of the USD

Courtesy of stockcharts.com

Still flirting with that resistance. The downtrend is in trouble, although not yet broken.

Black gold--WTIC.

Courtesy of stockcharts.com

Coming off of a double top, but still a solid longer term uptrend.

TNX

Courtesy of stockcharts.com

Where the heck are those rising interest rates???

Have a great week everyone!

Courtesy of stockcharts.com

Uptrend is broken, has pulled back to support, a bounce here could be buyable.

Now here is the S&P 500

Courtesy of stockcharts.com

Similarly, significant drop, but has pulled back to support. Two indices at a buyable support--but ONLY if they show strength

Next is the CRB

Courtesy of stockcharts.com

A pullback here, but still a solid uptrend--and, this actually looks more buyable than the equities, since the uptrend is still intact.

Gold.

Courtesy of stockcharts.com

Hugging that uptrend line. Probably a good low risk entry here.

VIX

Courtesy of stockcharts.com

Finally a big spike in fear, but by historical standards, not that much of a spike.

Now the continuing saga of the USD

Courtesy of stockcharts.com

Still flirting with that resistance. The downtrend is in trouble, although not yet broken.

Black gold--WTIC.

Courtesy of stockcharts.com

Coming off of a double top, but still a solid longer term uptrend.

TNX

Courtesy of stockcharts.com

Where the heck are those rising interest rates???

Have a great week everyone!

Weekend Wazzup for April 17, 2005

My roundup of the Fox News Channel' s "Cost of Freedom" Saturday Morning shows-- is here.

The big question this weekend is do we get a tradeable bounce here, or do we keep going lower?

Tom Ott at Sixth World notes the climbing VIX and says, time to buy! Taylor Tree is also looking for a rally from here. The Alchemy of Trading also says it might be time to buy--er, not quite, almost, not really, yet. Roberto's Nasdaq trader asks whether we have a Black Monday coming, and whether water is the next oil. Random Roger presented a defensive plan for Monday and had a very worthwhile quote from Barron's.

The Soothsayer of Omaha had an enlightening review of the technical picture at this point. Ron Sen had a nice post bringing together George Soros, Marty Schwartz, and toreadors; his Chart Student site showed what's up (or down) with the TNX, and the VIX. Bill Cara once again presents his comprehensive review of the week--he has a lot to say about Jim Cramer, so Cramer fans will want to check this one out. TraderMike summed up last weeks's action as "positively negative"and pointed to a piece by Dr. Duru on getting the Fed wrong.

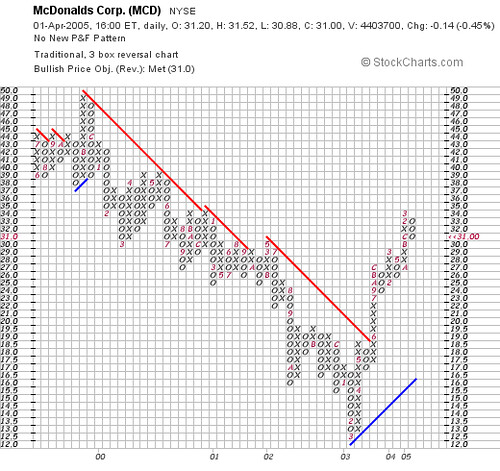

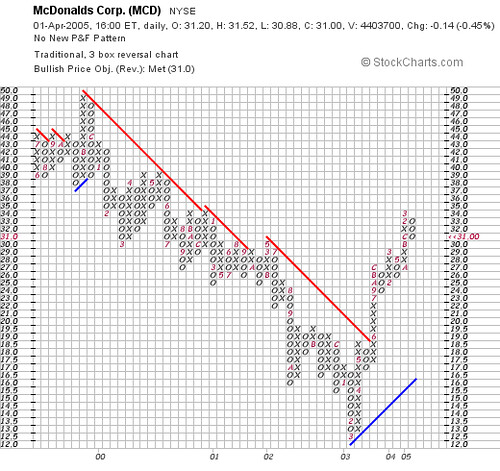

Galatime summarized his recent options trade results and discussed whether changing exit strategy might be worthwhile. Shiau Street takes note of the plunge in Apple. Byrne's Marketview noted Mickey D's plans for espresso. Chairman MaoXian is still posting the gratuitous Friday picture; check out his chat every weekday 4:30- 5:30 Eastern time. Stockcoach is still on an extended break, but hopefully will be back soon. Uglychart's "remainder" contest for stock market blogs continues, vote early and often! Ugly also points out that the end is nigh and that Garry Kasparov was attacked with a chessboard.

