Let me start with an anecdote about MCD that probably has nothing to do with buying the stock. I rarely go to McDonald's for myself, but I've gone there countless times because of my kids. When my oldest son was about 10 or so, after having been to McD's a few thousand times, he took one bite out of his quarter pounder and said--"yuck, they changed the burger". He was told, no, they hadn't. He replied, "Yes, they did--this one sucks." He was informed, no, that's the way they've always tasted. Catholics have confirmation, Jews have a bar mitzvah--my son started becoming a man when he realized that McDonald's burgers are not particularly tasty.

Bill Cara has in the past(though I can't find the link now) made a good point about the free valueline info on the Dow 30 stocks--they essentially have their whole page of analysis of each Dow stock available for free on their website. One interesting factoid that you can glean from the valueline pages is that McDonald's working capital is always a negative number--I've been told this is because of the nice deal they have with their suppliers--they are paying them next Tuesday for the fixins to sell a hamburger today.

In my view, MCD is a good example of a variation of the dogs of the dow strategy. While the dogs of the Dow strategy per se (i.e. buying the 4 or 5 highest yielding Dow stocks each year) has been somewhat discredited, more often than not these Dow stocks are buys when they hit multi-year lows. In this case, MCD would have been a great buy in early 2003 in the teens. Of course, at that time, people were talking that maybe McDonald's was finished--that's when it can be profitable to buy these Dow stocks. Companies picked for the Dow 30 are behemoths of American industry that can weather storms and probably aren't going away. There are always exceptions (and I would argue that GM might be one now), but the odds favor the beaten down Dow stocks coming back. (I haven't rigorously tested this hypothesis, but this week I will look at some charts and see what the results are of buying Dow stocks when they make new multi-year lows).

Right now though, in terms of fundamentals, there is nothing especially compelling about MCD--1.7% dividend, PE, PS, and PEG not far from the industry averages. As to technicals, a quick and dirty look shows me nothing terribly exciting either.

The long term weekly chart

courtesy of stockcharts.com

A shorter term pullback in a long term uptrend. There appears to be support around 30. A buy here should be accompanied by a stop just below 30. Alternatively, the Nicolas Darvas version would be to buy the long term breakout above 34.5.

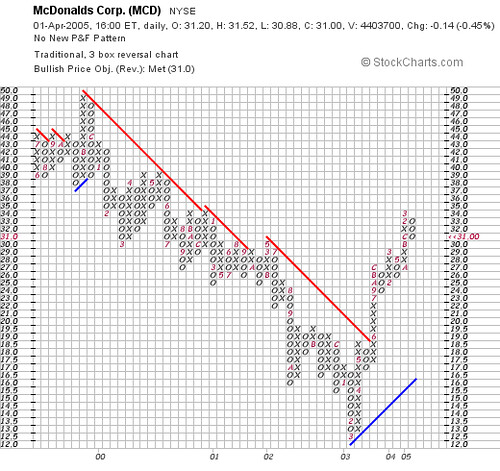

Point and figure chart

courtesy of stockcharts.com

The bullish price objective at 31 has been met, and no new patterns present themselves.

In summary, its hard for me to get too excited about big cap stocks, especially Dow stocks (JNJ and KO would be two notable exceptions for me). The time to really jump into MCD with both feet was two years ago. As Jonathan Hoenig might say, "I can't get excited about putting new money here now."

No comments:

Post a Comment