Stephen Castellano at Reflections on Equity Research has a new project up and running-- an open source equity research unit called Maverick Society Investment Research. Click on the link and check it out!

I encourage everyone to check out the Present Moment Trading Campaign by Market Monk. He's got a lot of posts, just start reading them.

Stephen Vita at the Alchemy of Trading usually has a great Sunday night overview-watch for it. Also watch for the LBR group's Sunday night chat--they usually have some good stuff.

Have a great week!

The big question this weekend is do we get a tradeable bounce here, or do we keep going lower?

Tom Ott at Sixth World notes the climbing VIX and says, time to buy! Taylor Tree is also looking for a rally from here. The Alchemy of Trading also says it might be time to buy--er, not quite, almost, not really, yet. Roberto's Nasdaq trader asks whether we have a Black Monday coming, and whether water is the next oil. Random Roger presented a defensive plan for Monday and had a very worthwhile quote from Barron's.

The Soothsayer of Omaha had an enlightening review of the technical picture at this point. Ron Sen had a nice post bringing together George Soros, Marty Schwartz, and toreadors; his Chart Student site showed what's up (or down) with the TNX, and the VIX. Bill Cara once again presents his comprehensive review of the week--he has a lot to say about Jim Cramer, so Cramer fans will want to check this one out. TraderMike summed up last weeks's action as "positively negative"and pointed to a piece by Dr. Duru on getting the Fed wrong.

Galatime summarized his recent options trade results and discussed whether changing exit strategy might be worthwhile. Shiau Street takes note of the plunge in Apple. Byrne's Marketview noted Mickey D's plans for espresso. Chairman MaoXian is still posting the gratuitous Friday picture; check out his chat every weekday 4:30- 5:30 Eastern time. Stockcoach is still on an extended break, but hopefully will be back soon. Uglychart's "remainder" contest for stock market blogs continues, vote early and often! Ugly also points out that the end is nigh and that Garry Kasparov was attacked with a chessboard.

Stephen Castellano at Reflections on Equity Research has a new project up and running-- an open source equity research unit called Maverick Society Investment Research. Click on the link and check it out!

I encourage everyone to check out the Present Moment Trading Campaign by Market Monk. He's got a lot of posts, just start reading them.

Stephen Vita at the Alchemy of Trading usually has a great Sunday night overview-watch for it. Also watch for the LBR group's Sunday night chat--they usually have some good stuff.

Have a great week!

Saturday, April 16, 2005

Fox Saturday Morning "Business Bloc" for April 16, 2005

Fox News Channel' s "Cost of Freedom" Saturday Morning shows--

Bulls and Bears started with the usual trading pit blather; i.e. Bob Froehlich said it's time to buy, Herb Greenberg said sell. Gary B. Smith said the charts show a big bounce is coming (I'm not sure what chart he's looking at) Tobin Smith made a bizarre comment, when asked if he was selling, said, "Not selling, just waiting to get back in lower." Joe Battipaglia, as always, is looking for at least 5-10% on the upside. The topic in the Chart Man segment was stocks to buy with an income tax refund; Bob Froehlich suggested SNP (China Petroleum) but Gary B. Smith said it has just broken a trendline so sell. Joe Battipaglia named RHI, but again Gary B said it's broken down on the chart. Gary's pick was MDC. Next was the lightning round-- NOK --Bulls were Herb G, Bob F, Toby, and Joey B; Bears were Scott and Gary B. Next was BAC -- Bulls were Toby, Gary B, Joey B, Bob F; Bears were Herb G and Scott. For MMM -- Bulls were Toby and Bob F; Bears were Joey B, Scott, Gary B, and Herb G. Finally LLY, everyone was bullish except for Herb G. In Predictions, Bob said Dow 12K this year, Joey B said oil to $40/barrel and gas down. Gary B says AAPL to 30 but becomes a buy there. Scott said HD up 20% by summer because people will still put money in their homes. Toby said buy SMG up 20% by summer because people will be growing grass.

Cavuto on Business started with a segment on whether the UN needs a lesson in ethics from the business world. Interesting stuff, but doesn't really help me make money. Lots of yelling over each other, and Jim Rogers did say "Balderdash". In the next segment, Meredith Whitney picked AXP, Gregg Hymowitz mentioned FON as a "cheap stock", Chris Lahiji picked PDG because "gold correlates with deficits", Jim Rogers is buying bonds of US airlines (some are apparently yielding 15%) .The next segment dealt with whether Bush should have picked tax reform instead of social security reform as an initiative. Again, this is politics, not investing and of little interest to me as far as trying to make money. Besides, nothing very novel was said. Fox on the spot was a bunch of nonsense about Tom Delay, American Idol, and breast implants.

Forbes on Fox (gulp) somehow, my DVR didn't record Forbes. OOPS!!, well I generally find Forbes to be the least useful of this group of shows.

Cashin' In started with a segment discussing Iraq. Lots of blather about whether US troops coming home from Iraq would help the markets. Very little novel was said. In the Best Bets segment, Jonas Max Ferris picked MNT because they may wind up with a monopoly on silicon breast implants in this country. Charles Payne suggested HRB (after tax day?). Wayne Rogers mentioned DOX, a software company, although he admitted that since Goldman Sacks upgraded it, that makes him nervous. Jonathan Hoenig said he is in TE, like other energy stocks BRG, EXC, AYE, DUK saying utilities are the "strongest group in a weak market". In the stock of the week segment, Charles picked EBAY, saying it is cheap now--and the usual discussion ensued about whether you want to buy cheap stocks or strong stocks. The last 10 seconds was rather curious--host Terry Keenan asked Wayne Rogers what he was looking toward in the next week, and he answered, "I've shorted a few things, I'm very nervous, at this time, you don't want to put new money to work without doing your homework." (Needelpoint that into a sampler and hang it on the wall.)

Bulls and Bears started with the usual trading pit blather; i.e. Bob Froehlich said it's time to buy, Herb Greenberg said sell. Gary B. Smith said the charts show a big bounce is coming (I'm not sure what chart he's looking at) Tobin Smith made a bizarre comment, when asked if he was selling, said, "Not selling, just waiting to get back in lower." Joe Battipaglia, as always, is looking for at least 5-10% on the upside. The topic in the Chart Man segment was stocks to buy with an income tax refund; Bob Froehlich suggested SNP (China Petroleum) but Gary B. Smith said it has just broken a trendline so sell. Joe Battipaglia named RHI, but again Gary B said it's broken down on the chart. Gary's pick was MDC. Next was the lightning round-- NOK --Bulls were Herb G, Bob F, Toby, and Joey B; Bears were Scott and Gary B. Next was BAC -- Bulls were Toby, Gary B, Joey B, Bob F; Bears were Herb G and Scott. For MMM -- Bulls were Toby and Bob F; Bears were Joey B, Scott, Gary B, and Herb G. Finally LLY, everyone was bullish except for Herb G. In Predictions, Bob said Dow 12K this year, Joey B said oil to $40/barrel and gas down. Gary B says AAPL to 30 but becomes a buy there. Scott said HD up 20% by summer because people will still put money in their homes. Toby said buy SMG up 20% by summer because people will be growing grass.

Cavuto on Business started with a segment on whether the UN needs a lesson in ethics from the business world. Interesting stuff, but doesn't really help me make money. Lots of yelling over each other, and Jim Rogers did say "Balderdash". In the next segment, Meredith Whitney picked AXP, Gregg Hymowitz mentioned FON as a "cheap stock", Chris Lahiji picked PDG because "gold correlates with deficits", Jim Rogers is buying bonds of US airlines (some are apparently yielding 15%) .The next segment dealt with whether Bush should have picked tax reform instead of social security reform as an initiative. Again, this is politics, not investing and of little interest to me as far as trying to make money. Besides, nothing very novel was said. Fox on the spot was a bunch of nonsense about Tom Delay, American Idol, and breast implants.

Forbes on Fox (gulp) somehow, my DVR didn't record Forbes. OOPS!!, well I generally find Forbes to be the least useful of this group of shows.

Cashin' In started with a segment discussing Iraq. Lots of blather about whether US troops coming home from Iraq would help the markets. Very little novel was said. In the Best Bets segment, Jonas Max Ferris picked MNT because they may wind up with a monopoly on silicon breast implants in this country. Charles Payne suggested HRB (after tax day?). Wayne Rogers mentioned DOX, a software company, although he admitted that since Goldman Sacks upgraded it, that makes him nervous. Jonathan Hoenig said he is in TE, like other energy stocks BRG, EXC, AYE, DUK saying utilities are the "strongest group in a weak market". In the stock of the week segment, Charles picked EBAY, saying it is cheap now--and the usual discussion ensued about whether you want to buy cheap stocks or strong stocks. The last 10 seconds was rather curious--host Terry Keenan asked Wayne Rogers what he was looking toward in the next week, and he answered, "I've shorted a few things, I'm very nervous, at this time, you don't want to put new money to work without doing your homework." (Needelpoint that into a sampler and hang it on the wall.)

Friday, April 15, 2005

U.S. Tax Day

Deadline for filing federal income taxes here in the good old USA, so I feel obligated to say something.

Just mailed things off this morning--I feel like I'm overtaxed, but then who doesn't?

A long time ago someone older, wiser, and richer than me told me I should aspire to owing a lot in taxes, because to owe a lot means you must have made a lot . . .

Here's hoping we all owe a lot . . . :>)

Just mailed things off this morning--I feel like I'm overtaxed, but then who doesn't?

A long time ago someone older, wiser, and richer than me told me I should aspire to owing a lot in taxes, because to owe a lot means you must have made a lot . . .

Here's hoping we all owe a lot . . . :>)

Loser List for April 15, 2005

TODAY IS THE 155th ANNIVERSARY OF THE INCORPORATION OF THE CITY OF SAN FRANCISCO. IT IS ALSO COUNTRY MUSIC SINGER ROY CLARK'S 72nd BIRTHDAY. TIME FOR RICE-A-RONI AND BIRTHDAY CAKE!

". . . Let's be careful out there . . ."

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

CPC still might want to go long strength, stop is of course 17

CNTY pullback after a breakout, long strength, stop 9.7

CVO long strength stop at 7.7

ELK short weakness, stop at 35

FRX short weakness, stop at 36

GM still either a short, or a multi-year buy

GAP long, stop at 15

IMCL sell it like martha, and put a stop at 32

IPCC short weakness, stop at 31.7

IRIS long, stop at 13.5

JNC long, stop at 33

MRX short, stop at 30.77

PH short, stop at 60

STC short stop at 38

How to use this list. And don't forget the disclaimer . . .

". . . Let's be careful out there . . ."

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

CPC still might want to go long strength, stop is of course 17

CNTY pullback after a breakout, long strength, stop 9.7

CVO long strength stop at 7.7

ELK short weakness, stop at 35

FRX short weakness, stop at 36

GM still either a short, or a multi-year buy

GAP long, stop at 15

IMCL sell it like martha, and put a stop at 32

IPCC short weakness, stop at 31.7

IRIS long, stop at 13.5

JNC long, stop at 33

MRX short, stop at 30.77

PH short, stop at 60

STC short stop at 38

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 15, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

ACKHQ long above 4?

GNOLF long above 0.32

GCCP long above 0.07

KWBT long stop at 0.039

TBIO breakout above 0.91

How to use this list. And don't forget the disclaimer . . .

ACKHQ long above 4?

GNOLF long above 0.32

GCCP long above 0.07

KWBT long stop at 0.039

TBIO breakout above 0.91

How to use this list. And don't forget the disclaimer . . .

Thursday, April 14, 2005

Loser List for April 14, 2005

ON THIS DAY IN HISTORY: ABRAHAM LINCOLN WAS SHOT, THE TITANIC STRUCK AN ICEBERG, AND IN THE YEAR 2000, THE NASDAQ DROPPED 355 POINTS . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ASMI short weakness, stop at 16

AVAN do you want to pick a bottom? right here, baby, stop at 1.37

CVO long? stop at 7.75?

CCL short a breach of 50

*CEN short, stop at 18

CHE short on weakness, stop at 72

STZ long strength, stop at 57

FRX short, stop at 36

GM either the buy of the decade, or a short, stop at 30.65. It could be both.

buy GAP stop at 15

IGI short weakness stop at 30.1

IPCC short, stop at 31.7

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ASMI short weakness, stop at 16

AVAN do you want to pick a bottom? right here, baby, stop at 1.37

CVO long? stop at 7.75?

CCL short a breach of 50

*CEN short, stop at 18

CHE short on weakness, stop at 72

STZ long strength, stop at 57

FRX short, stop at 36

GM either the buy of the decade, or a short, stop at 30.65. It could be both.

buy GAP stop at 15

IGI short weakness stop at 30.1

IPCC short, stop at 31.7

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 14, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

APYM range contraction, long, stop at 2.5

BSKO long strength, stop at 1.2

CTCHC range contraction, ready for an upside pop--stop at 0.66

*FDMLQ long above 0.53

GNOLF long above 0.32

HBSC buy it above 0.59

How to use this list. And don't forget the disclaimer . . .

APYM range contraction, long, stop at 2.5

BSKO long strength, stop at 1.2

CTCHC range contraction, ready for an upside pop--stop at 0.66

*FDMLQ long above 0.53

GNOLF long above 0.32

HBSC buy it above 0.59

How to use this list. And don't forget the disclaimer . . .

Wednesday, April 13, 2005

Loser List for April 13, 2005

TODAY, ACTOR TONY DOW ("WALLY" ON LEAVE IT TO BEAVER) TURNS 60 . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ATRS short, stop at 21

BMET short weakness, stop at 38.5

CELG long above 37.5

CNTY long stop at 9.77

CPO short weakness, stop at 23

DDIC long, stop at 3

GAP still a long, stop at 15

HET breakout, stop at 70

IPCC short weakness, stop at 31.7

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

ATRS short, stop at 21

BMET short weakness, stop at 38.5

CELG long above 37.5

CNTY long stop at 9.77

CPO short weakness, stop at 23

DDIC long, stop at 3

GAP still a long, stop at 15

HET breakout, stop at 70

IPCC short weakness, stop at 31.7

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 13, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

ACKHQ long above 3.5

DIAAF long stop at 0.05

EFTI long 0.25

IGACF long strength stop at 0.96

SMTR long above 0.06

How to use this list. And don't forget the disclaimer . . .

ACKHQ long above 3.5

DIAAF long stop at 0.05

EFTI long 0.25

IGACF long strength stop at 0.96

SMTR long above 0.06

How to use this list. And don't forget the disclaimer . . .

Tuesday, April 12, 2005

Voted off blog island

I never saw this one coming--I had, like, ZERO votes Sunday morning, and then I get over a two thousand?? I guess somebody listened to my "vote often" admonition.

I'm torn between thanking the academy, and demanding a recount.

Should I hurl ad hominems against those who can't blog and talk at the same time, or should I high five the crowd??

It's all about the traffic, thanks for reading.

And, oh yeah, vote for the Chairman this week.

I'm torn between thanking the academy, and demanding a recount.

Should I hurl ad hominems against those who can't blog and talk at the same time, or should I high five the crowd??

It's all about the traffic, thanks for reading.

And, oh yeah, vote for the Chairman this week.

Loser List for April 12, 2005

TODAY IS THE 44TH ANNIVERSARY OF MANNED SPACEFLIGHT . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

SVNX range contraction, long, stop at 12.6

BUD look to short weakness, stop at 46.5

BMET short, stop at 38.5

FRX short, stop at 36

IGI short, stop at 30

RSH short, stop at 27

USFC short it

UTSIE short, stop at 11.3

ATPL just look at the chart . . .

BKHM long strength, stop at 3.16

CNTY still a long, stop at 9.77

CMT long strength, stop at 5.75

DDIC long, stop at 3

GAP long, stop at 15

JNC long, stop at 33

NUAN if you've got the bottom fishing jones, buy this one above 2.6

How to use this list. And don't forget the disclaimer . . .

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . .

SVNX range contraction, long, stop at 12.6

BUD look to short weakness, stop at 46.5

BMET short, stop at 38.5

FRX short, stop at 36

IGI short, stop at 30

RSH short, stop at 27

USFC short it

UTSIE short, stop at 11.3

ATPL just look at the chart . . .

BKHM long strength, stop at 3.16

CNTY still a long, stop at 9.77

CMT long strength, stop at 5.75

DDIC long, stop at 3

GAP long, stop at 15

JNC long, stop at 33

NUAN if you've got the bottom fishing jones, buy this one above 2.6

How to use this list. And don't forget the disclaimer . . .

Penny Losers for April 12, 2005

For entertainment and/or education only. I may be long, short or out of any of these stocks, and positions may change in a flash. . . Remember these are penny stocks--despite being cheaper on a per share basis, you can lose money faster. This is like gambling, but without the women bringing you free drinks. YOU'D BE CRAZY TO DO THIS ! . . .

BSKO long, stop at 1.2

CTCHC long, stop at 0.67

JRSE long above .0004 (really--buy the whole float for like, 97 fifty)

SAMC long strength, stop at 1.18

SMTR long above .059

UNVC long above 0.125

DNAP long above 0.014

How to use this list. And don't forget the disclaimer . . .

BSKO long, stop at 1.2

CTCHC long, stop at 0.67

JRSE long above .0004 (really--buy the whole float for like, 97 fifty)

SAMC long strength, stop at 1.18

SMTR long above .059

UNVC long above 0.125

DNAP long above 0.014

How to use this list. And don't forget the disclaimer . . .

Monday, April 11, 2005

Buffett vs. Spitzer?